Aspora Closes Three Rounds in 9 Months, As it Reaches $93M in Total Funding

Hey FinTech Fanatic!

The Y Combinator-backed payments startup Aspora, founded by Parth Garg, has raised $93 million, bringing its valuation to $500 million.

Aspora had three funding rounds in under nine months: 🤯

- A $5 million extension in September

- A $35 million round led by Sequoia and Greylock

- And a final $53 million close in May, led by the same pair

Among the backers are some notable names: QuantumLight, the AI-native VC launched by Revolut CEO Nik Storonsky, along with angel investors Balaji Srinivasan (ex-Coinbase CTO), Sundeep Jain (ex-Uber CPO), and Rippling cofounder Prasanna Sankar.

Aspora was previously known as Vance until U.S. ad platforms began misclassifying its content due to the rising profile of Vice President JD Vance. That led the team to rebrand. 👀

The company has also shifted its base, with global operations now anchored in London after relocating from its original headquarters in Bengaluru.

Today, it serves over 250,000 users across the UK, EU, and UAE. The U.S. operations are set to launch in July, followed by Canada, Australia, and Singapore before year-end. What stands out in Aspora’s growth story: over half of its new users join through referrals.

Aspora competes with firms like Remitly and Wise, stepping into a space once tightly held by banks and legacy players like Western Union.

“People use our platform to send money home to their parents, for investments to buy property or invest in alternative assets,” Garg said. “We target communities and social groups of Indians in these countries to popularise our product.”

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

FINTECH NEWS

🇺🇸 The threat of a FinTech exodus could cost City IPO billions. Six large tech floats are in the London pipeline. Monzo’s potential exit is especially worrying, as it could merit a much higher valuation given its growth potential.

🇺🇸 Ripple IPO could break records with $30B valuation. This is based on Ripple’s ongoing share buyback program, where the company is purchasing at least $700 million worth of shares at $175 each. By multiplying this per-share price with the total share count, it arrived at the $30 billion figure, a valuation that would place Ripple ahead of many past IPO giants.

🇫🇷 Carrefour Bank prepares to unify cards and move ‘out of shop’. The initiative involves consolidating the different branded cards, Carrefour, Atacadão, and Sam’s Club, into a single product. This unified card will be tailored based on customers’ income and risk profiles, and it will provide benefits across all of the retailer’s brands.

