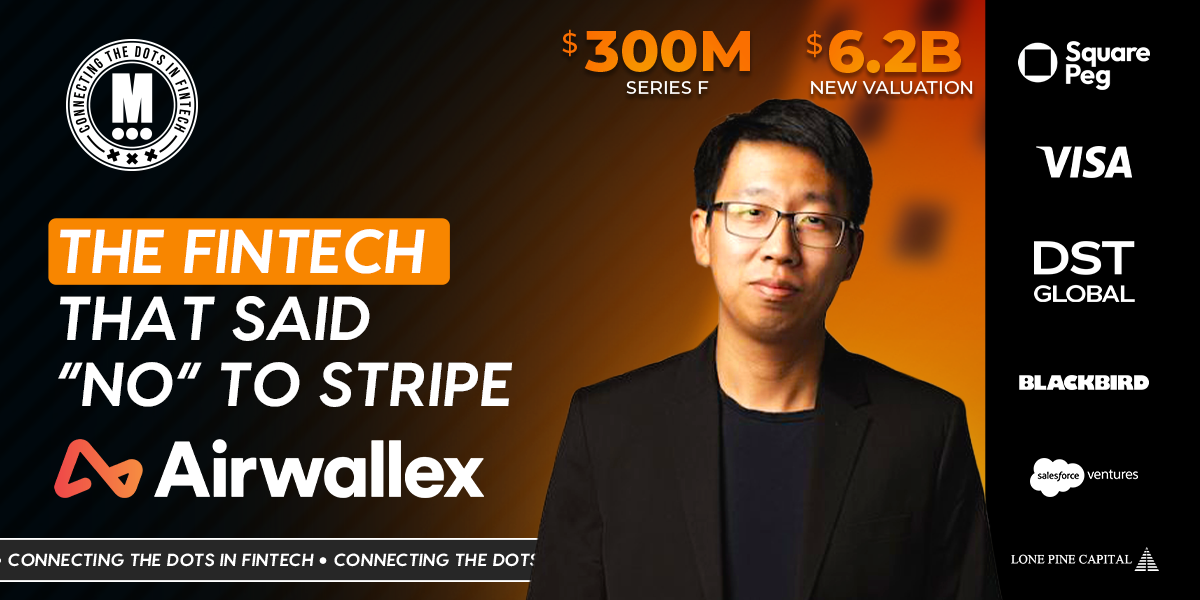

Airwallex Raises $300M, Sixfold Valuation Growth to $6.2B in Seven Years

Hey FinTech Fanatic!

Airwallex has secured $300 million in Series F funding, at a $6.2 billion valuation. The FinTech has multiplied its value by six in just seven years since becoming a unicorn, weathering global valuation resets while continuing to scale.

The round includes $150 million in secondary share transfers and brings total funding to over $1.2 billion. Visa Ventures, DST Global, Salesforce Ventures, and several pension funds backed the raise. By year-end, the company aims to hit $1 billion in annual run-rate revenue.

Today, Airwallex supports over 150,000 businesses worldwide through its cross-border financial infrastructure platform, offering services ranging from global business accounts to AI-powered spend management. With the new capital, it plans to expand into Japan, Korea, the UAE, and Latin America, while reinforcing its presence in Europe, North America, and Southeast Asia.

“The global financial system wasn’t built for today’s borderless economy,” said Jack Zhang, Co-Founder & CEO of Airwallex. “Too many businesses are held back by legacy infrastructure that’s slow, costly, and fragmented. At Airwallex, we’re building a new foundation for the global economy, one that’s fast, seamless, and built for scale.”

In March 2025, Airwallex reported $720 million in annualized revenue (a 90% increase YoY) and crossed $130 billion in annualized payments volume. Its customer base grew by 50% in 2024, with gross profit climbing at a CAGR of +250% in the Americas and EMEA regions over the past four years.

And there’s a story behind that $6.2 billion number. A few years ago, Stripe made a $1.2 billion acquisition offer, which Airwallex turned down. I highly recommend watching the full episode below, where Zhang explains why they said no 👇

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

FINTECH NEWS

🇦🇺 OtherPay joins Change Financial and FinTech Actuator's Prepaid Incubator Program. By participating in the incubator, OtherPay will introduce prepaid card functionality into its platform, enhancing its offering with new tools and features for purchase and identity protection.

🇺🇸 Block leans into lending after winning direct loans approval. The company has extended nearly $15 billion worth of short-term credit across over 9 million Cash App active accounts through its product Borrow, and over $22 billion worth of small business financing through Square Loans.

🇬🇧 Robinhood aims to launch UK investment platforms with a no-fee ISA. The move to create the tax-free account is a step by Robinhood, which pioneered zero-commission share trading, towards offering trading in shares of UK-listed companies as it seeks to expand its business.

🇬🇧 Trading 212 boss Ivan Ashminov gives a rare interview and reveals it now looks after £25BN of savers and investors' money. Just a year after launching its cash ISA, Trading 212 has become a provider in the UK, with 765,000 tax-free accounts now active on the platform.

