AI Won’t Run the Marathon for Me… but It Might Shop for You

Hey FinTech Fanatic!

Vegas, you were great, but I’m out.

Heading back to NYC to recover and (try to) get marathon-ready. Huge thanks to Mastercard for making a dream come true with that priceless NYC Marathon start.

And speaking of Mastercard… big news dropped as they’re teaming up with PayPal to bring Agentic AI payments to the mainstream. Yep, AI-powered checkouts are officially a thing.

AI won’t run the marathon for me, but it will be able to do your shopping soon.

Scroll down for that story and more while I take a quick nap on the flight..

Back tomorrow!

Cheers,

FINTECH NEWS

🇺🇸 Crypto.com files National Trust Bank charter application with the Office of the Comptroller of the Currency. This application is the latest step by Crypto.com in extending its commitment as the industry leader in regulatory compliance and customer protection.

🇺🇸 Big Banks enter the stablecoin era by taking Zelle International. Zelle said the initiative would help users move money across borders, and that the service would be available to customers of any bank that is part of the Zelle network. The move could help big bank owners of payment products head off competition from cryptocurrencies.

🇬🇧 Robinhood launches futures trading for UK customers. It provides customers with the ability to trade index, energy, metals, and foreign exchange futures directly through the Robinhood app and on Robinhood Legend. Customers can now access more than 40 CME Group futures products with low fees, seamless mobile and desktop access, and one-tap ladder execution.

PAYMENTS NEWS

🇲🇽 tapi launches tapipay to boost SME digital payments in Mexico. tapipay automates up to 80% of the collections process, reducing operational costs and enhancing efficiency. Businesses can issue invoices via email or WhatsApp, send automatic reminders, and accept payments through multiple methods.

🇬🇧 ClearBank announces plans to join Circle’s payments network to power faster, more connected finance. This collaboration will focus on expanding access to USDC and EURC, Circle’s MiCA-compliant, fully reserved stablecoins, through Circle Mint in Europe.

🇮🇹 Klarna signs an agreement with pagoPA for installment payments to public administrations, with the technological support of Worldpay. The agreement will enable users to utilize the payment system to make payments to public entities, including car taxes, fines, school fees, and healthcare charges.

🇯🇵 World's first yen-pegged stablecoin JPYC debuts in Japan. The company aims to issue 10 trillion yen ($66 billion) worth of JPYC over three years and have the digital assets used widely overseas. Continue reading

🇺🇸 Worldpay launches AI-powered service to increase payment approvals. The service uses AI to leverage insights from billions of global transactions processed by Worldpay and makes real-time decisions on when to apply 3DS to authenticate the transaction or directly authorize the payment based on risk, issuer preference, and other factors.

🇺🇸 Chargebacks911 and its sister company, Fi911, launched their Unified Dispute Management System. UDMS eliminates the industry’s long-standing data silos, providing real-time transparency, agentic AI tools, self-service automation, and instant collaboration across the payments ecosystem that works to improve and safeguard dispute and transaction integrity.

🌎 Mastercard and PayPal join forces to accelerate secure global agentic commerce. Mastercard Agent Pay, the company’s agentic payments platform, will be integrated into PayPal’s wallet to allow AI agents to simply and securely complete transactions on behalf of PayPal users.

🇺🇸 Western Union CEO unveils stablecoin plans for treasury, customer payments. CEO Devin McGranahan announced that Western Union is testing stablecoin-enabled solutions in treasury operations, focusing on leveraging blockchain settlement rails to reduce reliance on legacy correspondent banking systems while shortening settlement windows and improving capital efficiency.

REGTECH NEWS

🇺🇸 Trulioo powers record-breaking U.S. growth as global enterprises seek unified verification. The KYB growth has helped fuel a 134% increase in U.S. verification volume across all Trulioo products. The Trulioo identity platform has processed more than 20 million transactions for U.S. customers in 2025, underscoring its scale and market momentum.

DIGITAL BANKING NEWS

🇺🇸 bunq takes its first step into the US with broker-dealer license approval. As an approved broker-dealer, the mobile bank will be able to bring its US stocks offering to American users, giving them access to self-directed investing, including mutual funds and ETFs, as part of its wider product rollout.

🇬🇧 Klarna introduces the Premium and Max program. The program delivers premium benefits like cashback, travel perks, and lifestyle rewards in a transparent, monthly plan, without the need to take on expensive credit. Premium and Max offer more than 10x their monthly value.

🇪🇸 Revolut rises as neobanks claim 27% of Spain’s retail market. Revolut has rapidly become one of Spain’s top ten banks, alongside CaixaBank’s Imagin, as neobanks now hold 27.2% of the market. Between June 2024 and June 2025, Revolut’s deposits surged 323% to €3.1 billion, overtaking ING and Sabadell in user share.

