Binance's Reset, Coinbase's Innovation, And PayPal's 'Quantum Leap'

Hey FinTech Fanatic!

In today's headline story, Richard Teng, the newly appointed CEO of Binance, made his first public appearance in London. Following the exchange's historic agreement with the US government, Teng emphasized Binance's commitment to moving beyond its past challenges.

Founded in 2017, Binance quickly ascended to become the world's largest crypto exchange within just six months. However, this rapid growth led to outpaced compliance measures, a concern Teng assures is now in the rearview mirror.

Under Teng's leadership, Binance plans to establish a global headquarters and appoint a board of directors, marking a new chapter in its corporate governance. Teng remained tight-lipped about the possibility of reapplying for an FCA licence in the UK, underscoring the firm's policy of confidentiality in regulatory discussions.

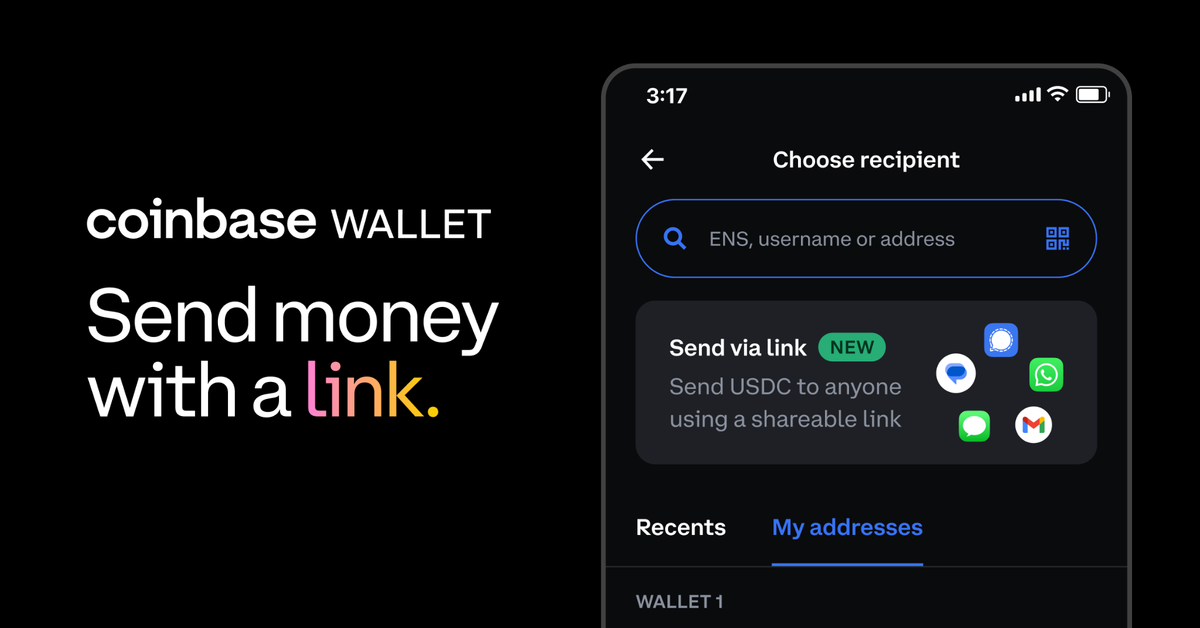

In other crypto news, Coinbase is revolutionizing the way users transfer money via its Coinbase Wallet. The platform now supports money transfers through links shared on various platforms, including WhatsApp, TikTok, Instagram, iMessage, Telegram, and even through email. This feature is part of Coinbase's broader strategy to integrate cryptocurrency into everyday financial transactions.

Meanwhile, PayPal, under the leadership of CEO Alex Chriss, is making bold strides to fortify its position in the competitive digital payments landscape.

In response to the evolving industry dynamics, where rivals are making significant gains (last year, PayPal’s revenue rose 8%, compared to 18% for Stripe and 33% for Adyen.), PayPal has launched an initiative named 'Quantum Leap'.

