Ant Group to acquire MultiSafepay for USD 200M in order to expand into the Western market

Hey FinTech Fanatic!

I'm enjoying my final days sipping cocktails under the Curacao sun. But, as they say, all good things must come to an end. It's time to swap the beach for the streets of New York.

In the Big Apple, I'm on a mission: to network with the best in the business. And not just from our beloved FinTech world (though that's always a plus!). I'm scouring the city for newsletter wizards, the best of the best, who can help me spice up my daily updates.

The goal? To bring you even more value in the coming year. Got someone in mind? Hit reply and let me know!

Now, let's dive into the heart of FinTech:

🔍 Bitcoin Buzz: A Week of Anticipation and Surprise

- ETF Update: TechCrunch's Jacquelyn Melinek keeps us on our toes. Earlier last week, she hinted at a potential breakthrough for a spot Bitcoin ETF. However, she's now shifting gears, saying, "Approvals could now be next week, but 'no definitive timing'." Talk about keeping us in suspense! It seems the gears of government grind slower than anticipated.

- The Satoshi Saga Continues: The Genesis wallet, the first ever created on the Bitcoin network, reportedly received 27 bitcoins! Speculations are rife – has Satoshi Nakamoto, the elusive creator, resurfaced? Or is it a million-dollar mystery? Coinbase's Conor Grogan adds fuel to the fire on X:

"Either Satoshi woke up, bought 27 bitcoin from Binance, and deposited into their wallet, or someone just burned a million dollars,"

So, folks, it seems Bitcoin is not just alive – it's thriving and full of surprises! Stay tuned for more updates, and don't forget – if you have those newsletter guru contacts, I'm all ears.

Cheers,

Marcel

SPONSORED CONTENT

POST OF THE DAY

Have you ever found yourself conversing with industry professionals, and it feels like they’re all talking in code? Here is a comprehensive alphabet from A all the way to Z made by Subaio:👇

BREAKING NEWS

Ant Group has announced the closing of its deal to acquire Netherlands-based MultiSafepay for USD 200 million deal-sources. Following this acquisition, Ant Group aims to accelerate its expansion process into the Western payment markets. The transaction is currently subject to regulatory approval, and it is expected to value MultiSafepay at around USD 200M, including USD 50M in revenue.

FINTECH NEWS

🇲🇱 Orange in Mali and TerraPay forge cross-border payments alliance. This partnership marks a significant milestone in the digital financial landscape for Mali, connecting over 12 Million Malians to the vast diaspora residing across the globe, including other African countries.

🇵🇰 ACE Money Transfer partners with Habib Metro for secure money transfers to Pakistan. This partnership leverages the strengths of both organizations and streamlines the remittance process, ensuring faster, safer, and more transparent money transfers for the Pakistani diaspora.

🇺🇸 Arc is introducing Arc Capital Markets — The First Venture Debt Marketplace for Silicon Valley. The result of combining Arc Capital Markets with Arc Cash Management is more yield, greater diversification, better terms, and less dilution—the four things founders care most about. Read on

🇨🇩 Mastercard teams with illicocash to issue virtual cards in Democratic Republic of the Congo. Through this partnership, the companies will introduce a virtual card program to support financial inclusion by providing a new and effortless way for consumers and businesses to perform e-commerce transactions.

🇺🇸 Carta, the cap table management outfit, is accused of unethical tactics by a prominent startup: "This might be the end of Carta as the trusted platform for startups," said Linear's CEO, expressing concern about Carta's trustworthiness, in light of accusations regarding the misuse of sensitive information.

Intuit TurboTax integrates with Credit Karma and QuickBooks. Leveraging Intuit's AI and TurboTax's tax expertise with a filer's data from Credit Karma or QuickBooks, these integrations create a more seamless and personalized tax preparation and filing experience for individual tax filers and small business owners.

🇨🇴 Colombia leads digital financial inclusion with 20% Fintech growth. This significant increase underscores Colombia’s pivotal role in driving digital transformation across Latin America, emphasizing the synergy between public and private sectors in advancing digital age progress.