🇸🇦 Barclays’ reentry into Saudi Arabia. The move comes as the kingdom accelerates efforts under its Vision 2030 plan to diversify the oil-driven economy and attract multinational headquarters into its capital. Continue reading

🇰🇷 The Bank of Korea urges banks to lead won stablecoin issuance and include deposit tokens in reserves. The BOK stressed that a won stablecoin should be issued mainly by the banking sector. The rationale is that banks are already subject to strict capital, foreign exchange, and anti-money laundering regulations, which can minimize risks that may arise from the introduction of stablecoins.

🇮🇹 Vivid strengthens its presence in Italy with the launch of the Italian IBAN for businesses and freelancers. Now, businesses and freelancers will be able to enjoy all the benefits of having a local IBAN, simplifying daily transactions and significantly improving access to services.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase x402 protocol logs 50,000 transactions, up 10,000%. Coinbase CEO Brian Armstrong posted on X that x402 is growing like crazy. The protocol allows AI agents and humans to transact in stablecoins directly over the internet without credit cards or traditional payment infrastructure.

🇺🇸 Coinbase CEO wants every startup to launch, fund, and IPO on-chain. Coinbase CEO Brian Armstrong outlined plans to move the entire startup lifecycle on-chain, from incorporation and fundraising to public listings, following the exchange's $375 million acquisition of capital-raising platform Echo.

🌍 Relai has obtained a MiCA license to simplify crypto access and enhance trust across Europe. The license enables the company to streamline cross-border operations, attract both institutional and mainstream users through regulatory assurance, and innovate within clear legal boundaries.

🇺🇸 Stablecoin Payments surge 70% Post-GENIUS Act. More than $10 billion flowed through stablecoins in August for goods, services, and transfers, according to a recent report from blockchain data provider Artemis Analytics. Keep reading

🇮🇹 Ferrari to launch exclusive crypto tokens for elite clients. The initiative, developed with Italian FinTech firm Conio, is designed for members of Ferrari’s Hyperclub, an exclusive group of around 100 clients with a passion for endurance racing, who will be able to trade the ‘Token Ferrari 499P’ and use it to participate in the auction.

🇨🇳 Ant Group files trademark for ‘AntCoin’ in Hong Kong amid digital asset push. According to filings with the Hong Kong Intellectual Property Department (HKIPD), the trademark application for “AntCoin” includes classifications covering digital currency, blockchain-based transaction systems, and virtual asset custody.

🇺🇸 Binance eyes US return after Trump Pardon for Changpeng Zhao. The presidential pardon carries sweeping legal implications that could fundamentally change Zhao’s involvement with Binance and its subsidiaries. Read more

🇺🇸 Uphold announced its integration with the Exactly Protocol. The new service enables Uphold users to borrow against their digital assets and to spend the loans through a Visa credit card offering unprecedented real-world utility. Alternatively, users can also choose to loan their digital assets, including XRP, and earn yield.

🇺🇸 IBM launches digital assets platform as crypto activity jumps. The new offering, called Digital Asset Haven, was built together with crypto wallet technology provider Dfns. IBM and Dfns are seeking to take advantage of a rising appetite among clients for creating and managing digital-asset services ranging from custody to settlement.

PARTNERSHIPS

🇩🇪 Unzer has achieved a key milestone in the rollout of Wero, completing the first successful transaction on its production system. As an EPI Company Principal Member, Unzer will enable thousands of merchants to accept secure, instant account-to-account payments, helping small and mid-sized businesses embrace digital commerce across Europe.

🇲🇭 BloFin partners with Checkout.com to power a next-generation fiat on-ramp experience. Users can now seamlessly purchase digital assets using Apple Pay, Google Pay, credit and debit cards, either directly or through mobile wallets, delivering greater flexibility and convenience in mobile-first markets.

🇺🇸 Mastercard and Citi bring Citi Flex Pay Installments to more retailers at checkout. Through the integration with Mastercard Installments Payments Services, Citi cardmembers can choose to pay over time directly at checkout, whether shopping with their Citi credit card online, in-app, or through a digital wallet with participating partners.

🌎 MAJORITY launches stablecoin transfers to millions across Latin America with Privy. With Privy, MAJORITY can create and manage on-chain wallets directly within its app experience, while users enjoy the benefits of stablecoin speed and transparency, without any crypto complexity.

🇲🇽 Belvo accelerates Banco Azteca digital origination beyond 6 million verifications. Banco Azteca has integrated Belvo’s cutting-edge technology into its robust digital origination process. The integration enables the use of reliable alternative data sources to conduct stronger, more accurate, and more tailored credit assessments.

