Allianz is suing Revolut for £10.4m over axed travel insurance deal

Hey FinTech Fanatic!

First, a spotlight on my recent exploration: Airbnb's financial performance in 2023. Astoundingly, they've raked in a whopping $529 million in interest income in just three quarters. This begs the question: Is Airbnb morphing into a FinTech powerhouse right under our noses? Your thoughts are eagerly awaited!

Continuing this theme, let's revisit my previous analysis where I delved into whether the Starbucks App is more than just a convenient coffee companion, but actually a stealth banking app.

Now over to the biggest news update today:

Allianz is suing Revolut for £10.4m, alleging that the neobank breached its obligations under a deal it struck in 2021 for Allianz to provide travel insurance to Revolut customers.

The lawsuit claims that Revolut breached the contract by moving its customers to a new insurance provider and eventually terminating the agreement. Allianz asserts this breach prevented them from invoicing and receiving further payments.

Starting April 2022, Allianz Partners became the global travel insurance provider for Revolut. This service was available to Revolut’s Premium or Metal Account holders in 31 markets across the European Economic Area and the UK.

These account holders had access to various travel insurance benefits directly through the Revolut app, including coverage for overseas medical emergencies, trip cancellation, interruption, lost or delayed baggage, and winter sports.

Additional features include a 24/7 medical assistance hotline and other benefits from Allianz Partners. The Premium plan covered children or dependents up to age 17, while the Metal plan offered extended travel liability coverage and car hire excess.

However, that has since changed.

According to its site, Revolut is currently arranging collective travel insurance for its subscribers through Cowen Insurance Company and Cover Genius .

Cowen Insurance, registered in Malta and regulated by the Malta Financial Services Authority, is the underwriter responsible for handling and paying out insurance claims.

Cover Genius, located in Amsterdam and regulated by the Dutch Authority for Financial Markets (AFM), acts as the policy administrator. Claims and payments are managed via the Xcover platform.

Have a great start to the week and I'll be back with more FinTech news tomorrow!

Cheers,

ARTICLE OF THE DAY

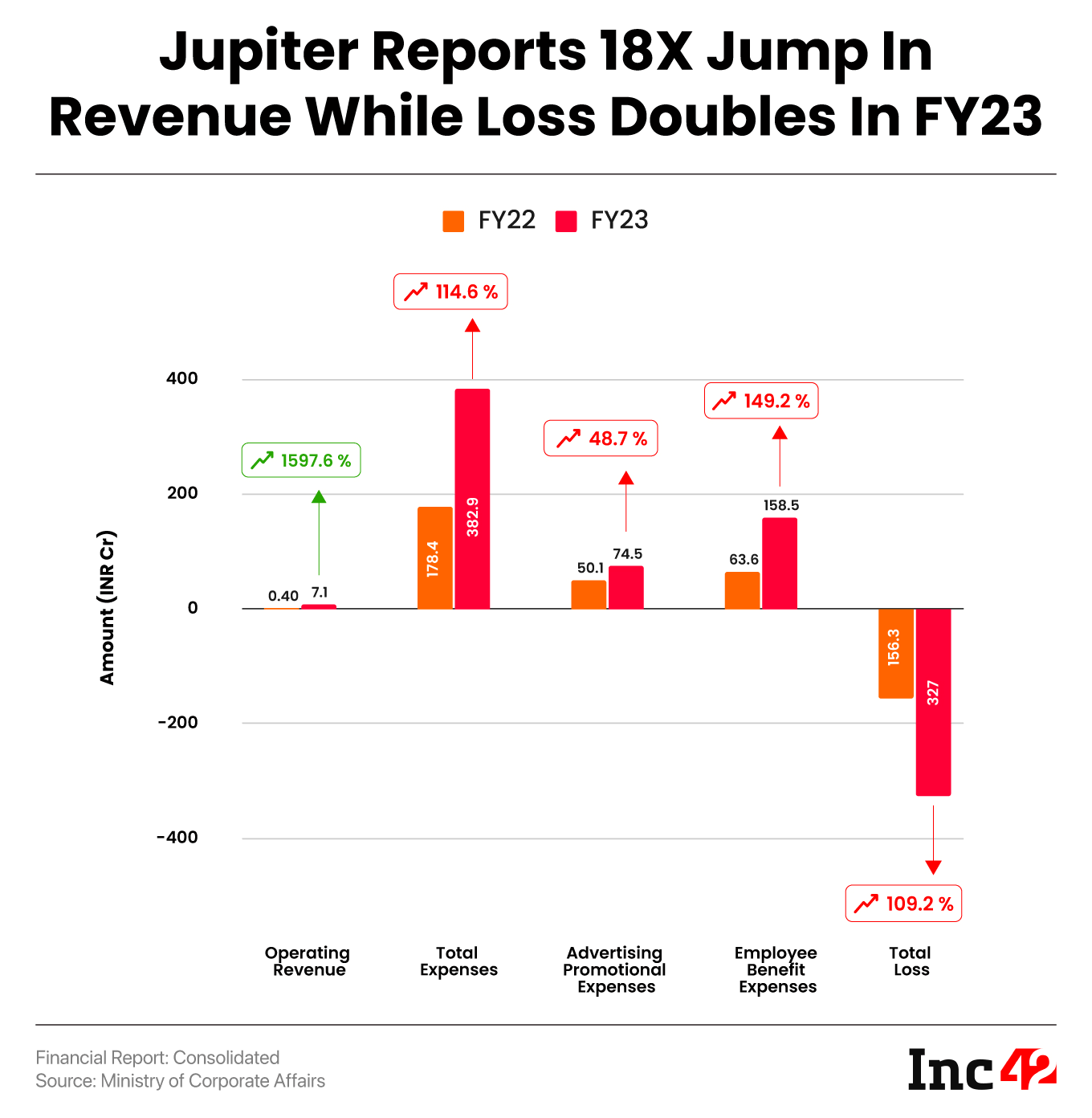

🇮🇳 Jupiter's Financial Marathon: More Spending, Bigger Losses but Increased Revenue in FY23. In a striking display of the volatile dynamics in the fintech world, Jupiter, an emerging neobank, has reported a fiscal pattern that turns heads. Dive into my detailed analysis for a deeper understanding.

