Binance Rolls Out Mastercard Crypto Cards Across CIS to Push Real-World Adoption

Hey FinTech Fanatic!

Binance just launched its Mastercard crypto card across several CIS countries, including Armenia, expanding its push to make crypto spendable in everyday life.

Verified users can now convert Bitcoin, Ethereum, stablecoins, and more than 100 tokens into local fiat instantly at checkout. Pay in crypto. Merchants receive fiat or crypto. Simple at the surface, complex under the hood.

“Pay in crypto. Merchants get fiat or crypto. Best way to push crypto payments and adoption,” praised Changpeng Zhao, co-founder of Binance, as one of the strongest regional expansions of the cryptocurrency card service.

Users can top up via credit and debit cards, Apple Pay, Google Pay, and local rails like Humo in Uzbekistan or tenge transfers in Kazakhstan.

At the same time, Binance is running a $20,000 Valentine-themed rewards campaign inside its ecosystem. Pink branding. Gamified tasks. Cashback mechanics. All designed to drive engagement and card usage.

If you’re watching how crypto keeps sneaking into mainstream payment flows, this is another signal 👇 As usual, I'll be back here tomorrow with more updates.

Cheers,

QUICK FINTECH TRIVIA 👀👇

Question:

Which payments giant recently widened its valuation lead over a major European rival by more than USD 100B in just 18 months?

Options:

A) A US-based “financial OS” for the internet

B) A Dutch enterprise-first processor

C) A Latin American acquirer

D) A global card network

FINTECH NEWS

🇺🇸 Do you live in NYC? You can't miss the upcoming FRC run with Pedro D'Avila at the Marsha P. Memorial Fountain. 🏃➡️ RSVP here to network casually!

🇺🇸 FinTech Clear Street postpones US IPO citing market conditions. Clear Street had already downsized its offering on Thursday to 13 million shares offered between $26 and $28 apiece. It had previously been offering 23.8 million shares for $40 to $44 each.

PAYMENTS NEWS

🇨🇳 WeChat Pay is now compatible with 29 foreign e-wallet apps. UnionPay International now enables 29 overseas mobile wallets from 12 countries and regions to pay via WeChat Pay at everyday locations across the mainland. The expansion comes amid growing demand from overseas travellers.

DIGITAL BANKING NEWS

🇪🇸 Bnext closes as a neobank on April 13 and pivots towards financial infrastructure services. In a statement, the company indicated that market conditions have become increasingly challenging, with growing competition and a more complex regulatory environment.

🇫🇷 Revolut's major offensive in France. Béatrice Cossa-Dumurgier said Revolut plans to make France its Western European hub, backed by a €1 billion investment and a new headquarters in Paris. She confirmed the firm is pursuing a French banking licence, aiming for approval in 2026 to support more localised, higher-value products.

🇪🇺 Apollo is in talks to offer funds to Revolut customers in Europe. The alternative asset manager would be one of the private capital managers set to offer vehicles via Revolut’s private markets offering, which the FinTech is expected to launch later this year. The funds would only be available in the European Union.

🇦🇷 Banks beat payment providers in Argentina. A proposal that would have allowed workers to receive wages in digital wallets managed by payment providers was defeated after banks pressured lawmakers to exclude that option during debates over Argentina’s new labor law reform.

🇿🇦 GoTyme confirms Apple Pay launch for South African iPhone users. According to GoTyme, this staggered approach allows it to prioritise security, stability, and performance while thoroughly testing each new function before it reaches customers. Apple Pay is next in line, and iOS users will be notified as soon as it is live.

BLOCKCHAIN/CRYPTO NEWS

🌍 Binance launches Mastercard crypto cards in several Commonwealth of Independent States countries. The Binance Mastercard is now available to verified users in select CIS jurisdictions, including Armenia, allowing users to instantly convert bitcoin, Ethereum, stablecoins, and more than 100 supported tokensinto local fiat currency at checkout.