PAYMENTS NEWS

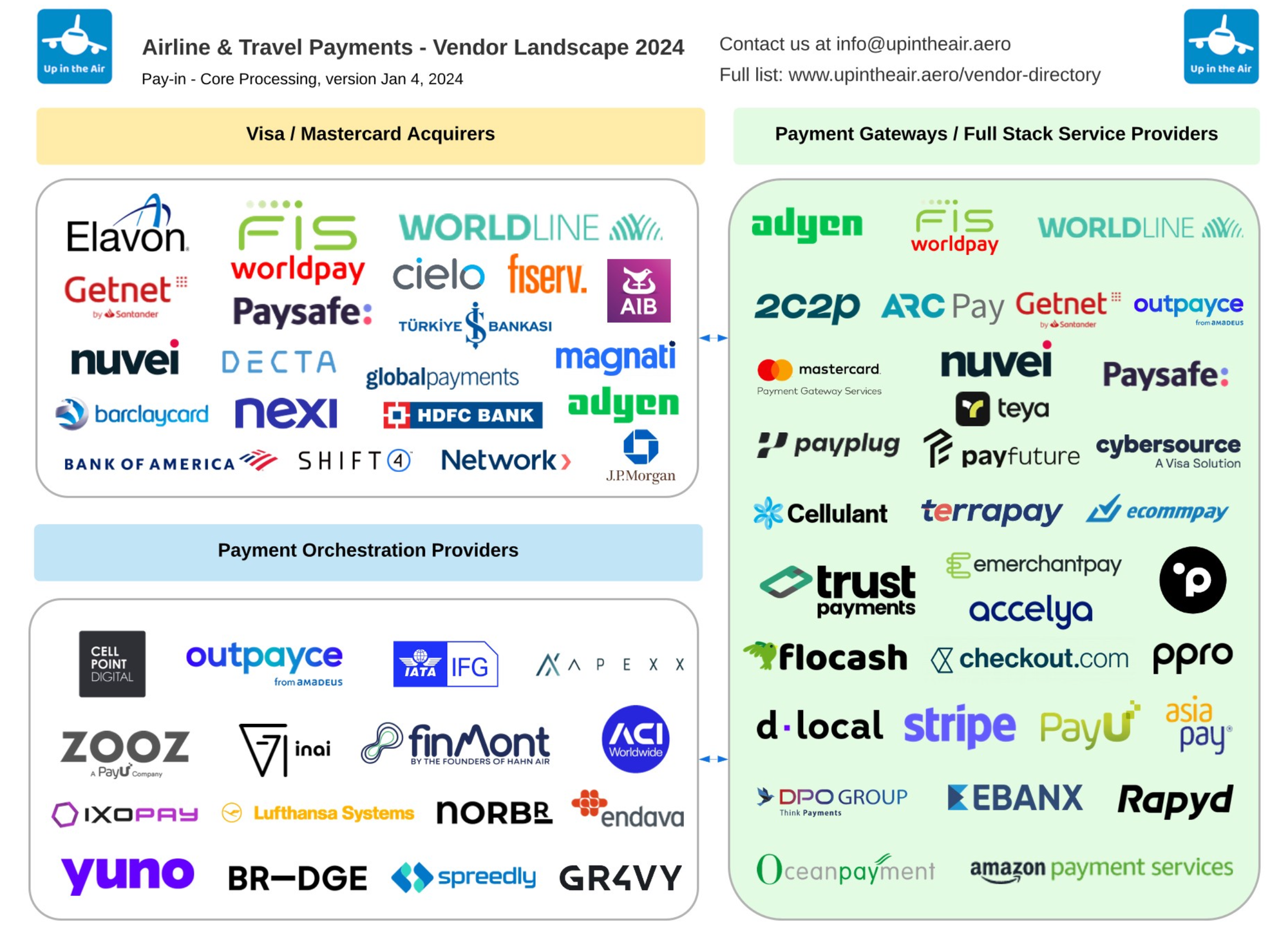

Airline & Travel Payments - Vendor Landscape 2024, by Up in the Air | Consultancy👇

Tamara BNPL service integrates with Paymob gateway. The agreement between two of the MENA region’s fastest growing fintech companies creates a payments ecosystem that enables merchants to offer more comprehensive solutions and seamless customer experiences.

HitPay delivers Tap to Pay on iOS in Australia, Canada, France, the UK, and the US. HitPay’s Tap to Pay feature on iOS simplifies the process of accepting contactless payments using an iPhone. Merchants simply show their iPhone to customers, prompting them to tap their card until the transaction finishes.

DIGITAL BANKING NEWS

🇬🇧 HSBC's new fintech app Zing built on Monese's platform. While the project is wholly owned and successfully kept under wraps by HSBC, over this time the bank tapped neobanking challenger Monese for its core banking platform to power Zing, according to people familiar with the matter.

🇲🇾 AEON Credit Gets Nod For Islamic Digital Banking Services. AEON Bank has obtained approval from the Bank Negara Malaysia and the Minister of Finance to commence its digital banking operations in Malaysia. This positions the bank as the first Islamic digital bank in the country.

🇪🇬 Central Bank of Egypt to soon allow ATM withdrawals for InstaPay users. The Deputy Assistant Governor of the CBE for Banking Operations and Payment Systems Ehab Nasr announced that more services will be launched on InstaPay soon – including cash withdrawal through ATMs.

