Bilt Rewards’ $250M Raise Pushes Valuation to $10.75B

Hey FinTech Fanatic!

Bilt Rewards just more than tripled its valuation in a single year, reaching $10.75 billion 🤯

The deal brought in $250 million in fresh capital and was advised by FT Partners, another one on the board for Steve McLaughlin and team, nicely done 👌

“We started five years ago with a direct-to-consumer card, but the business has evolved,” said CEO Ankur Jain. And how it has grown!

What began with rent payments has grown into a broader rewards-driven credit card model, now tied to retailers, property managers, and mortgage servicers, on track to cross $1 billion in revenue by early next year.

But there’s more on Bilt, fresh FinTech moves, and a closer look at how the EU and US are approaching crypto regulation, scroll down to catch it all 👇

See you on Monday!

Cheers,

ARTICLE OF THE DAY

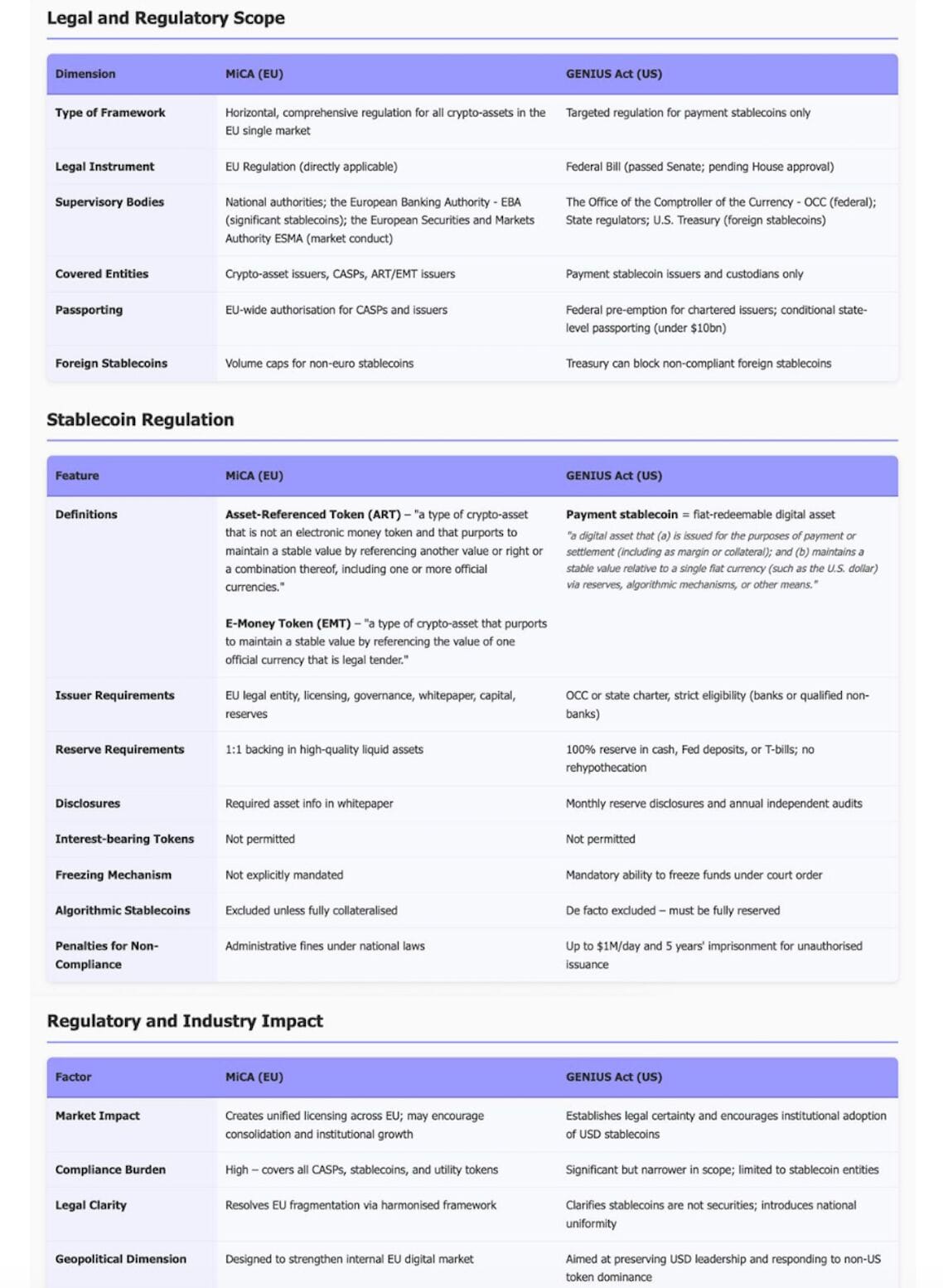

➡️ MiCA vs. GENIUS Act (2025). They represent two converging but distinct approaches to crypto regulation. MiCA offers a holistic, single-market regime encompassing most crypto-assets and services, while the GENIUS Act creates a focused, enforceable framework for dollar-backed stablecoins.

