Bancolombia gets into Crypto & Apple is All-In on Embedded Finance

Hey FinTech Fanatic,

Bancolombia is venturing into Cryptocurrencies with a new platform set to compete with Binance and Bitso, called Wenia.

Wenia aims to engage over 60,000 clients in its first year of operations, aligning with Colombia's potential as the third-highest country in Latin America in terms of crypto adoption.

The Bancolombia Group is entering the cryptocurrency market with Wenia, a new company within the group that will allow users to buy, convert, receive, send, and sell cryptocurrencies, challenging established platforms like Binance and Bitso. Additionally, the platform is introducing a new stable cryptocurrency: the COPW, a crypto asset that promises a 1:1 parity with the Colombian peso.

"With the launch of Wenia, developed to high-security standards and industry best practices, we begin to realize this journey where we aim to offer our clients a reliable experience and a new way to use their money," stated Pablo Arboleda, CEO of Wenia.

"Our goal is to help people connect with the crypto side in a more accessible, inclusive, and efficient manner."

Colombia is ranked as the third country in Latin America for crypto asset adoption, according to the Global Crypto Adoption Index 2023.

Enjoy more FinTech industry news updates I listed for you below, and I'll be back with more news in your inbox tomorrow!

Cheers,

#FINTECHREPORT

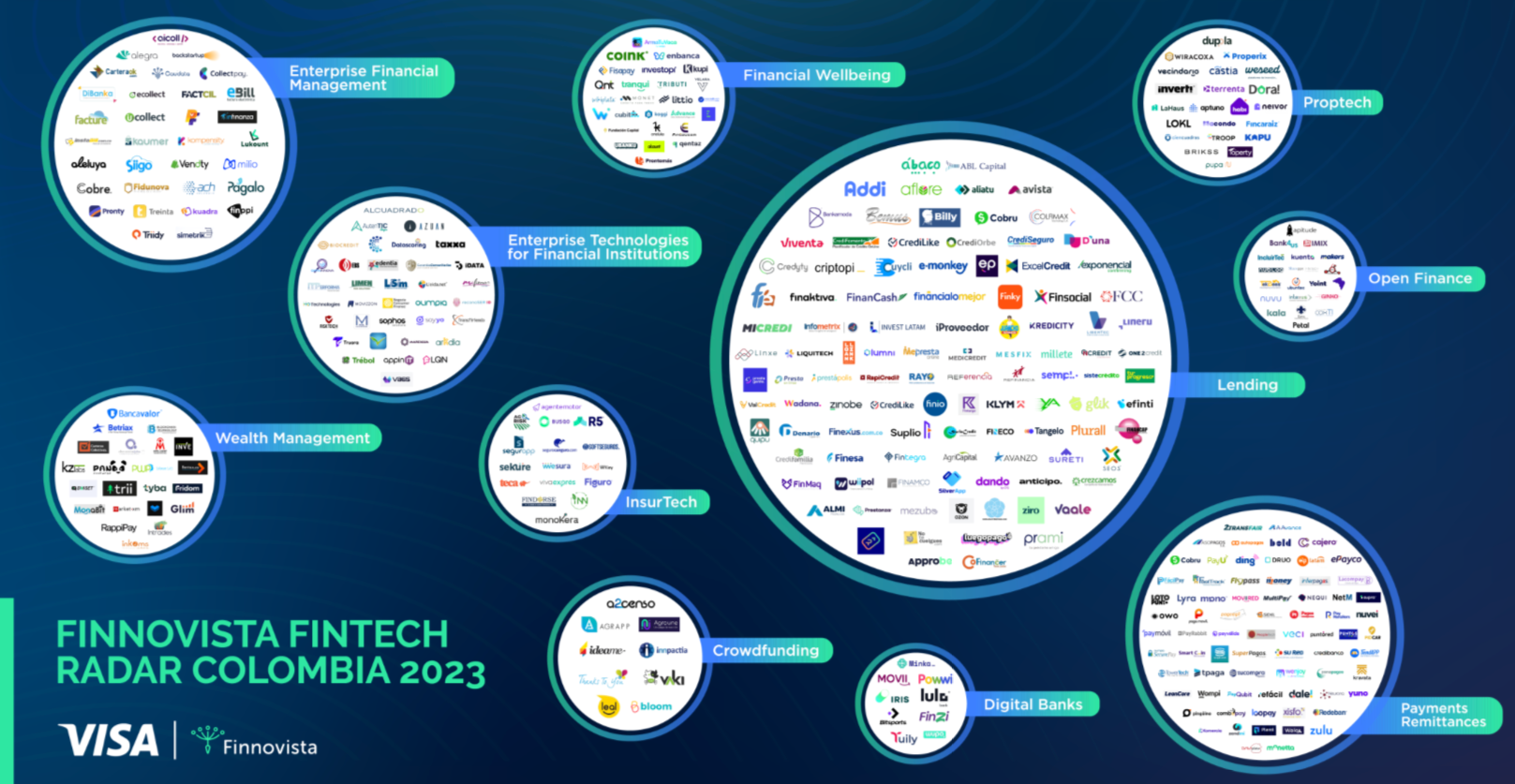

