Airwallex Hits an $8B Valuation with a New $330M Series G

Hey FinTech Fanatics!

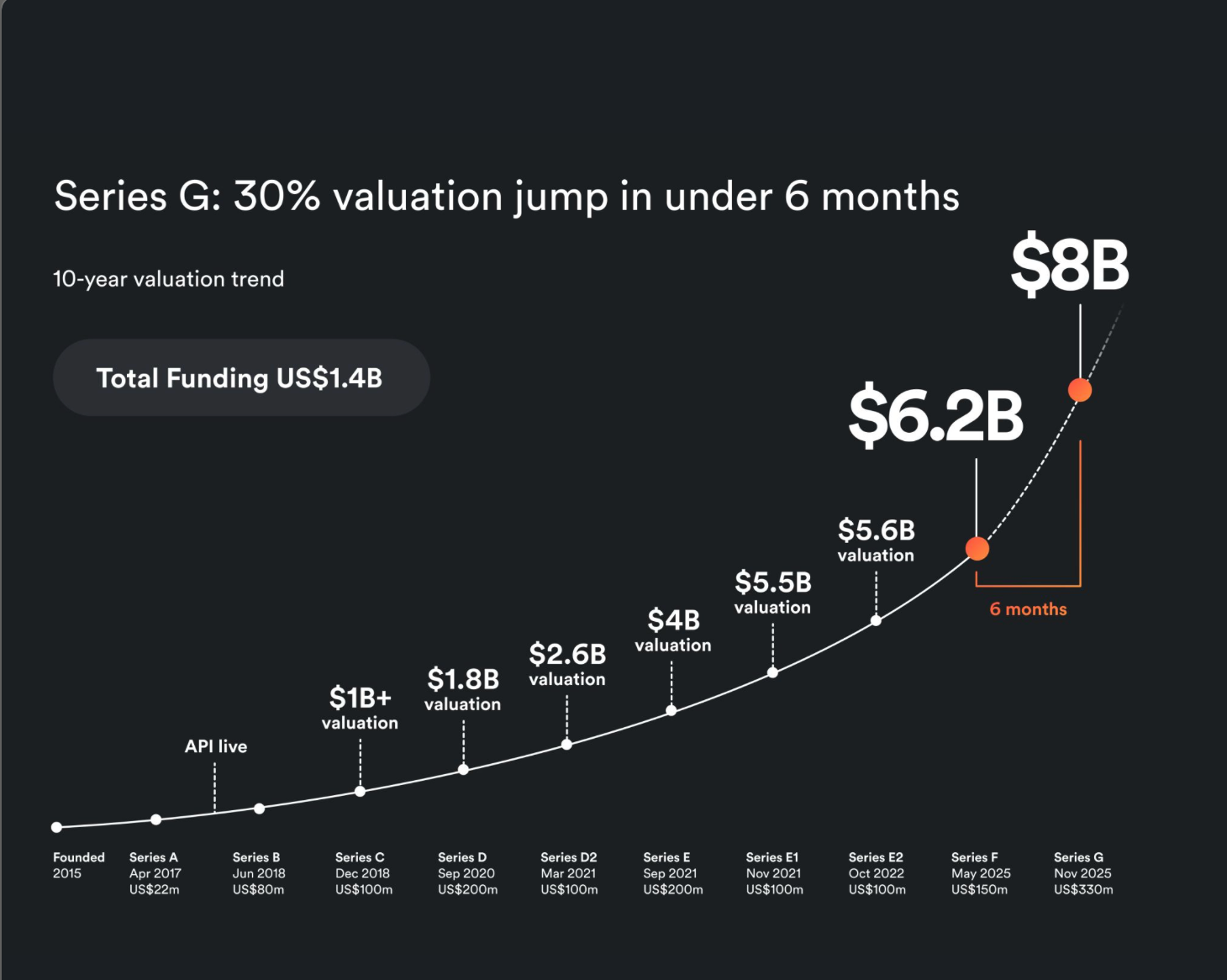

Airwallex just raised a $330M Series G at an $8B valuation. A 30 percent jump from the round six months ago.

The company is establishing San Francisco as a dual global HQ. More than $1B will be deployed in the US over the next four years to scale operations, hire AI talent, and accelerate product development.

The numbers they reported are massive. $1B+ in annualized revenue, up 90 percent year over year. $235B+ in annualized TPV, 2× year over year. Airwallex now holds more than 80 licenses and can operate in 200+ markets.

Take a look at the valuation arc. It really tells the story better than words👇

The company is also rolling out specialized AI agents to automate real financial workflows. From expense matching to policy checks to full orchestration.

