Apple Challenges Court Over Payment Control

Hey FinTech Fanatic!

"Apple Pay meets crypto. For the first time ever, we are using Apple Pay to pay in crypto. There's no Visa or Mastercard involved," said Bam Azizi, CEO and Co-founder of Mesh, on stage at TOKEN2049.

This was one of the most interesting moments I caught last week in Dubai: Apple being forced to open the door to external payment systems on iOS, and crypto stepping right through it.

A new U.S. court ruling requires Apple to let developers redirect users outside the App Store for purchases. No more mandatory 27% commission. No more “scare screens.” It’s a big deal for any developer working with Web3 or NFTs.

But Apple is pushing back. In an emergency motion, the company asked for a partial stay on the ruling, arguing it goes beyond the original 2021 injunction. Apple says it will suffer significant losses and that the new restrictions weren’t based on any finding of unlawful conduct.

The court disagreed, pointing to Apple’s continued use of warnings and fees even after the original order. Whether the stay is granted or not, it’s clear something fundamental is starting to shift in how value moves through mobile platforms.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

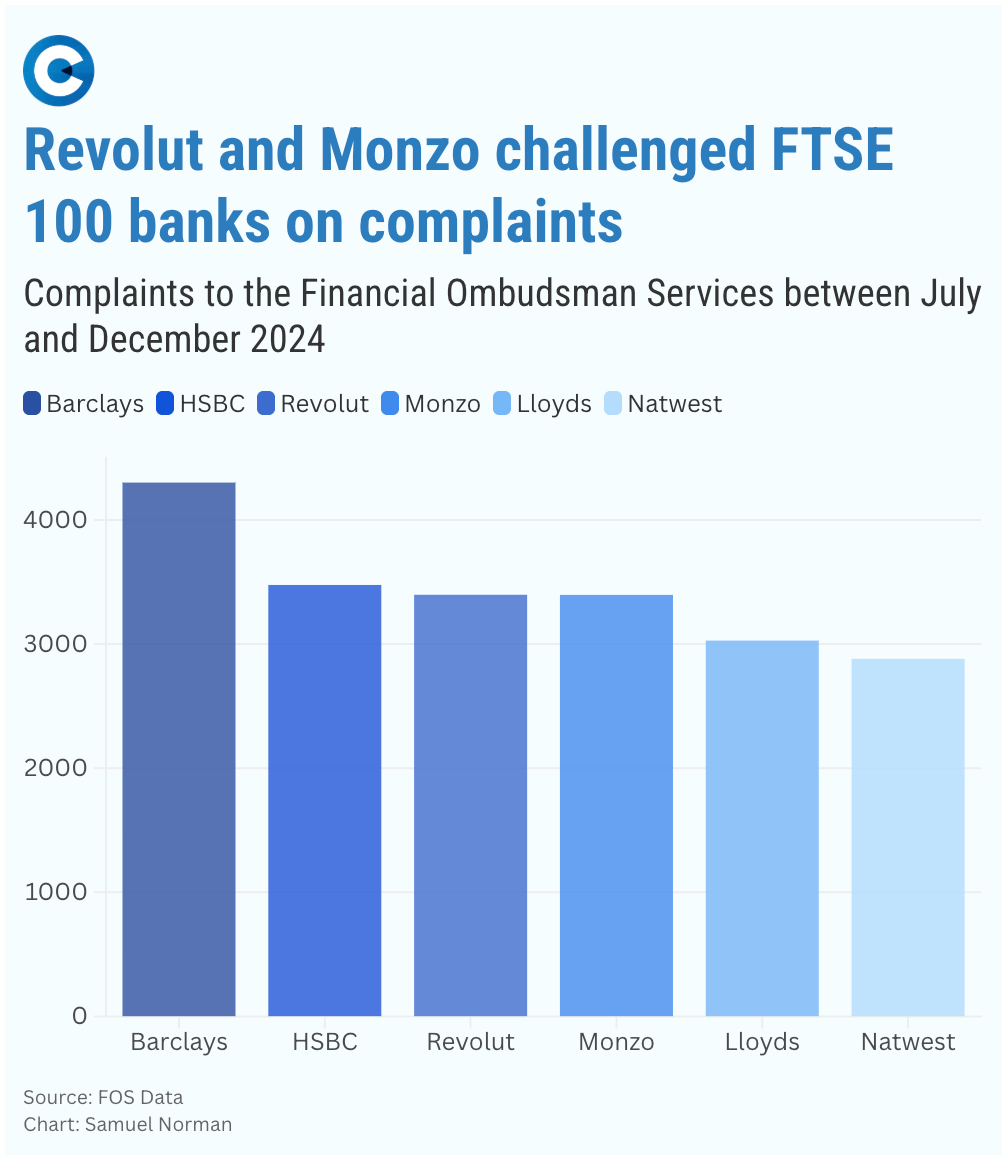

🇬🇧 Revolut, Monzo, and Wise: The UK FinTechs slapped with the most complaints.

FINTECH NEWS

🇺🇸 ACI Worldwide, Inc. reports financial results for the March 31, 2025, quarter. ACI ended Q1 2025 with $230 million in cash on hand and a debt balance of $853 million, representing a net debt leverage ratio of 1.2x adjusted EBITDA. Year to date, the company has repurchased 1 million shares for approximately $52 million in capital.

🇬🇧 Major change to customers of 30 UK banks after new Post Office deal. Millions of bank customers can access their money at Post Office branches. The five-year deal secures the role of postmasters up and down the country in providing banking services to their communities.