📊 The number of FinTech startups grew by an average of 19.7% per year since 2019 in Colombia, up to 369. Read more interesting stats from the local FinTech industry in this FinTech Radar Colombia FinTech Report by Finnovista👇

📈 The April edition of Finch Capital’s Monthly Market Pulse is out. Check it out here

INSIGHTS

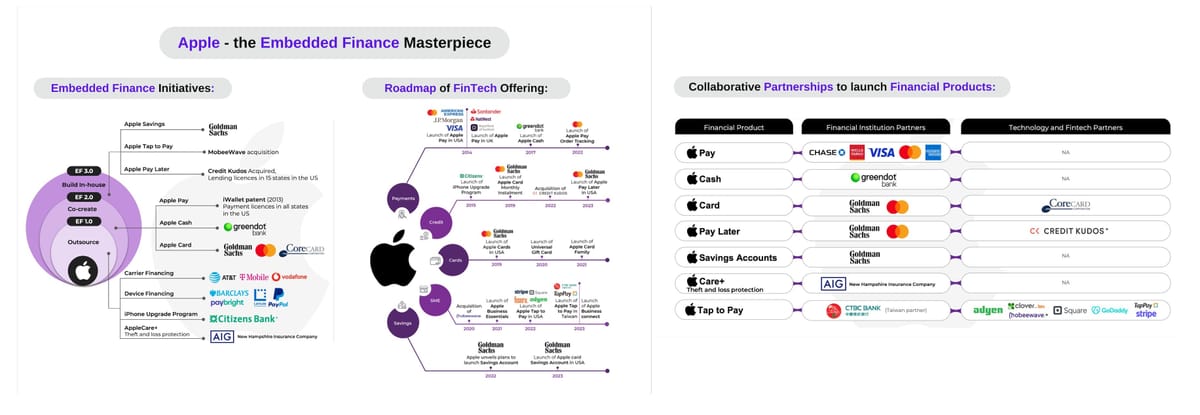

🇺🇸 Apple is all-in on Embedded Finance. Apple's Financial Services can be categorized into 5 major areas: Click here to learn more

FINTECH NEWS

🇬🇧 Checkout.com and Mastercard partner to bring virtual cards to Online Travel Agents. As part of the Mastercard Wholesale Program, customers of Checkout.com will be able to pay their suppliers more easily and benefit from higher conversion rates by issuing virtual cards.

🇦🇺 Airwallex announced the launch of Airwallex for Startups, Australia’s most comprehensive program for local startups seeking to accelerate their growth. The initiative has been created to empower the next generation of Australian entrepreneurs to scale faster and more efficiently.

🇰🇪 Payless Africa, the FinTech company pioneering digital financial solutions, has officially launched its youth-centric payment platform in Kenya. Through its mobile app and digital platforms, the company delivers a wide range of financial services tailored for the youth demographic.

🇨🇴 FinTech Plenti now facilitates domestic and international payments, enabling quick top-ups and transfers between the USA and Colombia. Plenti's new services offer fast ACH and Wire transfers from any US account, with funds available in one to three hours, surpassing traditional bank times, all at competitive rates.