🇮🇳 Startup Quid shoots past 5 million users in under a year. The AI-powered FinTech makes borrowing accessible to every Indian and bridges the much-needed gap between borrowers and RBI-approved banks & NBFCs. It streamlines the process for individuals and business owners to discover financial products.

🌍 Bloomberg terminal outage hits traders. Users complained that the $28,000-a-year Bloomberg terminal service was running with significant delays and that the absence of live pricing prevented them from carrying out trades. Keep reading

🇮🇱 eToro launches employee share plan post IPO. The offering included 10 million Class A common shares, split evenly between eToro and existing shareholders, with an additional 1.5 million shares available under an over-allotment option granted to underwriters. The IPO values the company at around $4.3 billion.

PAYMENTS NEWS

🇺🇸 Google introduced a new shopping experience in AI Mode. The new shopping experience combines Gemini’s capabilities with the Shopping Graph to assist users in browsing for inspiration, considering their options, and narrowing down product choices. The Shopping Graph now includes over 50 billion product listings.

🇬🇧 Worldpay collaborates with Yabie to power Worldpay 360: a modern payments solution for UK SMBs. The UK collaboration will help deliver streamlined, user-friendly solutions to independent businesses looking for a payments system that can enhance customer experiences and empower their business.

🇨🇴 Colombia to issue first CBDC on Cosmos. The initiative seeks to modernize cross-border settlements by leveraging the efficiency of programmable money without compromising institutional security. A CBDC is a digital form of a country’s sovereign money, issued and regulated by its central bank.

🇧🇷 Binance Pay brings instant crypto-powered payments to Brazil via Pix. This means users in Brazil can make real-time payments in Brazilian reais using crypto, seamlessly converting their digital assets into local currency through a system they already know and trust.

🇧🇷 Juspay expands to Brazil and establishes its first hub in Latin America. This marks a significant milestone in the company's international expansion, since it is the first official effort to acquire a solid customer base in the country as well as in Latin America.

🇺🇸 Visa announces the general availability of Visa AR Manager in the U.S. It is designed to grow and maintain existing card volume by automating the virtual card transaction process, addressing a significant pain point for suppliers accepting commercial credentials. Meanwhile, Visa launches commercial integrated partners to turbo-charge the FinTech ecosystem. The new program is designed to improve connectivity between FinTechs and Visa Commercial products through its commercial platform.

🇸🇦 Mastercard launches Cyber Resilience Center in Saudi Arabia. The initiative brings together key players from the financial sector to foster collaboration and support shared goals in building a secure commerce and payment ecosystem in the Kingdom.

🇺🇸 Circle Payments Network (CPN) mainnet is officially live, with a growing roster of financial institutions now moving value globally using this new network and coordination protocol. CPN delivers a significant software upgrade for global payments while enabling innovation to flourish.

DIGITAL BANKING NEWS

🇬🇧 Online criminals attacking HSBC ‘all the time’, says Ian Stuart, head of UK arm, with cybersecurity now its biggest expense, costing the lender hundreds of millions of pounds, amid growing concerns that other large businesses could fall victim to the kind of attacks that have caused chaos at retailers.

🇺🇸 Openbank by Santander reaches 100,000 customers in the United States, well-positioned for continued growth in 2025. This achievement is a significant milestone in advancing the Santander US business strategy to generate lower-cost, national deposits to position its Retail Bank for further success and fuel its leading Auto lending franchise.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase faces lawsuit over unauthorized biometric data collection. The suit, brought to federal court on May 13, claims the company violated Illinois’ Biometric Information Privacy Act (BIPA) by capturing users’ facial data without proper notice or consent.

🇺🇸 SEC charges Unicoin and executives with $100 million fraud. The regulator charged the company and executives Alex Konanykhin, Silvina Moschini, and Alex Dominguez for making false and misleading statements relating to the sale of certificates promising rights to receive crypto-assets and stock.

🇺🇸 Strive targets 75,000 Bitcoin from Mt. Gox claims to build a Bitcoin treasury. The company said buying the claims would allow it to purchase Bitcoin at a discount and grow its Bitcoin per share ratio ahead of its planned reverse merger with Asset Entities, which is expected to be completed sometime mid this year.

🇦🇪 Bitcoin Suisse secures In-Principle Approval from ADGM’s FSRA. With this achievement, the leading Swiss crypto financial service provider is set to expand into the Middle East, introducing a refined and client-centric approach to crypto finance. Read more

🌍 Crypto.com secures MiFID licence to expand traditional investment services offering across Europe. With this acquisition, the company will be able to offer eligible users a broad range of financial products, including securities, derivatives, contracts for difference, and more.

PARTNERSHIPS

🇺🇸 Capital Bank partners with Q2 for its new digital banking platform. The launch aims to offer a secure and modern experience for business customers and marks a step in the bank’s digital transformation. Its new digital platform delivers digital treasury management capabilities and aims to offer the users the scalability needed to expand into new markets and customer segments.