This ambitious project, commenced after Chriss's appointment in September, focuses on overhauling PayPal's digital wallet and online checkout systems to enhance their attractiveness to both consumers and merchants.

Internal sources reveal a rigorous development schedule aimed at integrating innovative features to improve user experience and functionality.

With an aggressive timeline set for 'Quantum Leap', PayPal is clearly intent on reasserting its dominance in the digital payments sector.

Enjoy your day, and I'll be back with more FinTech industry updates tomorrow!

Cheers,

P.S. Stay informed, stay ahead. Join my Telegram channel for real-time updates, and remember, in the world of FinTech, knowledge isn't just power - it's profit.

POST OF THE DAY

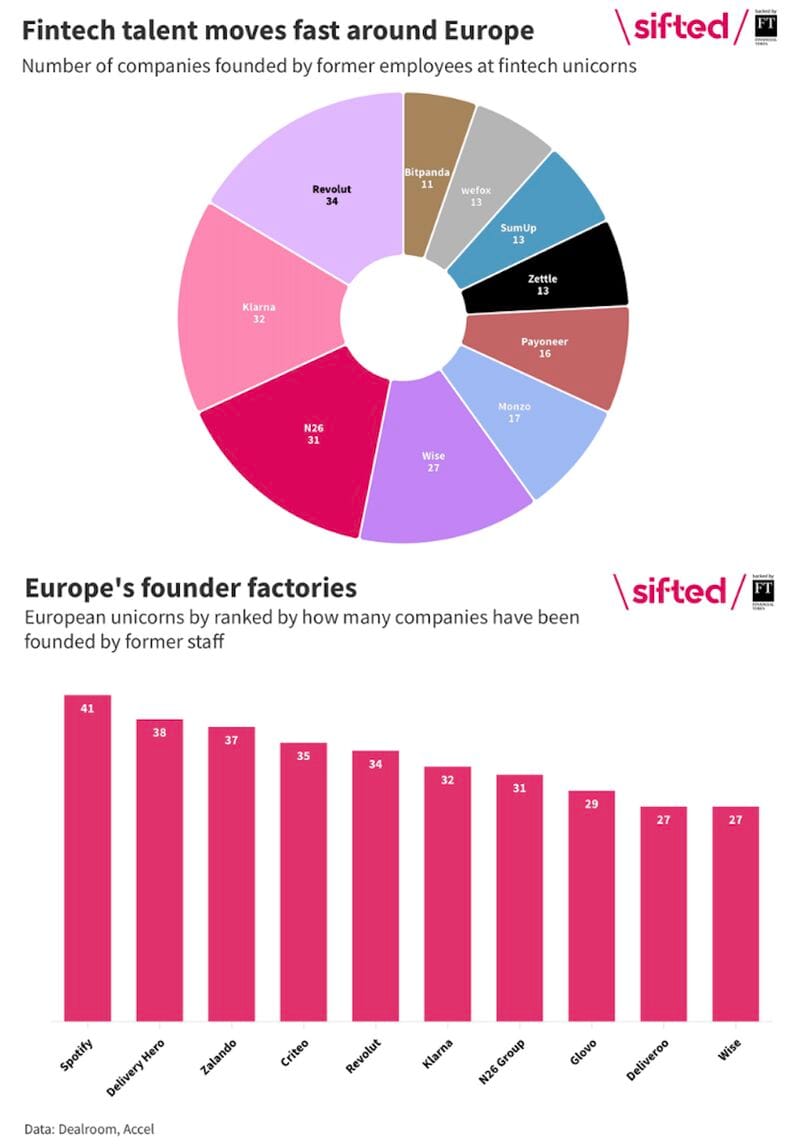

Revolut overtakes N26 and Klarna in spawning alumni founders. Let's dive into the data:

FEATURED NEWS

Embedded banking for the gig economy in Finland🇫🇮. How Free.fi turned invoicing upside-down to build an easier and more efficient experience for their customers. Learn about how it works by reading the full article by Swan here

#FINTECHREPORT

The ‘Tracking the Digital Payments Takeover’ report details how consumers expect their use of digital shopping and payments options to increase in the future. Read more interesting info and stats by downloading the complete report.