🇷🇺 Bank of Russia to explore the feasibility of a national stablecoin. The Central Bank and the national government expect that the bill on cryptocurrency regulation will be passed during the spring session of the State Duma, the lower house of the Russian parliament, the First Deputy Chairperson said.

🇺🇸 Coinbase posts $667 million net loss, revenue declines 20% in fourth-quarter revenue to $1.8 billion as falling crypto prices hit trading activity. The downturn reflects broader market pressure, with rivals like Gemini cutting staff and other exchanges also seeing weaker revenues.

PARTNERSHIPS

🇺🇸 Truist launches secure open banking experience with Mastercard. These clients can now seamlessly connect to the apps of their choice through direct connections to Mastercard's open finance platform. This experience offers clients secure, tokenized access to manage which applications can view their financial data.

🇬🇧 Gradient Labs selected by Wise as an AI partner to help scale customer support while navigating regulatory and operational complexity. The collaboration signals potential commercial traction for Gradient Labs in regulated financial services.

🇵🇪 PagoEfectivo and Yape join forces to expand online payment options in Peru. The collaboration aims to modernize the payment experience, improve merchant conversion rates, and consolidate the advancement of mobile and digital payments in the country.

🇵🇹 Feedzai and Neterium partner to deliver real-time customer and transaction screening. The partnership aims to reduce false positives, improve compliance efficiency, and provide institutions with faster deployments and fewer integrations. The combined offering is designed to support instant payments.

🇬🇧 City announces Revolut as official back-of-shirt partner. As part of the multi-year agreement, the Revolut brand will feature on the back of the Men’s team playing shirts for domestic cup matches and across WSL and cup fixtures for Manchester City Women, in addition to selected training wear.

🇺🇸 BitGo and 21shares accelerate global ETF partnership across staking and custody. Building on their existing collaboration, the firms have agreed to deepen their partnership across staking and custody services to support 21shares’ growing suite of crypto ETP products, serving investors across the US and Europe.

🇬🇧 Conferma announces Oracle integration to enhance corporate travel payments. The new integration leverages Conferma Connect Direct to deliver virtual card and payment instructions securely via API to OPERA Cloud, Oracle’s widely adopted property management system, used by over 30,000 hotel properties worldwide.

🇦🇪 du Pay Partners with eSewa to simplify wallet-to-wallet remittances for Nepalese in the UAE. The partnership will offer exclusive promotional incentives for customers sending money from du Pay to eSewa wallet, enhancing the value of wallet-to-wallet remittances.

🇧🇷 Fipto and Avenia partner to launch a real-time EUR / BRL corridor using stablecoins. The initiative aims to replace slow correspondent banking with 24/7 stablecoin-based settlement, enabling faster and more cost-effective cross-border flows for PSPs, digital asset funds, and global enterprises.

🌎 10x Banking and HassemPrag join forces to drive next-gen banking innovation across Africa. The partnership will combine 10x Banking’s best-in-class core banking platform with HassemPrag’s integration capabilities and regional expertise to deliver a unified, complete banking solution to replace legacy core banking technology.

🇨🇳 MariBank links remittances to Weixin Pay via TenPay Global. Users can send salaries and savings directly to their own or close relatives’ Weixin Pay accounts through MariBank Overseas Transfers, the digital bank’s remittance service. Keep reading

🇨🇳 DBS has added Weixin/WeChat as a recipient option on DBS Remit, enabling almost-instant overseas transfers to China with zero fees and preferential exchange rates. Users can send money for family support or personal savings through the digibank app, with additional promotional perks.

