Alpaca Hits $1.15B Valuation as It Raises $150M to Scale Brokerage Infrastructure

Hey FinTech Fanatic!

Alpaca just raised a $150M Series D at a $1.15B valuation, doubling down on its ambition to become the global standard for brokerage infrastructure.

The round was led by Drive Capital. The company powers trading and investing APIs for partners like Kraken, SBI Securities, and Dime!, supporting stocks, ETFs, options, and fixed income through a self-clearing custody model.

Alpaca now works with 300+ partners across more than 40 countries and has more than doubled revenue year over year.

The round also includes a $40M credit line, strengthening the balance sheet as the company secures licenses, expands institutional trading capabilities, and bridges traditional and on-chain markets.

Co-Founder & CEO at Alpaca, Yoshi Yokokawa, framed the raise around global access. He said the goal is to open financial services worldwide, including infrastructure that enables Shariah-compliant investing.

Wondering what’s next for FinTech? Dive into today’s updates 👇 Back tomorrow with more stories shaping the industry.

Cheers,

Marcel

POST OF THE DAY

🌍 Global Map of FinTech Unicorns 🦄 in 2025

#FINTECHREPORT

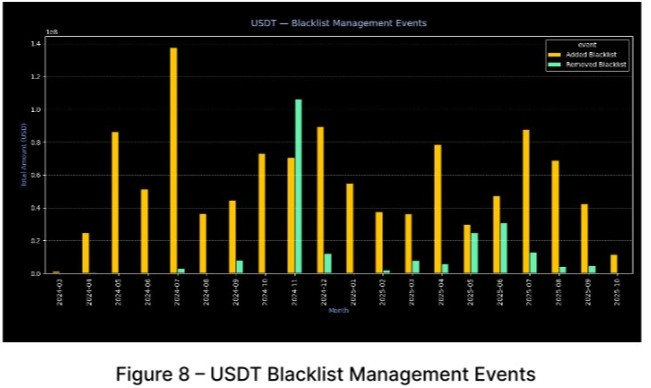

📊 Stablecoin Freezes 2023-2025: A Data-Backed Analysis of USDT vs USDC.

FINTECH NEWS

🇩🇪 Bitpanda said to gear up for Frankfurt IPO in the first half of 2026. The Vienna-based company could seek a valuation of between €4 billion ($4.7 billion) and €5 billion in the offering. Bitpanda has hired Goldman Sachs Group Inc., Citigroup Inc., and Deutsche Bank AG to arrange the offering.

🌍 eToro announces 7% workforce reduction amid strategic shift. The decision, part of a strategic realignment to enhance operational efficiency, comes as the company aims to align its resources with its business objectives and support long-term growth.

PAYMENTS NEWS

🇺🇸 BVNK to deliver stablecoin infrastructure for Visa Direct pilot programs. BVNK will help power Visa Direct’s stablecoin services in select markets, enabling certain select business customers to fund Visa Direct payouts using stablecoins instead of only fiat, and payouts to end recipients in stablecoins, putting digital dollars directly in recipients’ wallets.

🇺🇸 Affirm updates underwriting with enhanced signals to reflect consumers’ real-time finances better. These enhanced signals are already helping Affirm Card users who’ve linked a third-party bank account or have an Affirm Money Account.

🇳🇱 FinTech firm PayU Payments' loss narrows to Rs 248 crore in FY25. The company had posted a loss of Rs 429.51 crore in the same period a year ago. The consolidated revenue from operations of PayU increased by about 23% to Rs 5,562.98 crore in FY25, from Rs 4,527.39 crore in FY24.

🇸🇬 Tether-Backed Oobit expands Visa payments by adding Phantom Wallet. This update allows Phantom users to make real-time crypto payments through Visa-supported merchants without transferring assets to custodial services. According to Oobit, the platform’s “DePay” payment layer enables instant crypto-to-fiat conversions at the point of sale.

OPEN BANKING NEWS

🇬🇧 PayDo introduces Dedicated C2B Open Banking Collections Ecosystem to revolutionize high-volume merchant payments. This innovation addresses operational bottlenecks by providing automated reconciliation and real-time tracking for Open Banking transactions, rendering them as reliable and scalable as traditional card payments.

DIGITAL BANKING NEWS

🇬🇧 Klarna expands digital bank offer with peer-to-peer payments. The new feature enables Klarna customers to send money to friends and family, whether splitting bills or gifting cash, directly from the Klarna app: as simple as handing someone cash, with the protection of a regulated bank.

🇪🇸 CaixaBank fined by Spain’s money laundering watchdog on skyscraper sale. CaixaBank was handed several fines totaling more than €30 million ($35 million) combined. Read more

🇩🇰 Lunar launches Wallet Story. Built on individual transaction data and launched rapidly using in-house technology, the feature aims to make financial reflection more engaging and personal, without judgment or scoring, according to founder and CEO Ken Villum Klausen.

🇦🇪 Wio Bank launches UAE's first account for content creators, with no minimum balance. Wio Bank has launched the UAE’s first banking account designed specifically for content creators and digital entrepreneurs, offering tailored features to support income management, payments, and business growth.

🇬🇧 Monzo faces a major outage. Monzo has experienced an outage, causing thousands of customers to lose the ability to send or receive payments. Monzo's status page indicates that the company has identified some issues with the platform that will be investigated.

🇺🇸 Rhode Island proposes a bill to eliminate taxes on small Bitcoin payments. The bill, effective from January 1, 2027, through January 1, 2028, aims to simplify tax obligations for small-scale crypto trades and encourages compliance through self-certification, with guidelines for record-keeping and valuation.