PODCAST

In this podcast episode, Jason Mikula spoke with Jon Lear, President and cofounder of Fintech Meetup, which will take place in Las Vegas March 3-6, 2024. They explore the dynamic landscape of fintech and banking throughout 2023, discuss the exciting prospects for 2024, and more. Tune in and listen to the full episode here.

INSIGHTS

Shareholders have significantly increased the value of Klarna after a profitable quarter: This move comes as a welcome change for Klarna, particularly after a challenging period last year that saw its valuation plummet dramatically. The new valuation suggests that Klarna's overall market worth stands at approximately $7.85B

FINTECH NEWS

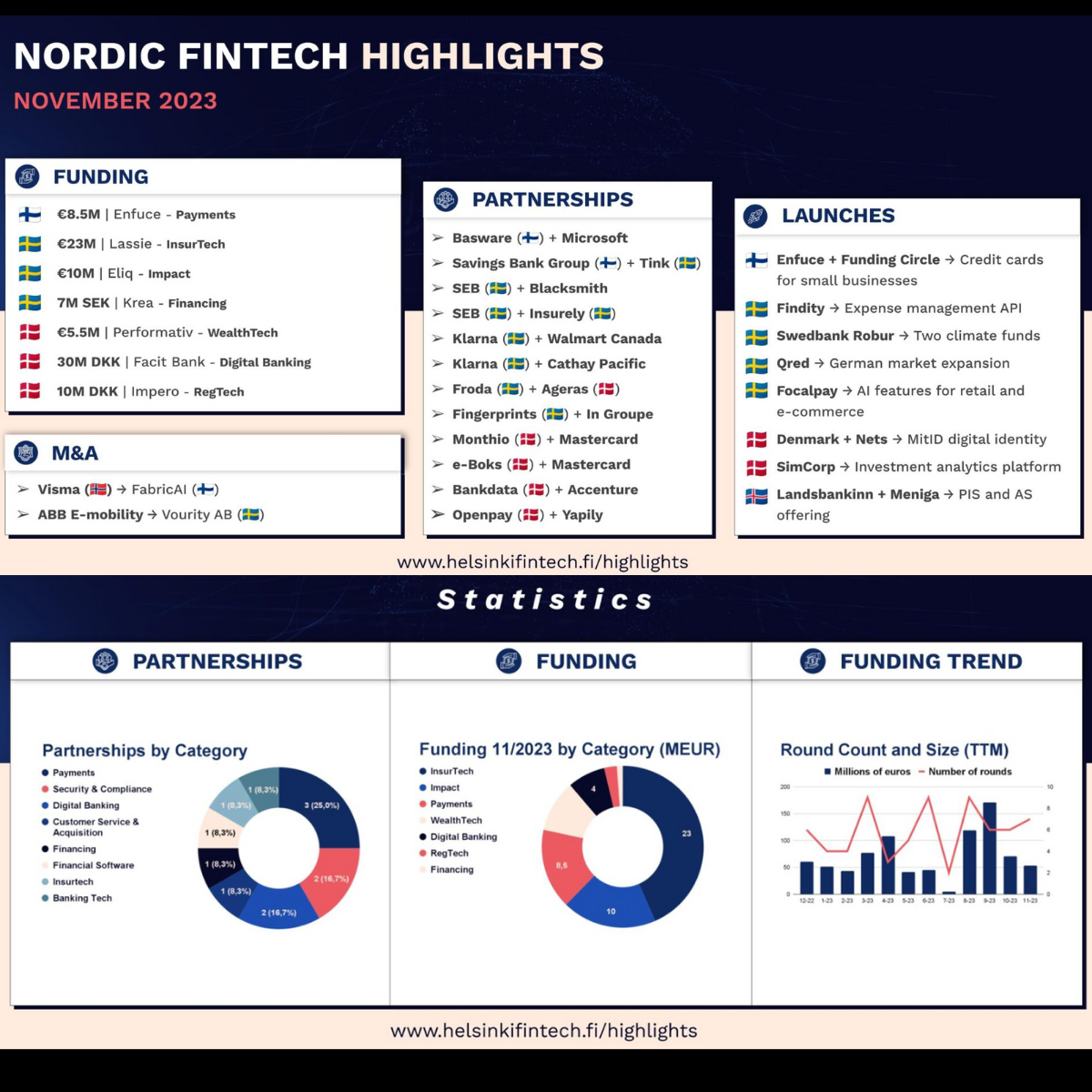

Take a look at “Nordic Fintech Highlights– November 2023,” by Helsinki FinTech Farm. More info here.