🇨🇴 Cobre and TerraPay partner to provide businesses globally with seamless cross-border payments. This collaboration enables companies to send and receive payments seamlessly across borders, with faster settlement times, lower operational complexity, and a fully compliant infrastructure.

🇺🇸 Binance.US partners with AptPay to expand fiat access nationwide. This integration will enable Binance.US customers to fund and withdraw U.S. dollars instantly and securely, leveraging real-time and same-day payment networks alongside traditional ACH.

DONEDEAL FUNDING NEWS

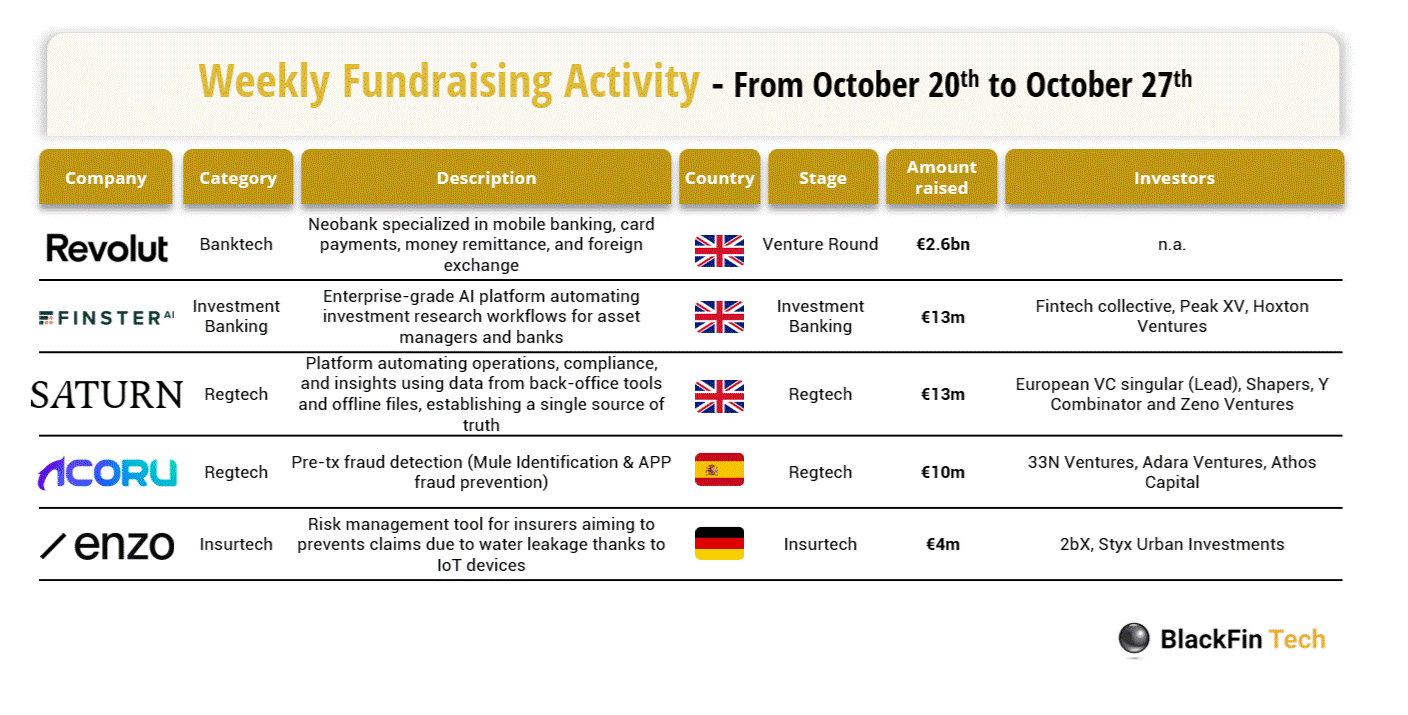

💰 Over the last week, there were five FinTech deals in Europe, raising a total of €2.6b, including three transactions in the UK, one in Spain, and one in Germany.

🇳🇬 Nigerian FinTech Raenest raises US$11M in Series A. The FinTech plans to deepen its presence in Kenya, Nigeria, Ghana, Tanzania, and Uganda, focusing on the gig economy to outcompete the dozens of FinTech players in those markets. Read more

M&A

🇿🇦 Nedbank R1.65-billion FinTech acquisition gets important approval. The acquisition will see iKhokha become a wholly owned subsidiary of Nedbank, while continuing to operate under its own brand and leadership team. It includes a comprehensive management lock-in to ensure managerial continuity and alignment with long-term growth objectives.

🇺🇸 CSI acquires Apiture to create an integrated banking ecosystem. The integration establishes a unified, cloud-based foundation designed to elevate the digital experience, strengthen customer relationships, and accelerate growth across both consumer and business segments.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()