A clear push toward intelligent infrastructure...

If you're tracking the next big FinTech moves, take a look at the updates below 👇

Cheers,

FINTECH NEWS

🇮🇩 Robinhood is coming to Indonesia. Robinhood has entered into agreements to acquire PT Buana Capital Sekuritas and PT Pedagang Aset Kripto. These acquisitions will mark Robinhood’s entry into Indonesia, accelerating its expansion across Southeast Asia and globally.

🇺🇸 Crypto treasury underwriter Clear Street plans to list in the new year. The listing could value the company at $10bn-$12bn. Clear Street has established itself as one of the most prominent underwriters of crypto-related stock offerings, including for Strategy.

PAYMENTS NEWS

🇮🇳 Wise to double down on cross-border payments and roll out prepaid forex card. The UK-based FinTech is rolling out a multi-currency prepaid forex card for users in India as the company is doubling down on expanding its presence in the cross-border payments space in the country.

🇧🇷 Pix sets a new record, surpassing 313 million transfers in a single day. In a statement, the Central Bank affirmed that the performance demonstrates the consolidation of Pix as one of the main digital tools in the country, directly impacting the pace of economic activities.

🇩🇰 Danish unicorn Flatpay bets on door-to-door sales to triple ARR by the end of 2026, aiming for €400-€500M by leveraging an intensive door-to-door sales model for small businesses, which involves in-person demos and setup, driving rapid adoption despite higher costs.

🇺🇸 Stripe is partnering with Instacart to enable direct checkout in ChatGPT. This new AI commerce experience is powered by the Agentic Commerce Protocol (ACP) Stripe launched with OpenAI a few months ago. Keep reading

🇺🇸 Rosen Law Firm encourages Klarna Group investors to inquire about securities class action investigation. Following a Yahoo! Finance article noting that Klarna’s first post-IPO earnings showed record revenue but higher-than-expected provisions for credit losses, resulting in a $95 million net loss and a stock drop of 9.3% on November 18, 2025.

🇨🇴 Cards that drive the evolution of digital payments in Colombia. Colombia’s payments ecosystem is rapidly modernizing as credit, debit, and prepaid cards shift from simple payment tools to digital platforms, driving inclusion and innovation. With credit card issuance up 59% and debit cards up 17.2% in early 2025.

DIGITAL BANKING NEWS

🇬🇧 Monzo Bank has launched Double Payday. Matt Jones shared that Monzo Bank has launched Double Payday, a new feature that each month doubles the net salary of ten eligible customers, randomly selected from the previous month’s qualifying payments. Monzo will match up to £10,000 per winner.

🇬🇧 UK FinTech Plum follows Klarna in securing an e-money licence. The move gives Plum the green light to essentially operate as a bank with a narrower scope by offering online transfers, prepaid cards, and managing digital wallets. The company has more than 2M clients and helps to automate complex aspects of personal finance.

🌍 Xero rolls out AI bank reconciliation with JAX tool. The beta is available on Xero Grow plans in Australia, New Zealand, and the UK, the Growing plan in the US, and Standard plans in other markets and above. The system aims to give users a more current view of their cash position by matching and coding transactions as they arrive.

🇬🇧 Deutsche Bank to move into Revolut's Canary Wharf headquarters. The German bank will take about twice as much space in the YY building on South Colonnade as Revolut, the report said. Read more

🇺🇸 Prometeo launches Name Match, a new capability within its U.S. Bank Account Verification API that helps businesses evaluate likely bank-account ownership before initiating payments. The feature returns an indicative outcome, Match, Partial Match, No Match, or No Data, that institutions can incorporate into risk and payment-decision flows.

BLOCKCHAIN/CRYPTO NEWS

🇮🇳 Coinbase starts onboarding users again in India, plans for fiat on-ramp next year. The exchange previously shut down Indian services in 2022 after UPI support was blocked and later off-boarded all local users, but has since engaged with regulators, registered with the Financial Intelligence Unit, and resumed onboarding.

🇦🇷 Argentina's Central Bank is considering allowing banks to operate with cryptocurrencies. The publication reports that regulations are being drafted, but no date has yet been set for their presentation. A cryptocurrency brokerage operating in Argentina said that the measure could be approved in April 2026.

🇦🇪 Binance secures ADGM licenses to operate international platform. Richard Teng, the co-CEO of Binance, said in a statement that the licenses provide regulatory clarity and legitimacy, enabling Binance to support its global operations from ADGM.