🇫🇮 Enfuce certified for Visa Fleet 2.0 mobility cards. The continued collaboration between Enfuce and Visa aims to revolutionize fleet management in Europe, providing improved efficiency, cost reduction, and a shift towards sustainable transportation and mobility budgets.

🇬🇧 Toqio evolves a platform to help large firms integrate embedded finance into B2B ecosystems. Toqio’s new platform focus hopes to provide a viable ‘safe haven’ for corporate financial empowerment, genuine market decentralisation, as well as increased financial inclusivity.

Coztyc is set to revolutionize the financial system and boost financial inclusion for the entire population with its new credit card, backed by Visa and powered by Pomelo. This development is especially significant for individuals who lack access to traditional financial services.

🇮🇳 IppoPay partners with Visa powered credit cards. As per IppoPay, this will uplift small business owners, and catalyze financial inclusion across tier II and III cities and rural areas. Read more

Tapi has recently partnered with Utoppia, a California-based NeoBank, to enhance its service payment platform in Argentina, Mexico, Colombia, and Chile. This collaboration enables Utoppia's users to make service payments in these countries, encompassing utilities like water, credit card services, and more.

🇳🇬 Nigerian regulator clamps down on unlicensed deposit-taking fintechs as fraud concerns mount. The NIBSS cautioned that firms with switching, payments processing, and superagent licenses, being non-deposit-taking institutions, should not be listed as beneficiaries for bank transfers.

Retail investors on Public’s brokerage will be able to buy slices of corporate bonds (powered by Moment) just like they do with stocks, bringing a wider buyer base to the multi-trillion dollar fixed-income markets. Link here

PAYMENTS NEWS

🇨🇳 Chinese borrowers barred from mobile payments amid record defaults. Over 8.5 million individuals, mostly aged 18 to 59, have found themselves blacklisted due to missing payments, the Financial Times reported Sunday (Dec. 3), citing local court records.

🇧🇷 Fintech Open Co to launch BNPL product for SMEs in Brazil. The Fintech intends to grow the 'credit as a service' (CaaS) business, inherited from BizCapital and BoletoFlex. The firm has not yet ruled out entering secured lending.

MSMEs can now accept payments beyond QR and cash. OCBC Bank and MOBY Group are collaborating to enable small and micro merchants with pop up stores or kiosks to widen their payment collections beyond QR pay and cash.

OPEN BANKING NEWS

TrueLayer partners with Lunar for Nordic push. This partnership will boost TrueLayer's instant payment capabilities in the Nordics by seamlessly integrating with Lunar's payment infrastructure. Read more

DIGITAL BANKING NEWS

🇷🇺 Tinkoff launches first smart financial camera. This launch represents a first in the Russian banking market. Users will be able to use the camera within the Tinkoff mobile banking app. It gives them the ability to carry out a variety of financial tasks in one click.

🇩🇪 German fintech unicorn Trade Republic is granted a full EU banking licence. The new licence will allow the fintech to hold customer deposits, making it less reliant on revenue from payment for order flow. Read on

🇬🇧 Revolut’s HR, recruitment, and performance platform is LIVE. Revolut People is a platform for all things people management — including HR, recruitment, and performance. Click here to learn more

🇯🇵 Japan's Rakuten aims to raise $433m by selling down bank unit. The planned sale of 25.5 million shares is equivalent to just under 15% of the online bank, according to LSEG data. The group said it would use the proceeds to repay bonds early as it was committed to reducing interest-bearing debt.