🇺🇸 SEC seeks to settle legal fight with Ripple Labs for $50 million. The SEC and the blockchain infrastructure company will jointly ask a federal court in Manhattan to dissolve an injunction against Ripple and release more than $125 million in civil penalties into an escrow account.

🇩🇪 Scalable Capital is launching Kids’ accounts this summer. This will allow you to invest on behalf of your mini-me(s) to bring long-term investing to the next level, start early, and benefit from compound growth. Keep reading

🇦🇪 NymCard launches open finance services under the CBUAE open finance regulation. With this milestone, NymCard becomes one of the first entities in the UAE to embed regulated payment functionality within a broader financial infrastructure through one modular platform.

PAYMENTS NEWS

🇲🇽 Mexico experiences accelerated adoption of digital payments. The use of digital wallets has quadrupled in the past decade, increasing from 6% of e-commerce transaction value in 2014 to 28% in 2024. This trend is expected to continue, with digital wallets projected to account for 37% of online transactions by 2030.

🇺🇸 Affirm Card GMV jumps 115% year over year to $807 million and reaching 2 million active cardholders. Affirm expects increased demand from shoppers seeking payment flexibility while being able to adjust approvals to maintain target credit results.

🇺🇸 Apple tries to delay a ruling that bars it from taking a cut on external app payments. A U.S. court ruled in favor of Epic Games in a long-running case against Apple, after the Judge found that Apple did not comply with an order that was handed down in 2021.

🇺🇸 Corpay strengthens its push into accounts payable for smaller businesses. Corpay will invest approximately $500 million for a 33% equity stake in AvidXchange. The $2.2 billion transaction is expected to close in Q4 2025, subject to shareholder and regulatory approval.

🇮🇩 Korea is set to introduce a QR code payment service in Indonesia. This initiative aims to promote advanced digital financial services in Asia and operates under the guidance of the Bank of Korea (BOK). Read more

🇨🇦 Nuvei enables near-instant payouts via Mastercard in Canada. The service enables funds to be transferred directly to eligible cards, bypassing the need for traditional bank transfers or cheques. Businesses can access this capability through their current integration with the company’s platform.

🌍 PalmPay expands into four African markets after Nigerian success. The move comes on the back of strong growth in its home market of Nigeria, where the platform processed over 15 million daily transactions in the first quarter of 2025. Continue reading

DIGITAL BANKING NEWS

🇺🇸 FinTech Firm Chime signs 84K-SF lease at 122 Fifth Avenue. San Francisco-based Chime signed an 84,000-square-foot lease for space in the property five blocks south of the Flatiron Building, where it will move its New York City offices from 101 Greenwich Street.

🇲🇽 Revolut expects to start operations as a bank in Mexico in the second half of 2025. The company received approval from Mexico's National Banking and Securities Commission, allowing it to establish a multiple banking institution, Revolut Bank, with a capital of 1.43 billion pesos. The bank's headquarters will be in Mexico City.

🇪🇹 Safaricom to launch credit, savings products to boost M-PESA in Ethiopia. Ethiopia is opening up its financial sector, and Safaricom is betting this will pay off. The country licensed its first two investment banks in April 2025 and launched its securities exchange two months earlier.

BLOCKCHAIN/CRYPTO NEWS

🇨🇭 Swissquote seeks to shake crypto link despite 1,500% stock rally. Swissquote co-founder and CEO Marc Buerki stated that the company does not consider itself a "Bitcoin stock." However, he acknowledged that some investors may primarily associate Swissquote with its cryptocurrency business.

🇪🇺 Gemini has obtained its MiFID II License. This milestone marks a significant step in Gemini’s 2025 European expansion strategy, bringing the company closer to launching derivative products for both retail and institutional users within the region.

🇺🇸 Former Celsius CEO Alex Mashinsky sentenced to 12 years for crypto fraud. The sentencing, handed down by a U.S. District Judge in Manhattan’s Southern District, marks a significant moment in the ongoing crackdown on cryptocurrency fraud.

🇺🇸 Coinbase to launch 24/7 Bitcoin and Ethereum futures trading. Traders can access crypto futures around the clock, including weekends, offering constant execution and risk management capabilities. This development arrives after Coinbase announced its $2.9 billion acquisition of crypto derivatives exchange Deribit.

PARTNERSHIPS

🇺🇸 Affirm and Costco launch BNPL partnership for e-commerce. Customers, if approved, will be able to select monthly Affirm payment plans when shopping on Costco’s website. Keep reading

🇦🇹 DenizBank partners with Konsentus to enhance open banking operations. This collaboration aims to ensure compliance with regulations, improve operational efficiency, and enhance security within its digital banking landscape. DenizBank provides a variety of retail and commercial banking services.

🇺🇸 Paysafe and Fiserv strengthen partnership to drive SMB growth with enhanced capital access, fraud protection, and new digital wallet solution. This wallet will enable businesses to receive faster settlements and access a full range of banking services, while enhancing the customer experience.

🇺🇸 Stripe partners with Verifone. The partnership aims to deploy durable in-person payments through Verifone’s payment devices, expanding the company’s reach to businesses seeking enterprise-grade equipment and global payment capabilities.

DONEDEAL FUNDING NEWS

🇺🇸 Rogo raises $50M series B from Thrive Capital, J.P. Morgan, and Tiger Global to Build Financial AI. Patrice Maffre, International Head of Investment Banking at Nomura, stated that the strategic integration of Rogo is set to transform the way the firm delivers value to its clients.

MOVERS AND SHAKERS

🇲🇽 Dafne Cisneros has joined Clara as Marketing Lead in Mexico. Dafne brings sharp FinTech and digital marketing experience from Google, Nubank, Visa, and Mercado Pago, and she’s already making waves at Clara. Read on

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()