INSIGHTS

🇬🇧 FinTech leads surge in London finance hiring. New financial services job vacancies rose three per cent quarter-on-quarter, according to Morgan McKinley’s London Employment Monitor. At the same time, Greater London FinTech hiring is expected to surge by 72 per cent in 2025.

FINTECH RUNNING CLUB

🌎 What's new in the FinTech Running Club?

FINTECH NEWS

🇺🇸 Shareholders of a private market startup vow to fight bankruptcy. Managers of Linqto claimed former executives mismanaged the firm's business by misleading customers into believing they owned shares in privately held companies. Sapien Group said its objectives are to preserve the value of Linqto and protect the value of the shareholders' investments.

🇺🇸 Wise has been hit with a $4.2 million fine by multiple US states for AML deficiencies. The watchdogs have ordered Wise to conduct a lookback for previously closed accounts, enhance its reporting procedures for suspicious activity, strengthen its due diligence procedures for AML/CFT risk, and improve its systems for data integrity.

🇬🇧 Flagstone to launch up to 10 Cash ISAs by January 2026. Simon Merchant, CEO of Flagstone, comments: “Our Cash ISA products will offer competitive tax-free rates to savers who deserve to be rewarded for taking action and trying their best to make their money work harder for them“.

🇺🇸 Ramp introduces AI Agents to automate finance operations. Ramp agents are powered by Ramp Intelligence, the company's AI platform that automates expense reporting, data entry, contract review, and accounting accuracy. Read more

PAYMENTS NEWS

🇦🇺 Aussie FinTech Zepto launches PayTo Index, revealing real-time payments momentum. PayTo allows Australian businesses to collect payments instantly and securely from customers’ bank accounts, operating as a real-time alternative to traditional direct debits.

🇺🇸 Rain launches embedded earned wage access solution within Workday. This integration allows Workday customers to enable Rain directly within the Workday platform, eliminating the need for third-party implementations, system changes, or data handoffs.

🇦🇺 Australia advances digital currency exploration with Project Acacia. The Reserve Bank of Australia will collaborate with three of the four major banks and other participants to pilot various digital currency use cases. These include stablecoins, bank deposit tokens, and a wholesale CBDC designed to facilitate credit and liquidity risk-free settlement.

🇺🇸 Truist merchant engages powers SMB growth in bank’s latest payments suite expansion. The platform is designed to help small and medium-sized businesses (SMBs) streamline operations, gain real-time insights, and scale with certainty. Keep reading

🇬🇧 Global FinTech SumUp launched SumUp Terminal. Terminal empowers merchants to streamline their entire operation, from taking orders at the table to managing staff, inventory, and reporting. This design allows staff to leave the sales counter behind, taking orders and payments directly on the shop floor or right at the table.

🇳🇦 NPCI and the Namibian Central Bank enter a licensing agreement to develop a UPI-like instant payment system. The aim is to modernize Namibia’s financial infrastructure, enabling instant person-to-person and person-to-merchant transactions.

🌍 Google Pay launches in Oman and Lebanon, Expanding Mobile Payments in MENA. The company said Google Pay allows people to pay and make secure purchases in stores (where contactless payments are accepted), in apps, and on the web.

🇺🇸 Apple, Visa, and Mastercard win dismissal of merchant antitrust lawsuit over payment fees. U.S. District Judge David Dugan in Illinois ruled that the merchants had not provided enough evidence to support their claim that Apple illegally declined to launch a competing payment network to rival Visa and Mastercard.

DIGITAL BANKING NEWS

🇮🇹 The Italian Competition Authority has opened an investigation into Revolut. Regarding investment services, Revolut allegedly promoted the option of investing in shares, highlighting the absence of commissions and failing to clarify the presence of additional costs and the limitations that characterize commission-free investments.

🇦🇺 MYOB moves into banking services with the launch of Solo Money. Solo Money will provide an all-in-one mobile solution for sole operators from day one, incorporating a transactional bank account with market-leading accounting software so they can stay on top of their finances.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Binance founder’s family office backs BNB treasury firm eyeing IPO. YZi Labs said it will support the investment firm 10X Capital in spinning up a BNB treasury company that will pursue a listing on “a major US exchange. Additionally, Binance reaches 280M users and sets sights on ‘1 billion’ goal. The exchange added 130 million users in 18 months, driven by spot ETF approvals, clearer regulations, and a focus on Binance listings.

🇸🇬 Ant International is exploring stablecoin license applications in multiple global jurisdictions, according to an executive’s statement on July 9. Kelvin Li, head of platform tech at Ant International, shared the plans during the Reuters Next Conference in Singapore. Sources say that the company is working with Circle Internet Group Inc. to adopt its stablecoin on the Chinese FinTech company’s blockchain platform.