PAYMENTS NEWS

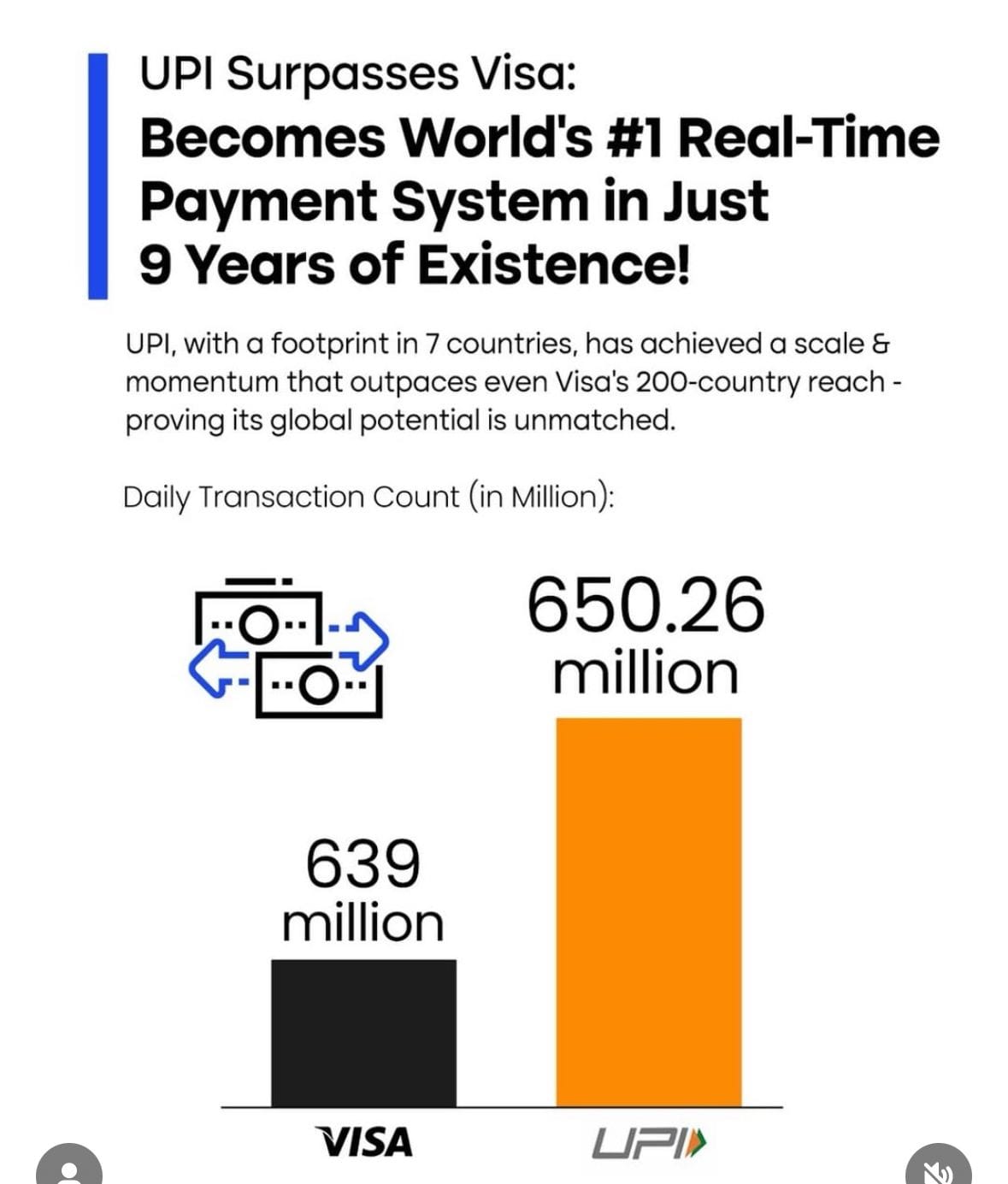

🇮🇳 India’s Unified Payments Interface (UPI) has achieved a significant milestone, emerging as a leading digital payment platform within just nine years of its launch. UPI’s monthly transaction growth is currently at 5-7%, with an annual growth of 40%, compared to Visa’s 10% yearly growth.

🇺🇸 View. Click. Buy. PayPal Storefront Ads expand merchant reach across the web. With Storefront Ads, merchants can dramatically broaden their e-commerce reach across the open web, reaching consumers wherever they are, on desktop, mobile, or emerging digital environments.

🇲🇾 Ria Money Transfer sets sights on supporting businesses in Malaysia to manage worker wages. The Ria Wallet enables users to deposit funds, withdraw cash from ATMs, pay bills, and also facilitates domestic and international transfers. Customers can also make payments in millions of locations via QR payment linked to DuitNow.

🇧🇷 Automatic Pix for recurring bills starts working in Brazil. The Central Bank explains that with automatic PIX, payments can be made by giving prior authorization through the account app, without needing to authorize each payment. The new tool promises to simplify the way payments are made for recurring bills.

🇨🇦 Accept/Pay Global enables real-time payments in Canada with Interac. The platform allows integration with current business systems, supporting audit trails, reporting, and automated reconciliation. Continue reading

🇺🇸 Luxury credit card rivalry heats up as Amex and JPMorgan tease updates to their premier cards. The expectation among industry experts is that both companies will offer ever-longer lists of perks in travel, dining, and experiences like concerts, while potentially raising their annual fees.

🇧🇷 PPRO adds Pix Automático to payments platform. This newest enhancement to Brazil’s instant payment system, Pix, offers consumers an effortless and cost-effective way to manage recurring payments by enabling seamless cross-regional recurring transactions.

🇱🇺 Digital Payment Wallet Wero arrives in Luxembourg. Luxembourgish consumers will have access to EPI’s services via the Wero standalone app, allowing them to make instant account-to-account payments, both within Luxembourg and across borders with Belgium, France, Germany, and subsequently the Netherlands.

🇵🇹 Klarna reaches 700,000 consumers and 6,000 partner brands in Portugal in less than four years. The company now works with six thousand retailers in the national market, including internationally renowned brands. Also, Klarna grows 56% in Spain and reaches 1.8 million customers. Its rapid growth in Spain is explained by its commitment to services beyond payment methods.