FEATURED NEWS

🇧🇷 Nubank has introduced an innovative feature allowing personal account (PF) holders to transfer their credit limit to their business (PJ) accounts to enable entrepreneurs to shift up to 99% of their personal credit card limit to their business card as needed. The neobank is also stepping up its crypto adoption drive, adding trading capabilities for five more altcoins to its banking app.

#FINTECHREPORT

Future of Payments Review 2023 chaired by Joe Garner, reports on the steps needed to successfully deliver world leading retail payments in the UK. Check out the full report here

FINTECH NEWS

🇵🇪 The new Paytech Tarjeta W, arrives in Peru in collaboration with Visa and Corporación E. Wong. Designed to meet the rising trend of digital wallets in Peru, the electronic wallet Tarjeta W provides a fully digital purchasing experience, both locally and internationally.

🇺🇸 Blue Ridge Bank sheds fintech partners, explores capital raise: The Charlottesville, Virginia-based firm, whose fintech program came under OCC scrutiny last year, said it is in the process of offboarding about a dozen of its roughly 50 BaaS partners.

Meet the 23 African Startups selected for the inaugural Visa Africa Fintech Accelerator. Click here to explore them.

🇫🇷 Embedded Finance Europe applies for EMI licence in France. “This is another positive development for the Company after a very challenging period. We are now on the front foot again, rebuilding momentum quickly.” Embedded Finance CEO has said.

🇺🇸 Did the OCC hire a con artist to oversee fintech? The Office of the Comptroller of the Currency announced in March that it had set up a new division to oversee fintechs and banking as a service, which it called the Office of Financial Technology. To run the unit, it hired Prashant Bhardjwan, whom the OCC said had "nearly 30 years of experience serving in a variety of roles across the financial sector." Read more

2023 Roundup: The Synergy of BNPL and E-commerce. In 2023, we’ve witnessed a surge in e-commerce-BNPL collaborations across different regions, with several e-commerce platforms working their magic to seamlessly integrate BNPL options into online checkouts: Dive into the details here

OPEN BANKING NEWS

🇩🇰 Mastercard and e-Boks partner up to make it easier to pay invoices in just a few clicks with open banking The payment solution will make invoice payments simpler than ever and improve the user experience rapidly by being fully embedded in the e-Boks platform.

🇬🇧 More UK banks add support for Apple Wallet’s Connected Cards feature. Apple iPhone users with debit/credit cards issued by five additional banks and issuers in the UK can now view balance, remaining credit, and card transaction history in Apple Wallet.

REGTECH NEWS

AMLYZE and Plumery join forces for digital banking experience. This collaboration heralds a new era in the financial technology domain, where compliance meets consumer experience, driving growth and security hand-in-hand.

DIGITAL BANKING NEWS

🇲🇽 The Rate Revolution: How does the game change in the Mexican financial sector? In a dynamic shift in Mexican Fintech, Ualá, Stori, and Nu México are leading a competitive race to offer the most attractive savings rates. This rate war they initiated is not only enticing users seeking higher returns but also poses a direct challenge to traditional banks.

🇬🇧 Majority of UK banks already piloting GenAI. Nearly three quarters of UK financial services firms are now piloting the use of generative AI for things like ‘co-pilot’ employee efficiency tools, according to a UK Finance survey.

🇵🇰 How digital are Pakistan’s top big banks? Most banks don’t really report metrics related to digital operations, and the regulator doesn’t care much about measuring progress. This article focuses on the four big players. Read on for more details

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 MAS to tighten crypto rules for Singapore retail customers. The proposed measures include preventing crypto service providers in Singapore from accepting payments through locally issued credit cards.

Two crypto platforms linked to Justin Sun hit by hacker attacks. Both projects were hacked in separate exploits that may have drained more than a combined $110 million worth of cryptocurrencies.

🇧🇷 Nubank adds five more Altcoins to banking app. The bank added support for Polkadot (DOT), Avalanche (AVAX), Stella Lumens (XLM), Arbitrum (ARB), and Optimism (OP) on November 22. Read more

DONEDEAL FUNDING NEWS

Neobank startup iPeakoin raised nearly $10 million Series A from Zhenfund. The company aspires to create a new generation of banking for global businesses, allowing greater control over business funds and simplifying transactions.

🇳🇱 Euro stablecoin startup lands €3.3 million seed round: Shortly after minting its first stablecoins, StablR said it had won the backing of Deribit, Maven 11, Theta Capital, Folkvang and Blocktech. The firm said it hopes to transform the stablecoin market by establishing “a fresh benchmark for stability and trustworthiness.”

Take a look at the Fintech Deals in Portugal in 2023 featured at the Portugal Fintech Report 2023 by Portugal Fintech.

MOVERS & SHAKERS

73% of FS execs expect GenAI to take their jobs. Almost three-quarters (73%) of executives working in financial services expect to eventually be replaced by Generative AI (GAI), according to a recently released study.

Flutterwave’s Chief Financial Officer (CFO) Oneal Bhambani has resigned just 18 months after joining the fintech startup, raising questions about the company’s plans to list on the stock market. Read more

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()