🇲🇽 Mercado Libre’s investments in Mexico propel earnings. Saying that its “ecosystem is our competitive strength,” Mercado Libre reported strong Q1 revenue growth in all areas of its multifaceted business Thursday (May 2). The results were driven in part by investments made during Q1 in Mexico and Brazil.

PAYMENTS NEWS

Instant payment transactions to surpass USD 58 trillion worldwide by 2028. Juniper Research has published a new study showing that instant payment transactions are set to surpass USD 58 trillion globally by 2028, competing with card payments.

🇮🇳 Airtel Payments Bank has introduced its own soundbox, rivaling Paytm's Soundbox and Google's SoundPod. The all-new soundbox from Airtel Payments Bank aims to transform the banking and payment landscape for merchants across the country. Continue reading

REGTECH NEWS

Liquid Noble partners with iDenfy. The collaboration between Liquid Noble and iDenfy will aim to accelerate the development of onboarding security and compliance measures within the overall digital asset industry. This process is set to ensure a secure and improved experience for the platform’s investors at the same time.

DIGITAL BANKING NEWS

🇬🇧 Zopa Bank hits £4 billion in customer deposits. In just under four years since the former peer-to-peer lender received its banking license, Zopa Bank has amassed £4 billion in customer deposits. The gains for the bank are in part due to Zopa’s Smart Individual Savings Accounts (ISA) that brought in £1 billion in under a year.

🇺🇸 In an exclusive interview with Forbes, Chris Britt, CEO of neobank Chime, has revealed some interesting stats, but not quite the 38 million a Cornerstone Advisors survey research earlier this year suggested. Read the full interview here

🇺🇸 Chase announces new digital products to help small businesses grow. Starting in May, Chase is offering a digital invoicing solution that gives small business clients an easier way to bill their customers so they can get paid faster. It’s exclusively available for Chase Business Complete Banking customers at no additional cost.

🇺🇸 Finxact, a Fiserv Company and provider of a core banking platform to the U.S. regional and super-regional banking sector, and Zafin, a provider of SaaS core modernization and transformation solutions for banks, form a partnership. More on that here

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase generated $1.6 billion of total revenue and $1.2 billion of net income. Adjusted EBITDA was $1.0 billion – more than they generated in all of 2023 🤯

🇨🇴 Bancolombia is venturing into cryptocurrencies with a new platform set to compete with Binance and Bitso, called Wenia, which aims to engage over 60,000 clients in its first year of operations, aligning with Colombia's potential as the third-highest country in Latin America in terms of crypto adoption.

🇬🇧 Vodafone looks to integrate crypto wallets with SIM cards. Vodafone, a United Kingdom-based telecommunications provider, hopes to bring blockchain technology to smartphone users by integrating cryptocurrency wallets with subscriber identity module (SIM) cards.

🇺🇸 MoonPay users can now buy crypto Via PayPal. This partnership means MoonPay users in the U.S. can seamlessly buy crypto with PayPal through wallet transfer, bank transfer, and debit card transactions, according to a press release. Read on

🇳🇬 At least three Nigerian FinTech startups—Moniepoint, Paga and Palmpay—will block the accounts of customers dealing in cryptocurrency and report those transactions to law enforcement after Nigeria’s National Security Adviser (NSA) classified crypto trading as a national security issue.

M&A

🇺🇸 SVB Financial Group enters into Definitive Agreement for the Sale of SVB Capital. Under the terms of the agreement, SVB Capital would be acquired for a combination of cash and other economic consideration. Keep reading

🇮🇳 UGRO to acquire lending tech startup MyShubhLife in a cash & equity deal. MyShubhLife was last valued at INR 240 Cr during its Series B round in 2022. The deal will enable UGRO to leverage the lending tech startup’s tech stack and partnerships with ecosystem players to further bolster its offerings.

MOVERS & SHAKERS

🇩🇰 Experienced international FinTech player Tim Brooke Thom joins Nordic bank challenger Lunar as the new chairman of the Lunar Group board. He started as chairman of the board on April 29th and succeeded the former chairman Henning Kruse Petersen.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()