🇧🇦 Raiffeisen Bank goes live with Temenos Core in Bosnia-Herzegovina. The core modernization marks a significant milestone, enabling Raiffeisen Bank to enhance customer experience and drive greater efficiency. Continue reading

🌍 One Trading partners with ClearBank to enhance fiat rails and user experience. By integrating ClearBank’s real-time, One Trading will offer clients more efficient, secure, and reliable fiat capabilities across Europe. This will mean quicker deposits and withdrawals, reduced friction at the fiat on/off-ramp, and a smoother user experience overall.

🇦🇺 Bank of Sydney turns to Infosys Finacle for digital banking. Through this strategic collaboration, Bank of Sydney aims to deliver a best-in-class staff and customer experience, reduce cost and complexity through automation and digitization, and position itself strongly for future growth.

🇦🇪 FAB pilots virtual B2B card solution with Oracle and Mastercard. The new system is intended to address long-standing inefficiencies in corporate payment processes, such as manual data entry, disjointed workflows, and limited financial visibility.

DONEDEAL FUNDING NEWS

🇺🇸 Airwallex raises $300 million at a $6.2 billion valuation to build the future of global banking. Airwallex will use the additional capital to expand its global infrastructure into new markets and continue refining and scaling the software that empowers businesses to operate anywhere, anytime.

🇺🇸 Clair has raised $23.2 million in Series B funding. This funding allows Clair to further its mission to solve the everyday cash flow challenges faced by so many. In the last 2 years, the company has massively accelerated, now enabling over 2M employees to access their earned wages, often in under 75 seconds for new users.

🇺🇸 Seeds secures $10M Series A funding round to reimagine personalized investment management. This latest round allows the firm to accelerate product advancements, support strategic growth with high-impact hires, and solidify its market position as an investment experience platform for registered investment advisors.

🇺🇸 Blooms raises $2.6m in seed funding. The company intends to use the funds to expand operations and its development efforts. Led by Francisco Meré, Blooms focuses on AI-driven trade finance, payments, and FX solutions for Latin American produce exporters supplying the US and Canadian markets.

🇺🇸 US FinTech startup Affiniti raises $17m in series A. The Series A funding will support the expansion of the platform’s offerings, including banking, bill payments, cash flow analytics, and integrations with enterprise resource planning and point-of-sale systems.

🇺🇸 Lendflow secures $15 million in growth capital. This growth capital is specifically allocated to accelerate key product initiatives, with a particular focus on powering the next generation of its AI-driven data intelligence and automation platform.

🇺🇸 Sam Altman’s World raises $135m in token sale. The sale was to venture capital giants a16z and Bain Capital Crypto, and will be used to fund network expansion, the team shared. Read more

🇧🇪 Auric secures €4m seed round to accelerate growth and revolutionize embedded finance. This latest investment represents a strong vote of confidence in Auric’s vision and marks a significant step forward as the company accelerates its efforts to redefine embedded financial solutions.

🇪🇸 Wealthreader raises €1 million to strengthen its dominance in Open Banking. This funding represents a significant milestone in its expansion and strengthens its position in the competitive global Open Banking market, a sector experiencing annual growth of over 27%.

🇸🇪 Swedish FinTech Treyd adds Klarna Veteran to Board and secures €5M in new funding. The company plans to use the capital to expand its product development and support further growth. Keep reading

🇩🇪 German FinTech startup Aufinity Group raises €23 million to innovate payments in the automotive sector. With this funding round, the group is setting its sights on accelerating growth across Europe. By forming new strategic partnerships with leading OEMs and maintaining a strong focus on dealerships.

🌏 Ringkas raises US$5.1 mil pre-series A round to bring AI-powered mortgage solutions to Malaysia and Southeast Asia. The new funding will strengthen the company’s position as a key player in financial infrastructure by supporting the development of future AI capabilities and expanding its regional reach.

🇺🇸 Greenlite AI raises $15 million Series A. This investment marks a pivotal moment in its mission to help finance move faster with a powerful and trustworthy AI workforce. Continue reading

M&A

🇺🇸 Private equity circles Green Dot as bank-backed FinTech seeks buyer amid regulatory hurdles. The US FinTech, known for its prepaid debit cards and banking infrastructure, is attracting strong interest from private equity firms as it explores a potential sale.

🌍 Apex acquires majority stake in tokenisation firm Tokeny. According to Apex, the deal shows the fund services firm's commitment to pushing the institutional adoption of tokenisation as well as bolstering its own digital assets infrastructure.

MOVERS AND SHAKERS

🇧🇷 Youssef Lahrech steps down as COO of Nubank. Lahrech will maintain a role at Sao Paulo-based Nu as permanent observer on the board’s audit and risk committee, and he will advise the company on credit strategy. The company said it continues to “streamline efficiency” and speed its operations.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()