Biometric UPI Is Here. PayPal Joins the Party.

Hey FinTech Fanatic!

India’s payments scene just leveled up again. Starting tomorrow, users can make UPI payments with their face or fingerprint — no PIN required.

The new biometric authentication, powered by Aadhaar, will make instant payments even faster and more secure.

The NPCI is showing it off at the Global FinTech Festival in Mumbai this week — where India is clearly flexing its payments muscle to the world.

Speaking of which… PayPal CEO Alex Chriss took the same stage and dropped a few big lines:

“Everywhere I go, India comes up.”

He announced UPI as the first payments system integrated into PayPal World, calling India central to PayPal’s global strategy — not as a competitor in domestic payments, but as a connector to the world.

From biometric UPI to PayPal’s global embrace, India isn’t just leading in FinTech — it’s exporting the future of it.

👇 Scroll down for more FinTech stories shaping the week, and I'll be back in your inbox tomorrow!

Cheers,

INSIGHTS

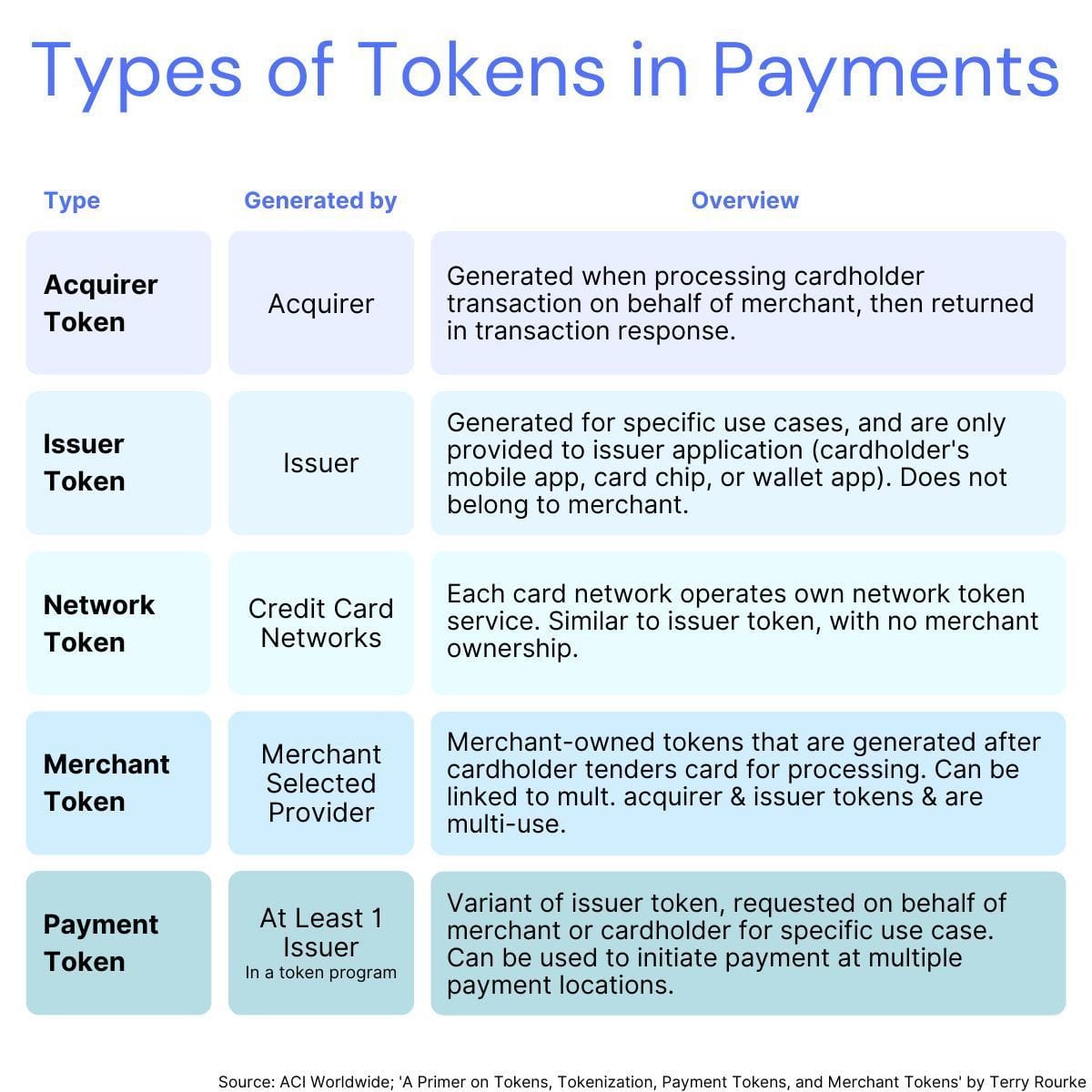

💳 Navigating the complex world of tokenization in retail payments.