🇰🇷 Gov't moves to strengthen crypto exchanges' liability after Upbit hacking. The move is a shift to treat major crypto exchanges as rigorously as traditional financial platforms, applying similar scrutiny to compliance, consumer protection standards, and the overall regulatory guidelines for Korea’s fast-growing crypto market.

🇦🇪 UAE’s ruya becomes the first Islamic bank to offer Bitcoin trading. Islamic bank ruya has launched a Bitcoin investment service through its mobile app, becoming the first in the region to do so under the framework of Islamic financial ethics. This move was made possible through a partnership with Fuze.

🇺🇸 Stripe launches USD stablecoin payments on Ethereum, Base, & Polygon. This integration would allow customers to carry out payments using stablecoins like USDC via digital wallets, while businesses continue receiving the payment in US dollars.

🇵🇹 xMoney announces three new stablecoins to bolster the global payments industry. xMoney has released whitepapers for its upcoming stablecoins, EURXM, USDXM, and RONXM, scheduled to launch in June 2026 and designed to support compliant, seamless global payments across Web3 and traditional finance.

PARTNERSHIPS

🇨🇳 TenPay Global and Mastercard collaborate to enable fast and secure remittances to Weixin Pay. Eligible senders around the world will be able to send salaries and family support directly to Weixin Pay Wallet Balance or linked bank cards in Weixin Pay.

🇦🇪 Bybit and Circle forge a strategic partnership to advance global USDC adoption. As part of this partnership, Bybit will enhance USDC liquidity across spot and derivatives markets, enabling a more efficient trading environment for retail and institutional users.

DONEDEAL FUNDING NEWS

🇺🇸 Airwallex raises $330M Series G at $8B valuation. The investment will fuel Airwallex’s continued growth in the U.S. and key markets worldwide. Airwallex has established a second global headquarters in San Francisco and will deploy more than $1 billion from 2026-2029 to scale its U.S. operations, attract top talent, and expand its physical and brand footprint.