BLOCKCHAIN/CRYPTO NEWS

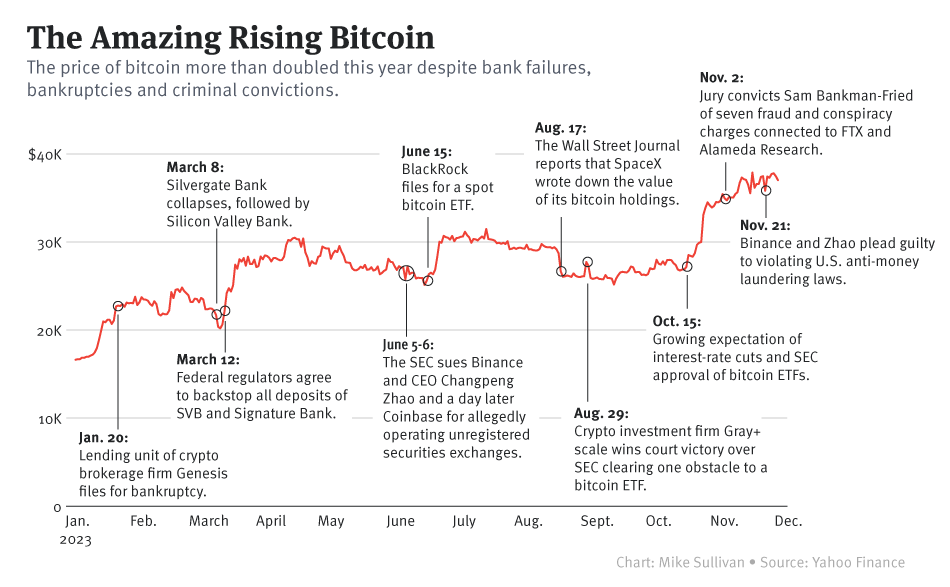

2023: Bank failures, bankruptcies and criminal convictions. There was a lot of bad news about cryptocurrency this year. And yet the price of bitcoin kept rising, more than doubling from a year ago. Read the full piece here

🇧🇷 Nubank increases crypto offer one day after Itaú debut: Nubank partnered with Circle to offer a stablecoin pegged to the U.S. dollar, USD Coin. Starting in the first quarter of next year, the neobank will also allow its customers to transfer cryptocurrencies from their Nubank account to other digital wallets and vice versa.

🇫🇷 France’s 3rd-largest bank, Société Générale, launches euro-pegged stablecoin, making it one of the first European banking giants to venture into the stablecoin market. The euro-pegged stablecoin will be available to the bank’s customer base for trading use.

DONEDEAL FUNDING NEWS

🇨🇱 Chilean fintech Colaboramed raised $1M in a round led by U-Payments, valuing Colaboramed at $8.8M. This investment represents 12% of Collaboramed's ownership, and is fueled by the creation of an advanced AMOL prepaid health card, streamlining health co-payments. Read more

🇦🇷 Moonflow, a fintech company, recently completed a successful investment round, raising $700,000. Moonflow provides businesses with all the necessary tools for carrying out collection processes, including communication infrastructure, payment gateways, and ERP integrations.

Fintech-focused Canapi Ventures raises $750M. The close comes as the firm has been quietly growing its geographic footprint beyond its headquarters in Washington D.C. Read full article by clicking on this link

MOVERS & SHAKERS

🇺🇸 PayPal Names Suzan Kereere as President of Global Markets. She will have end-to-end accountability for leading PayPal's local businesses and growth strategies in the markets around the world where the company operates to ensure seamless execution and drive profitable growth.

🇺🇸 Valley Bank CIO Stuart Cook leaves to join start-up True Digital Network as CEO. As his first move as CEO, Cook also announced the launch of the start-up’s new app open to all bankers and credit union staff. Read more

🇩🇪 N26 appoints Juan Bongiovanni as Chief Marketing Officer. In his new role at N26, Juan will assume end-to-end responsibility of the company’s global marketing organization as it expands its investment product offering into stocks, equities and ETFs, and further scales up marketing efforts in the coming year.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()