Tokens can vary in format, but generally, they fall into three categories:

FINTECH NEWS

🌍 We’re Expanding! FinTech Running Club is looking for new hosts in Paris, London, and Lisbon. If you’re passionate about building community and have a natural sense of leadership, we’d love to have you lead the community in your city! 👉 Apply now and help us grow the global FinTech running network

🇬🇧 Cleo's founder on achieving unicorn status and city regulations. Cleo plans to return to the UK after leaving in 2022 to focus on U.S. users, but CEO Barnaby Hussey-Yeo remains wary of the UK’s regulatory climate. He says regulators need clearer guidance on the government’s risk tolerance before real change can happen.

🇮🇳 Lending startup Niro shuts down operations. Regulatory pressure, credit deterioration, and limited capital forced the company to wind down operations. Niro’s model linked consumer platforms with financial institutions, but tightening lending and risk regulations created a volatile environment.

PAYMENTS NEWS

🇺🇸 Airwallex Celebrates Dual Milestones. Airwallex hit two major milestones this week: acquiring billing platform OpenPay to advance its global, multi-currency solution, and winning the 2025 Pledge 1% Impact Award for its boosted volunteer efforts and $62M in community support.

🇬🇧 How network tokenization can help fix failed subscription payments by Ecommpay. Ecommpay highlights that 7% of subscription payments fail on the first attempt, leading to costly involuntary churn, despite customers not intending to leave. Their network tokenization solution automatically updates payment information, helping merchants reduce churn and increase renewal success rates by up to 3%.

🇪🇸 New era of instant Payments. Are you ready? by PagoNxt. In Episode 3 of PayTalks by PagoNxt, Susana Delgado (Swift), David Hurtado (Microsoft), Mattia Gamberoni (Stripe), and Francisco Huerta (PagoNxt) discuss how instant payments are reshaping global commerce. They explore the shift in customer expectations, the role of AI in security and efficiency, and the need to offer preferred payment methods in a world where speed is no longer optional.

🇬🇧 Solidgate releases VAMP enforcement guide to help merchants avoid fines and manage fraud thresholds. Merchants flagged for enumeration or hitting "Excessive" levels face per-transaction fees, with stricter thresholds coming in April 2026. Risk leaders should monitor their VAMP ratio, strengthen fraud tools, and prepare proactive remediation plans. Download the full VAMP guide here

🇮🇳 PayPal’s focus will remain on connecting India to the world rather than competing in the domestic payments market, Alex Chriss, CEO, said. He said India is playing a defining role in the global FinTech ecosystem, from remittances to commerce to technology, calling it a “critical market” for the company’s international strategy.

🇮🇳 India to roll out biometric authentication for instant digital payments. India will allow users to approve payments made through the popular domestic payments network, the Unified Payments Interface, using facial recognition and fingerprints. Authentications will be done using biometric data stored under the Government of India's unique identification system - Aadhar.

🇺🇸 FinTech Ramp launches fraud-fighting and bill payment AI agents. The agents help catch fraudulent invoices by evaluating 63 pieces of data. In addition to the fraud piece, the agents aim to automate tasks like confirming bank account numbers or coding the invoices to the proper expense category.

🇲🇦 Morocco moves closer to launching a central bank digital currency. Morocco is advancing plans to launch a central bank digital currency (CBDC), the e-Dirham, as part of a broader push to modernize its financial system and boost financial inclusion. Continue reading

🇮🇳 Zoho boosts its FinTech offering with POS and QR devices, along with a range of payment solutions including payout capabilities, virtual accounts for collections, and marketplace settlements. The launch enhances the company's footprint in the FinTech landscape, with innovative, end-to-end payment solutions.

🇨🇴 EBANX brings Bre-B, Colombia's new instant payment system, to global companies from day one. To facilitate this access, the FinTech has partnered with MOVii, which provides a complete issuing and acquiring payment infrastructure for individuals and businesses.

🇩🇰 Pleo launches multi-currency accounts to simplify global spending and help businesses tackle billions lost in FX fees. Designed to eliminate the hassle and expense of cross-border transactions, the new feature streamlines global business spending by automatically detecting the transaction currency and withdrawing funds from the corresponding account.

REGTECH NEWS

🇺🇸 AI-powered, real-time decisioning: A complex retailer’s success story with ACI Worldwide. A leading omnichannel retailer partnered with ACI Worldwide to combat rising fraud while maintaining real-time transaction speed. Using AI-driven risk scoring and global threat intelligence, ACI’s platform automates approvals and defenses, cutting manual work and boosting revenue without compromising security.

DIGITAL BANKING NEWS

🇲🇾 UAE's Fasset secures provisional banking license for stablecoin-powered Islamic bank in Malaysia. The firm said in a statement that the license completes its ability to provide full-service digital banking to its existing global user base of 500,000 within a regulated sandbox for Islamic FinTech innovations, establishing Fasset as the world’s first stablecoin-powered Islamic digital bank.

🇩🇪 Australian-founded business lender Bizcap expands lending in Germany to accelerate fast funding for SMEs. The move underscores Bizcap’s commitment to empowering small and SMEs worldwide with fast, flexible, and transparent financing solutions.