BLOCKCHAIN/CRYPTO NEWS

🇰🇷 South Korea’s Korbit accepts $2m FIU fine for major AML violations in crypto trading. Investigators identified multiple compliance gaps during the on-site review. Korbit processed 19 virtual asset transfers involving three unregistered overseas virtual asset service providers, violating prohibitions on dealings with unreported foreign entities.

🇱🇺 Ripple expands European regulatory footprint with preliminary EMI approval in Luxembourg. This license represents a significant step in Ripple's efforts to scale its cross-border payments infrastructure across Europe, and to support institutions there as they move from legacy technology to seamless, real-time, 24/7 payments.

PARTNERSHIPS

🇸🇬 Agoda and Mastercard collaborate to modernize loyalty programs with flexible travel rewards. Through this collaboration, banks connected to Mastercard’s rewards ecosystem can embed the Agoda-powered travel redemption solution into their own loyalty programs, where points can be redeemed instantly and applied directly to Agoda’s global inventory of accommodations and flights.

🇬🇧 Nationwide taps Moneyhub for spending insights tech. The development will leverage the categorisation and enrichment engine from Moneyhub, which organises transaction data into categories and adds metadata like merchant geolocation and transaction types to provide a structured view of spending.

🇺🇸 Chainalysis and BVNK extend partnership to power compliance in self-hosted digital asset payments. This deepening collaboration allows businesses using Layer1’s self-hosted payments infrastructure to seamlessly monitor and manage transaction risk, embedding Chainalysis’ industry-leading data directly into their core operations.

🇸🇪 Pay. expands its payment mix with Brite. The integration gives merchants immediate access to a fast and secure payment method that allows consumers to pay directly from their own bank environments, reaching around 350 million users across more than 3,800 banks in Europe.

🇵🇪 Bybit Pay links with digital wallets Yape and Plin to offer crypto payments in Peru. Users can spend stablecoins and major cryptocurrencies, which are automatically converted into Peruvian soles at the point of sale. Read more

🇺🇸 Citizens State Bank partners with MANTL to unify and modernize deposit account opening across all banking channels. By leveraging MANTL's full suite of omnichannel account opening products, the bank will deliver a consistent, streamlined experience across every channel while optimizing efficiency for staff and ensuring simplicity for retail and business customers.

🇯🇵 Quant and Dentsu Soken partner to advance Japan’s tokenized deposit infrastructure. This partnership combines Quant’s proven interbank settlement technology with Dentsu Soken’s extensive experience in Japan’s payment systems.

🇳🇱 Lovable turns to Stripe to accelerate its growth. Lovable now uses Stripe Billing to charge customers based on AI token consumption for its Lovable Cloud and Lovable AI services, aligning revenue with actual usage and underlying AI costs.

DONEDEAL FUNDING NEWS

🌎 Spanish bank Bankinter joins BBVA and Tether with a stake in crypto exchange Bit2Me. The investment strengthens Bit2Me's capital structure and supports its regulatory ambitions in Europe and Latin America, as it operates under the EU's new MiCA regulation, the exchange said.

🇺🇸 MagicCube raises $10m to scale payments security platform, and expand into biometrics. The company says the capital will be used to accelerate product development, scale international commercial operations, and broaden the scope of its software-defined trust technology.

🇺🇸 Alpaca raises $150 million at a $1.15b valuation to build the global standard for brokerage infrastructure. Alpaca intends to deploy the proceeds to further strengthen its global investment infrastructure in support of sophisticated financial institutions and institutional trading clients worldwide.

🇺🇸 Project Eleven raises $20M to tackle quantum threat against crypto. Project Eleven is working with blockchain protocols such as Solana on migration strategies and plans to launch self-custody solutions to protect users’ assets even before networks like Bitcoin adopt quantum-resistant upgrades.

🇺🇸 Kraken-backed SPAC, KRAKacquisition Corp., files for $250 million initial public offering. The special purpose acquisition company will focus on cryptocurrency ecosystem businesses, expanding Kraken's presence in public markets.

M&A

🇵🇹 Goparity acquires Spanish Bolsa Social to consolidate Iberian leadership in impact investing. This acquisition represents a significant milestone for the Iberian and European impact investment ecosystem, accelerating Goparity's expansion and strengthening its position as a leading reference in sustainable crowdfunding.

🇨🇦 Crypto exchange Coincheck to buy digital asset manager 3iQ. Under the terms of the agreement, Coincheck will acquire approximately 97% beneficial ownership of 3iQ in a deal that values the digital asset manager at $118m. Read more

🇬🇧 Fast-growing Abound expands into mortgages with first acquisition. Under the deal, which is Abound’s first acquisition, Ahauz will continue operating with its existing specialist focus, while gaining access to Abound’s capital and its AI-led underwriting approach.

🇳🇬 Paystack moves beyond payments with Ladder Bank acquisition. The newly acquired institution will be rebranded as ‘Paystack Microfinance Bank (Paystack MFB). The deal allows the FinTech company to hold customer deposits and provide loans, which are capabilities it previously lacked under its payments-only licence.

MOVERS AND SHAKERS

🇺🇸 ACI Worldwide appoints JP Krishnamoorthy to lead technology innovation. Krishnamoorthy joined ACI in December 2025 and assumes full technology leadership as the company accelerates its shift toward smarter payments orchestration, embedded AI capabilities, and faster time to market for banking, biller, and merchant clients.

🇺🇸 Vergent appoints Mike Rogers as Chief Growth Officer. In his new role, Rogers will be responsible for company-wide revenue growth with a focus on delivering industry-changing consumer user experience, customer value, and service delivery.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()