DIGITAL BANKING NEWS

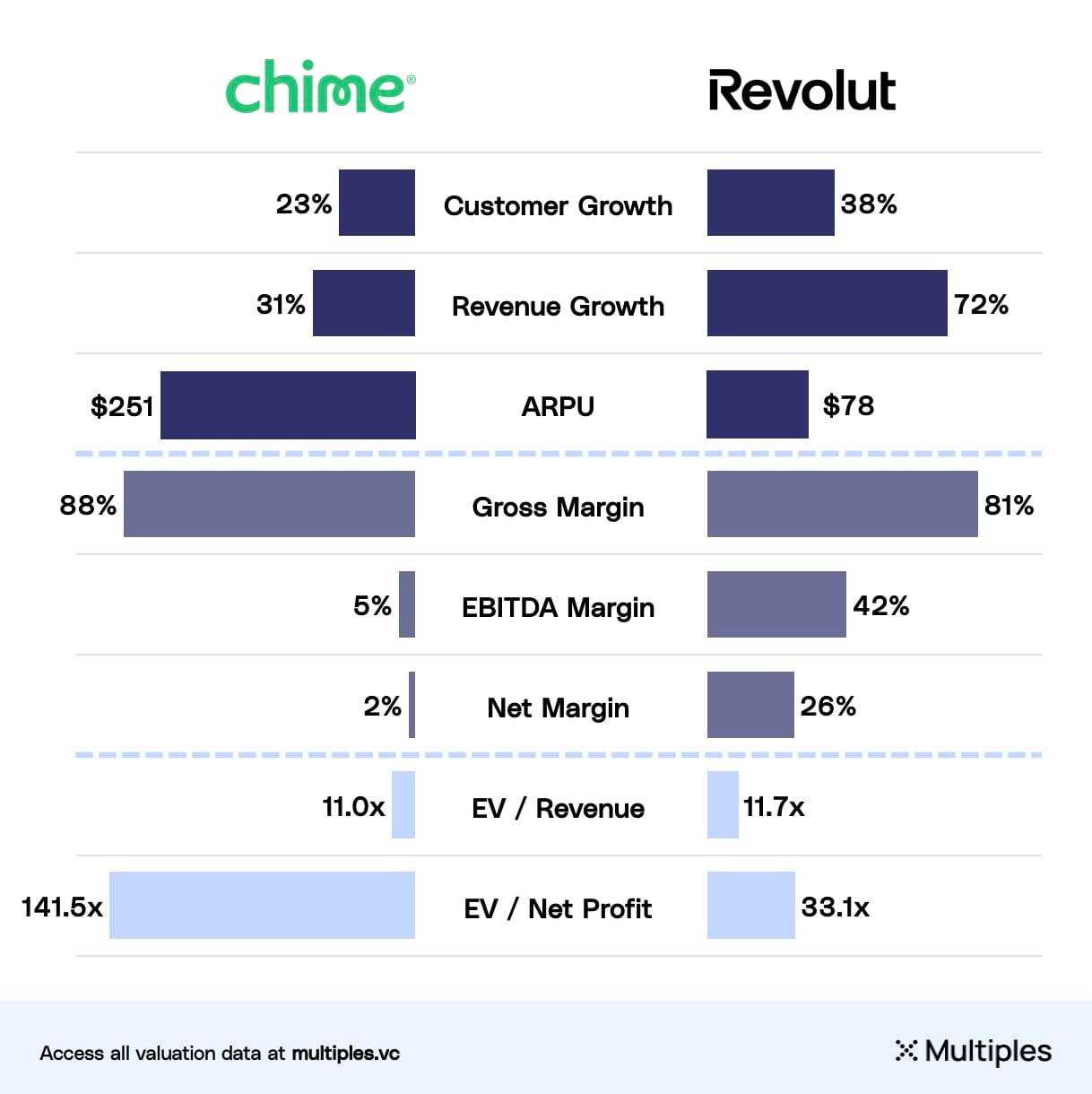

📈 Chime went public last Friday, surging 59% and reaching a valuation of $18.4 billion.

🇸🇪 Klarna challenger Zaver becomes a bank. The company has been granted a license for financing activities by the Swedish Financial Supervisory Authority. This authorization allows Zaver to provide payment services under the Swedish Payment Services Act and the European PSD2 regulations.

BLOCKCHAIN/CRYPTO NEWS

🇪🇺 Coinbase and Gemini reportedly in line for EU crypto licenses. The companies are reaching this milestone amid contention among EU regulators over how quickly and easily some countries are granting such licenses. These licenses will enable both to operate across all 27 EU members without the need for separate approvals.

🇸🇬 Bybit targets Q3 launch of new Solana-based DEX Byreal. It aims to release its new Solana-based decentralized exchange, Byreal, with a testnet version coming out at the end of June. Byreal was designed with RFQ (Request for Quote) and CLMM (Concentrated Liquidity Market Maker) routing.

🇺🇸 Tron is looking to go public in the U.S. Tron will go public via a reverse merger with Nasdaq-listed SRM Entertainment. The deal is being managed by Dominari Securities, an investment firm with ties to the Trump family. Continue reading

🇻🇳 Digital assets are legalized in Vietnam. The country has officially legalized digital assets with the approval of the Law on Digital Technology Industry by the National Assembly, the country's legislature. Under the new law, digital assets are categorized into two types: virtual assets and crypto assets.

🇸🇬 Interlace launches white-label card solutions to power personalized enterprise payments. A white-label card allows enterprises to customize their design, such as adding a brand logo or tailoring the card appearance, giving their bank cards a distinct and branded look.