🇫🇷 Net-zero banking movement suffers blow as NZBA ceases operations. The Net-Zero Banking Alliance (NZBA), a UN-backed initiative created to align banking practices with Paris Agreement climate goals, has ceased operations following a member vote on the future of the organisation.

🇪🇺 EU banking review ready in ‘about a year’. The EU’s financial services commissioner expects a review of the bloc’s banking rule book to be ready in about 12 months, with some of the changes requiring updates to EU laws, dampening hopes from some in the industry for a speedier timeframe against a backdrop of swift deregulation in the US.

BLOCKCHAIN/CRYPTO NEWS

🇦🇪 BitGo secures VARA broker-dealer licence to launch regulated institutional trading services in Dubai. The license enables BitGo MENA to provide regulated digital asset trading and intermediation services to institutional clients across the region and supports the company’s continued global expansion.

🇪🇺 EU eyes crypto oversight under ESMA to end fragmented supervision. The European Union’s markets regulator is preparing to expand its authority to cover cryptocurrency exchanges and other operators, a move officials say would better align oversight with the bloc’s newly implemented Markets in Crypto-Assets (MiCA) framework.

🇮🇳 India to launch digital currency. India is set to launch its own RBI-backed digital currency, aiming for simpler, faster, and traceable transactions while reducing paper use. Union Minister emphasized that the nation discourages cryptocurrencies lacking sovereign or asset backing, imposing heavy taxes on them due to inherent risks and lack of accountability.

🇺🇸 BNY Mellon explores tokenized deposits and blockchain payments. The new initiative is part of BNY Mellon’s broader plan to modernize its infrastructure, support instant cross-border payments, and improve overall financial transfer methods using digital assets and blockchain technology.

PARTNERSHIPS

🇬🇧 Microsoft and Checkout.com unite to elevate enterprise payments performance and build trust in the digital economy. Alliance will improve digital payment experiences and help prepare businesses for the rise of agentic commerce. Collaboration reflects a joint ambition to embed trust at the heart of today’s and tomorrow’s digital and agentic economy.

🇩🇪 vobapay integrates Mastercard Open Finance to enable A2A payments. As part of this collaboration, vobapay will integrate Mastercard’s Open Banking technology into its platform. This will enable companies working with vobapay to offer their customers secure and fast account-to-account (A2A) payments directly at checkout.

🇫🇷 TerraPay adopts stablecoin-native flows, powered by Fipto. This partnership enables Terrapay’s clients to fund directly in stablecoins and payout partners to receive them, where supported, in regions where stablecoins are allowed by regulators. The shift is already delivering treasury benefits and has helped reduce prefunding requirements.

🇮🇳 Banking Circle and EbixCash to simplify cross-border payments for Indian students and travellers. Banking Circle will enable EbixCash World Money ('EbixCash') to offer faster and more transparent international money transfers. Keep reading

🇵🇭 HitPay partners with Ingenico to launch a payment solution to drive digital adoption for Filipino SMEs. The collaboration equips local merchants to seamlessly accept all major payment types, from credit cards to popular local e-wallets. The partnership’s initial deployment has already begun for businesses in key industries.

DONEDEAL FUNDING NEWS

🇪🇬 Egyptian FinTech startup Sabika raises funding for platform enhancements and expansion. The startup has secured a six-figure USD strategic investment to expand its presence in Egypt and the Gulf, led by M-Empire Angels. The new funding will support platform enhancements, AI-driven features, and Saudi expansion in 2025.

🇮🇳 India’s Raise Financial becomes a unicorn after $120m series B. The round also saw participation from Mitsubishi UFJ Financial Group, BEENEXT, Ramesh Damani, DSP Family Office, JM Financial Family Office, Aashish Somaiyaa, and other investors. Read more

🇺🇾 Akua raised US$8.5 million and accelerates its expansion in Latin America. With this capital injection, the company will seek further growth in the region. It currently operates in Colombia and Uruguay and is in "advanced discussions" with major regional banks.

🇦🇺 Stakk secures a $15.0M placement from prominent international and domestic institutions. Funds will be used to expand Stakk´s SaaS-focused business model in the U.S and Australia. The company will focus its efforts exclusively on organic and strategic growth initiatives.

M&A

🇮🇳 Groww completes acquisition of wealthtech platform Fisdom. This follows the investment platform receiving the necessary regulatory approvals from Sebi. The deal is valued between $140 million and $160 million. Per the terms of the deal, Fisdom’s founders will continue to lead the business, along with the existing team.

MOVERS AND SHAKERS

🇧🇷 MagaluPay hires former Nubank employee, Faizal McBride, as Director of Credit and Data. Faizal McBride will also be responsible for incorporating data, analytics, and data science into decisions across various areas of Magalu's FinTech. Keep reading

🇳🇴 Norwegian FinTech Stø hires Christoffer Hernæs as CTO. Hernæs will lead a team of approximately 170 technologists working across BankID, BankAxept, and Stø Kundesjekk, which offers proprietary know-your-customer (KYC) services. Continue reading

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()