🇮🇱 Digital bank One Zero cutting 10% of workforce in Israel as it prepares to expand to Europe. The digital bank is setting up operations in Italy in partnership with Generali. Simultaneously, the bank plans to streamline its operations in Israel, including laying off 30-40 employees. Read more

🇸🇬 YouTrip raises e-wallet limits after MAS rule change; Revolut and Wise to follow suit. Users of multi-currency e-wallets are now able to spend and hold more money in their accounts following recent changes to these regulatory limits. Singapore operators, starting with YouTrip, are preparing to implement these platform changes.

🇰🇷 ZilBank.com empowers South Korean entrepreneurs with seamless US payments. The cloud banking platform ensures efficient and affordable cross-border transactions, enabling South Korean entrepreneurs to conduct business easily and cost-effectively. More on that here

BLOCKCHAIN/CRYPTO NEWS

TechCrunch reporter revises Bitcoin ETF prediction, expects greenlight soon. Jacquelyn Melinek posted a statement on Jan. 5 updating her expected timeline for spot Bitcoin ETF approvals. Earlier, Melinek said she had spoken with sources and “expected something” on Friday without explicitly stating that an approval would occur.

Bitcoin ETF planned fees revealed: BlackRock goes low, Grayscale stays high. More fund groups vying to launch spot bitcoin ETFs revealed planned fees that would undercut a low mark previously held by Fidelity, as a fee war brews ahead of a possible approval. Link here

🇰🇵 North Korea-affiliated hackers were involved in a third of all crypto exploits and thefts last year, making off with some $600 million in funds, TRM Labs reports. The sum brings the Democratic People's Republic of Korea's (DPRK) total take from crypto projects to almost $3 billion over the past six years, the blockchain analytics firm said recently.

🇭🇰 Cryptocurrency’s future looks uncertain in many respects, but that is not deterring Hong Kong from doubling down on its digital assets bet. The erstwhile British crown colony seems determined to transform itself into Asia Pacific’s premier cryptocurrency hub at the soonest. Read more

DONEDEAL FUNDING NEWS

🤑Since December 12th, we saw 24 deals in Europe for a total amount of €188.2m raised officially with thirteen deals in the UK, five in France, two in Sweden, two in Switzerland, one in Germany, and one in Luxembourg. Link here

Investment in US and UK fintech startups experienced sharp declines in 2023 due to factors like inflation, increased interest rates, geopolitical issues, and other macroeconomic conditions. This impacted valuations, deal activity, and saw a downturn in acquisitions in both countries.

🇦🇪 UAE-based agriculture-focused fintech Maalexi, has closed $3 million in pre-Series A funding. The company’s overall focus and strategy are to build resilience in the food supply chain and replicate the same model across the GCC. Funds will be used to enhance its platform and drive customer acquisition in the UAE, Saudi Arabia, and beyond.

🇰🇿 Kazakhstan fintech Solva raises $20 million in bid to become a bank. Solva plans to use part of the funding to support its ongoing transformation from a microfinance organisation into a fully licensed SME-focused bank, expected in 2024. The investment will accelerate Solva's regional expansion plans, bringing its credit scoring platform and inclusive finance principles to Central Asia.

🇮🇩 Indonesian neobank KOMUNAL gears up for expansion with a US$5.5M funding round led by Sumitomo Corporation Equity Asia. With the fresh funds, KOMUNAL aims to expand its product offerings and develop close partnerships with more rural banks, particularly those outside Java and Bali. More here

MOVERS & SHAKERS

Cubed announced that Eelco-Jan Boonstra will be joining as Founding Partner and Managing Director of Europe starting Feb. 1, 2024. His mastery of Sales, Market Expansion, Product Development, Customer Growth, and leadership of high-performing teams sets Eelco as a standout asset to both the firm customers and the overall success of Cubed.

🇬🇧 Chetwood Financial names Julian Hynd as COO. As Chief Operations Officer, Hynd will have executive responsibility for bringing Chetwood Financial’s strategy to life through the company’s technology, operations, and people. He will also help bring the ModaMortgages proposition to market later this year.

🇳🇱 Paula Steiner: From group Head of Compliance to interim Chief Compliance Officer at Fiat Republic. Steiner's exceptional leadership, innovative approach to compliance, and unwavering commitment to excellence have been crucial to the firm's success. Read more

🇺🇸 Fintech pioneer and serial entrepreneur, Simon Wilson-Taylor joins capital markets innovation lab and incubator FastFin. Wilson-Taylor will leverage his deep institutional fintech expertise to lead groundbreaking sell-side and buy-side innovation projects at FastFin clients.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()