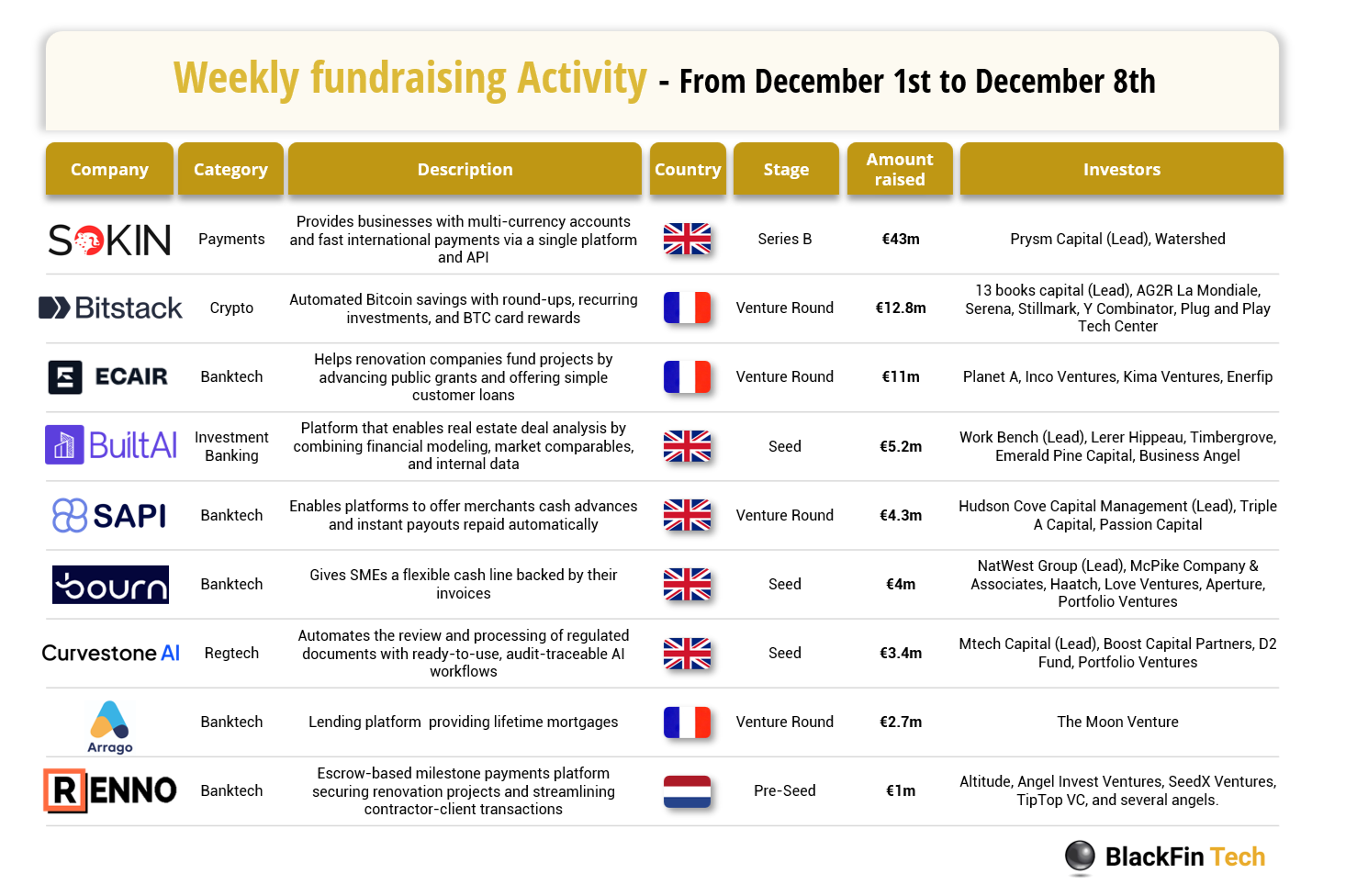

💰 Over the last week, there were nine FinTech deals in Europe, raising a total of €87.4 million, including five transactions in the United Kingdom, three in France, and one in the Netherlands.

🇺🇸 Nuuvia’s CUSO secures $4m investment from VyStar and Desert Financial Credit Unions. The investment reinforces Nuuvia's mission to partner and collaborate with progressive financial institutions to build best-in-class youth engagement tools that address critical membership growth challenges.

🌎 Remittance FinTech Bless Payments raises $3.75 million Seed round. The funds will be used to support expansion into Canada, the UK, and the US. The company serves over 1,500 users, offers remittances to 60 countries, and has launched a no-fee travel card, with its mission focused on providing transparent, low-cost financial tools for migrants.

🇺🇸 AllScale raises $5m seed led by YZi Labs to build the world's first self-custody stablecoin neobank. The company’s mission is to provide the underlying payment infrastructure for the next generation of "super individuals" and small and medium-sized businesses (SMBs).

🇨🇦 Canadian FinTech Tuhk Inc. raises US$6 million seed round led by FINTOP, with Lloyds Banking Group and Capital One Ventures. The platform aims to revolutionize payments by enabling secure, real-time collaboration among merchants, banks, and service providers to combat the global US$10.5 trillion cybercrime threat.

M&A

🇫🇷 Worldline announces the contemplated divestment of its payments orchestration platform, PaymentIQ, to Incore Invest. This transaction will simplify operations, optimise resource allocation, and enable increased management focus on core payment activities for merchants and financial institutions.

🇿🇦 Capitec expands into SME payments market with R400 million Walletdoc acquisition. "This acquisition is a strategic step in Capitec's ongoing commitment to lowering the cost of payments, broadening access to digital financial services, and promoting financial inclusion in South Africa," the bank said.

🇬🇧 Shawbrook expands SME financing offering with Playter acquisition. In a statement, Shawbrook says it will combine Playter's tech with its own existing digital capabilities and funding resources in an effort to broaden its suite of financing services for SMEs.

MOVERS AND SHAKERS

🌍 Aspora names Varun Sridhar CEO to lead global FinTech expansion. At Aspora, his mandate will focus on accelerating the company’s entry into priority markets such as the US, UK, UAE, Germany, Italy, and Ireland, alongside building tailored wealth and loan products for globally mobile Indian professionals and families.

🇺🇸 Pipe picks Product Chief Claurelle Rakipovic as New CEO. A Pipe spokesperson said that the company is making leadership changes as “part of broader changes,” and that an official announcement would come this week. Continue reading

🌍 OPay appoints James Perry as Chief Financial Officer. In this role, Jim will lead OPay’s financial strategy, capital planning, and investor relations as we continue to scale our FinTech ecosystem across Africa and expand globally. Keep reading

🇬🇧 Volt appoints ex-Checkout.com Product Director Mathew Tuvesson as VP of Product. Mathew will take centre stage in delivering a new generation of Volt’s product suite, as the company ramps up its evolution and prepares to add stablecoin payments and treasury solutions to its real-time payments capabilities.

🇨🇳 Daniel Lee named CEO of Cactus Custody as the firm expands institutional crypto services. In an exclusive interview, Lee reflects on the rapid institutional maturity of digital assets, custody, and tokenised financial instruments. Lee describes his transition as a natural, perhaps inevitable, progression.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()