🇹🇭 KuCoin launches SEC-Licensed crypto exchange in Thailand. The platform is licensed by Thailand’s Securities and Exchange Commission and is now available to all eligible users after an initial invite-only phase. Keep reading

PARTNERSHIPS

🌍 Klarna in collaboration with Norwegian Vipps Mobilepay, which means that Vipps Mobilepay is integrated as a payment method through Klarna both in the app and stores in Norway, Denmark, and Finland. Read more

🇴🇲 Dhofar Islamic’s Mastercard World credit card: An invitation to experience a world of exceptional privileges. The Dhofar credit card allows customers to enjoy an enhanced spending experience as it unlocks a comprehensive suite of rewards, travel benefits, and lifestyle offerings that can be availed of both locally and internationally.

🌎 Mastercard onboards customers up to four times faster with Cloud Edge. Cloud Edge offers customers cost efficiency as well as greater choice, speed, and flexibility. For instance, FinTechs can serve customers easily during demand spikes like national holidays or sales events without needing more physical infrastructure.

🇦🇪 Jingle Pay collaborates with Western Union to power and enable the delivery of international money transfers (remittances) from select markets. Jingle Pay will serve as a key partner for Western Union, providing support to the flow of cross-border money transfers currently to bank accounts & mobile wallets.

🇬🇧 RiseUp and Salt Edge join forces to bridge financial insights and payments with open banking. By partnering with Salt Edge, RiseUp is doing just that. UK businesses will receive a richer financial experience and a deeper understanding of their customers’ financial behaviours.

🇬🇧 ClearScore and Oakbrook partner on debt consolidation loans. With this broader partnership and integrating ClearScore’s newly developed ‘Clearer’ technology, loans will now come with a direct settlement option, whereby outstanding debts are paid straight to creditors on the borrower’s behalf.

🇪🇺 ConnectPay partners with InSoil for EU expansion. The integration will allow InSoil users to access features such as personal IBAN accounts, multi-currency settlements, and digital wallets. Users will also be able to reinvest funds without topping up accounts manually.

🇹🇿 CRDB Bank migrates card systems to BPC's SmartVista platform. The platform features multi-card issuance capabilities, including corporate and virtual cards, as well as acquiring services for processing transactions across POS networks, cardless withdrawals, and foreign exchange (FX) at ATMs, among others.

DONEDEAL FUNDING NEWS

🇮🇳 Sequoia, Greylock, and Nik Storonsky’s QuantumLight invest $90M into FinTech for overseas diasporas. There are plans to launch an interest-incurring multi-currency account, which will take advantage of an Indian government subsidy on foreign currency accounts held in the country, and to launch a full-stack Indian bank account for NRIs.

🇳🇬 Nigerian agri-FinTech Winich Farms secures Pre-Series A funding. With this new capital, Winich plans to strengthen its operations, empower more farmers, and explore expansion opportunities both across Africa and into the MENA region. Read more

🇫🇷 Enterprise WealthTech XFOLIO lands $2M seed funding. The newly secured capital will support the company’s go-to-market strategy and fund the development of AI-powered recommendation tools and cross-bank trading features. The platform is designed to help automate and visualize bankable and non-bankable assets.

🇬🇧 Pryme to raise £30m to power financial tools for Africa’s freelancers and SMEs. The goal is to scale a platform that has outgrown its e-commerce beginnings and morphed into what Pryme describes as a financial operating system for modern businesses.

🇺🇸 Juniper Square announces Series D financing round at $1.1 billion valuation. Juniper Square will use the capital to accelerate investment in JunieAI, the first enterprise-grade AI built specifically for the needs of private markets GPs. Read more

M&A

🇬🇧 LemFi buys Pillar to expand credit services to immigrants. The company plans to offer Credit Cards to customers, starting with the UK, and roll out the full suite of LemFi Credit features publicly. LemFi secures access to Pillar's proprietary credit scoring technology, its FCA credit licence, and Bhatt and Lewis.

MOVERS AND SHAKERS

🇮🇳 FamApp co-founder Kush Taneja to step down, in talks to sell stake. Taneja’s exit comes amid an overhaul at FamApp, which has restructured operations, shifted away from its teen-focused model, and grappled with funding challenges. Read more

🇺🇸 TreviPay names Matt Dewell as new Chief Information Security Officer. Dewell will work to establish security as a true competitive advantage within the firm's suite of solutions. These offerings include payment processing, credit and risk management, invoicing, automated accounts receivable, and collection management services.

🇬🇧 MoneyGram names Lamia Pardo its Chief Marketing Officer. In this role, Pardo will lead global marketing across all channels and markets, with a clear mandate to accelerate sustainable growth by scaling customer acquisition, increasing retention, and strengthening long-term loyalty.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()