DONEDEAL FUNDING NEWS

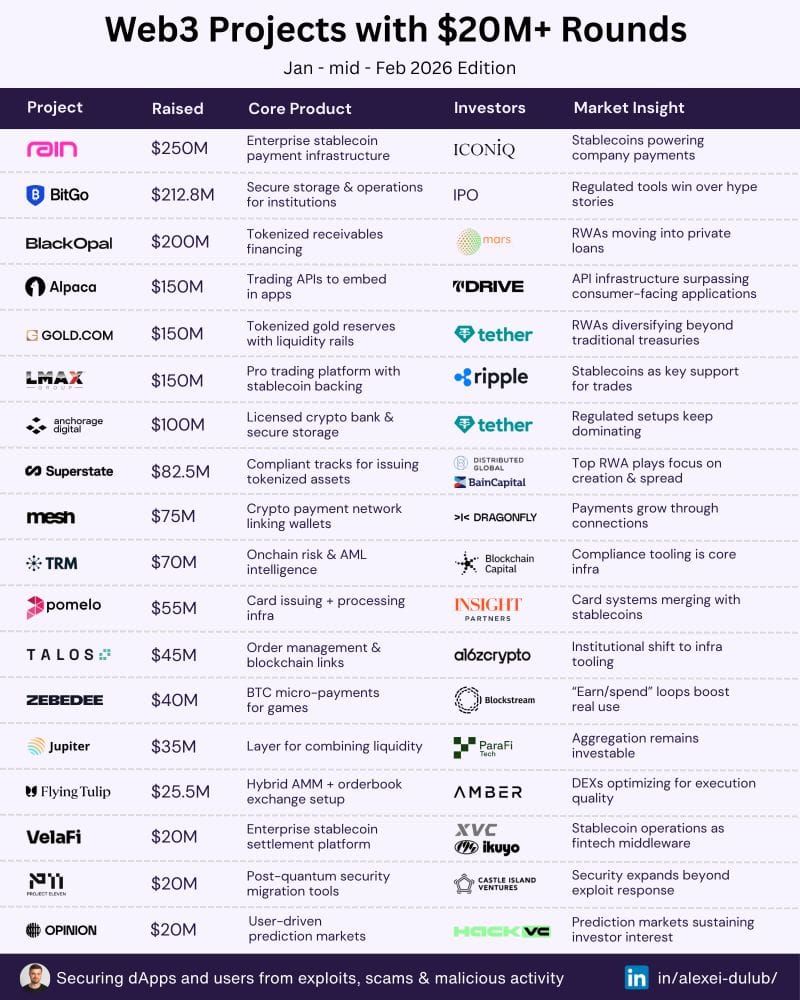

💰 Web3 projects $20M+ rounds.

January - mid - February edition👇

🇮🇳 FinTech Platform Endl secures 1.5 million dollar investment to scale global payment infrastructure. The funding Will suport Endl´s expansión across South East Asia, the Middle East, and India, while strengthening its product capabilities and regulatory infrastructure.

🇮🇳 Indian online identity verification firm IDfy nets $53m series F. The primary capital will be used for acquisitions, international expansion, and product development, while the secondary portion provides liquidity for early investors and employees.

🇮🇳 Razorpay shortlists four bankers to helm $700mn IPO. The move follows Razorpay’s conversion into a public entity and its reverse flip back to India in 2025. The company serves over 8 million businesses and has raised more than $816 million, with revenue rising 65% year-on-year in FY25.

M&A

🇬🇧 UK FinTech Zempler Bank snapped up for less than half its previous valuation. “The Access Bank UK Limited has agreed to acquire a 100% shareholding in Zempler Bank Limited,” the bank said. “The transaction has now received regulatory approval and is expected to be completed in the coming weeks.”

🇧🇷 Brazilian digital lending FinTech Meutudo is acquired by BTG Pactual (48%) to expand in the retail segment. The acquisition aims to support the company's growth plans. According to BTG, BTG originates high-quality, well-structured digital loans. If the deal progresses favorably, the bank intends to acquire a controlling stake.

🇺🇸 Gennius XYZ acquires majority stake in Utoppia to expand financial infrastructure. Through the integration, Utoppia will leverage Gennius’ global payments, rewards, tokenization, and treasury capabilities while maintaining regulatory and operational independence.

🇺🇸 Payments processor Stripe acquires the PartyDAO team. According to a notice published on the PartyDAO website, the PartyDAO team is joining Stripe to help shape a new generation of crypto products. PartyDAO began with the belief that crypto could unlock new forms of social and economic coordination on the internet.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()