PARTNERSHIPS

🇫🇷 Worldline partners with commercetools to enhance payment solutions for e-commerce businesses. Customers can now access a diverse range of Worldline’s payment solutions, including local payment methods, multi-currency support, advanced fraud detection, and real-time transaction monitoring, all designed to ensure secure and efficient payment processing.

🇬🇧 Debenhams taps Mangopay for wallet payments. The collaboration aims to simplify multi-seller payouts, optimise operational processes, and create a scalable foundation for seamless multi-vendor commerce. Keep reading

🇬🇧 Weavr teams with Visa to offer embedded payments in the employee benefits sector. Weavr is now empowering SaaS companies to integrate Visa-powered financial products into their platforms, focusing initially on the rapidly growing sector of employee benefits.

🇦🇺 Stryd and Experian to launch Open Banking-powered loan-matching solution for brokers. The collaboration allows brokers to better match clients to suitable loans and maintain client engagement throughout the loan lifecycle. Continue reading

🇧🇭 Visa and Tarabut partner to unlock smarter credit decisions. Visa has partnered with Tarabut, a leading regulated financial technology platform specialized in embedded finance, open banking, and powering data-rich digital financial services, to introduce a bundle of innovative services for banks in KSA and Bahrain.

🇺🇸 MANTL and the Alkami solution team offer Plaid Layer. Through this integration, MANTL empowers regional and community financial institutions to deliver the same seamless digital onboarding experiences as tech-first neobanks while unlocking faster growth and stronger conversion.

🇺🇸 Ria Money Transfer and Xe join forces with Google to collaborate on seamless, cross-border money transfers. The collaboration will improve access to payment services and enable more digital money transfer customers to benefit from Ria and Xe's industry-leading money transfer services.

🇮🇩 Jenius chooses Wise Platform to transform cross-border payments for millions of digitally-savvy Indonesians. Through this collaboration with Wise Platform, Jenius is further empowering users with a seamless process of sending money abroad in multiple currencies, including USD, EUR, GBP, SGD, AUD, and HKD, directly from the Jenius app to other banks, 24/7.

🇺🇸 Finix rolls out WooCommerce plugin to support merchants. Through this integration, Finix seeks to allow merchants operating across the US and Canada to accept payments, minimise operational complexities, and provide a consistent and optimal checkout experience.

🇺🇸 Coinbase partners with Perplexity AI on real-time crypto data service. The move marks the latest high-profile tie-up between leading blockchain and AI firms, like the deal between prediction market Polymarket and Elon Musk’s AI firm xAI last month.

DONEDEAL FUNDING NEWS

🇺🇸 Bilt has raised $250 million in new primary funding, valuing the company at $10.75 billion. “We started five years ago with a direct-to-consumer card, but the business has evolved,” Bilt Chief Executive Officer Ankur Jain said. Bilt aims to eclipse $1 billion in annual revenue by the first quarter of next year.

🇳🇱 Dutch AI FinTech Conpend secures majority investment from Cape Investment Partners. This strategic investment will significantly accelerate Conpend's growth ambitions, supporting its global expansion, enhancing product innovation, and broadening its customer base among banks and financial institutions worldwide.

🇺🇸 Moment raises $36 million for fixed-income FinTech. Moment works with players in the asset-management and retail-trading sectors to modernize their fixed-income trading operations and is focused on centralizing and automating the core operations of the fixed-income market.

🇧🇷 Neon raises US$25 million from IFC and DEG. Jamil Marques, Neon's CFO and COO, said the funds will help Neon accelerate credit investments, with a focus on private payroll loans and technological development. Read more

🇺🇸 Stablecoin startup Agora raises $50 million Series A led by crypto VC giant Paradigm. With the new funding, which follows a $12 million seed round last year, Agora hopes to build up AUSD, its stablecoin, or a type of cryptocurrency that is pegged to an underlying asset such as the U.S. dollar.

M&A

🇺🇸 Clarity AI buys sustainability FinTech ecolytiq. The deal expands Clarity AI's climate engagement offering for global retail and commercial banking financial institutions. Ecolytiq’s platform specialises in analysing real-time transaction data to quantify environmental footprints and deliver high-impact sustainability content.

🇰🇪 Roqqu acquires Kenya-based Flitaa to enter East Africa’s crypto market. The acquisition, which Roqqu claims has received regulatory approval, allows the company to bypass Kenya’s slow-moving crypto licensing process and sidestep the hurdles that competitors like Busha and Luno have faced.

🇬🇧 Alpaca buys WealthKernel in European brokerage push. The deal immediately provides Alpaca brokerage licenses in the U.K. and the EU, allowing it to bypass a lengthy regulatory licensing process. Continue reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()