After All, There’s Always a Deal: Coinbase Backs CoinDCX

Hey FinTech Fanatic,

Coinbase is re-entering the Indian market with a fresh investment in Mumbai-based CoinDCX.

Just over two months ago, Mint reported talks of a potential Coinbase acquisition of CoinDCX, once valued at $2.2 billion, with whispers that its valuation had dipped below $1 billion.

The investment is part of CoinDCX’s earlier funding round and lifts its post-money valuation to $2.45 billion – a remarkable rebound, isn’t it?

Coinbase’s move follows its March registration with India’s Financial Intelligence Unit, allowing formal operations. After stepping back in 2022 due to regulatory challenges, the company is now back in India!

Scroll down for more FinTech stories shaping that future 👇

Cheers,

#FINTECHREPORT

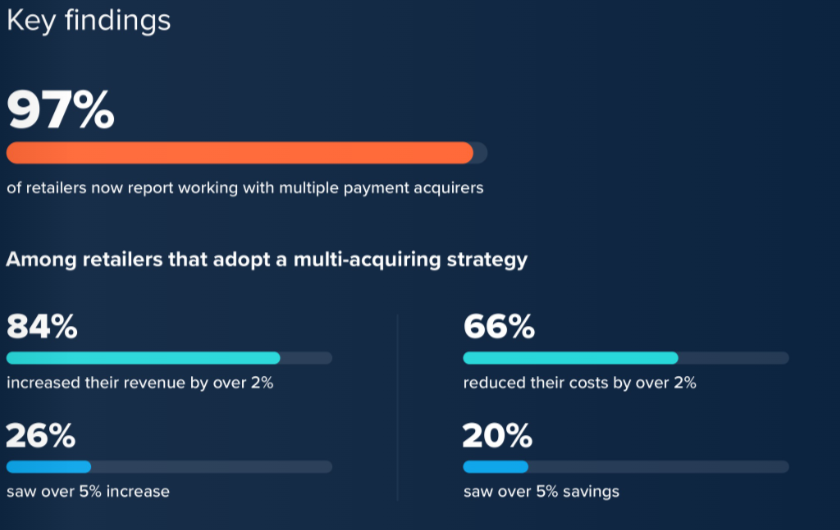

📊 Unlocking Opportunity: How Payments are Powering Merchant Growth by ACI Worldwide. The report reveals that 97% of global retailers are already working with multiple acquirers, and that 96% of those using two or more acquirers report an increase in revenue. The research also highlights the surge in alternative payment methods (APMs). Read the complete report here

FINTECH NEWS

🇺🇸 Rakuten jumps on reports that it is weighing a US IPO of its credit card unit. Rakuten Group shares rose as much as 6.7%, the most since April 10, after Reuters reported the Japanese e-commerce firm is considering listing its credit card business in the US. The company is in the early stages of considering a US IPO.

🇸🇬 Temasek-backed US FinTech firm iCapital to expand Singapore, Hong Kong operations. Marco Bizzozero, iCapital’s head of international, said that the firm is relocating to a significantly larger office in Singapore, having outgrown its current space due to rapid team expansion and increased client activity. He also noted that iCapital is exploring a larger office space in Hong Kong.

PAYMENTS NEWS

🇬🇧 Solidgate Treasury joins the global SWIFT network. Solidgate Treasury is designed to simplify the complexities of managing global operations. With direct integration with SWIFT, businesses can now transfer funds globally in multiple currencies with fewer intermediaries, reducing delays, risks, and costs.

🇮🇳 Revolut’s game plan for cracking India’s payments market. Paroma Chatterjee, CEO of Revolut India, talks about the U.K.-based payments company’s foray into the Indian market and its aim to make the process of remittances more transparent. Watch the full interview

🇦🇺 PayPal launches PayPal Open in Australia to support businesses in managing commerce and development needs. The company states that PayPal Open allows businesses of various sizes, from small and medium enterprises to large organizations, to access a single merchant platform that brings together a suite of PayPal's tools and services.

🇺🇸 Stripe introduces stablecoin payments for subscriptions. Stripe’s stablecoin payments, launched a year ago, are now adding subscription support, letting businesses accept recurring crypto payments that settle in fiat, manage all billing in one dashboard, and integrate with Stripe’s tools.

🇺🇸 Plaid Transfer announced Transfer for Platforms, a new solution that combines flexible, multi-rail money movement with Plaid’s trusted user experience and integrated risk tools. It is designed for vertical SaaS platforms to integrate seamless bill payments directly into their products.

REGTECH NEWS

🇺🇸 Introducing Ti2: The next generation of Plaid Protect’s Trust Index. Using twice the training data and enhanced behavior analysis, Ti2 detects 30% more fraud and uncovers patterns traditional tools miss. It identifies complex fraud such as synthetic identities, account takeovers, and coordinated attacks, giving fraud teams clearer, faster signals.

DIGITAL BANKING NEWS

🇰🇷 Kbank surpasses 15 million customers, reaching 1 in 3 Koreans. Kbank said its products, featuring low interest rates and quick loan processing, have been the main drivers. As a result, mid- to low-credit borrowers now make up 58% of Kbank's individual business loan customers.

🇩🇪 Openbank and Santander Consumer Finance to integrate in Europe, expanding the range of products and services to customers. The merger will simplify the business and give SCF and Openbank customers access to a broader range of products, while further enhancing the service provided to partners.

🇵🇱 Revolut is preparing to implement Blik transfers to your phone. The new terms and conditions include a note that the FinTech company will allow its customers to send and receive Blik transfers by phone. Stefan Bogucki, responsible for Revolut's communications in Poland, said that this is a preparation for the launch of the service in the Polish market.

🇦🇪 Emirates NBD scales its cross-border payment network to 40 countries globally, allowing customers to send funds faster and with unprecedented savings. These services include real-time money transfers without delays or uncertainty, the ability to send money anytime, anywhere through the ENBD X Mobile Banking App or Online Banking.

🇬🇧 UK's Lendable launches first mobile plan by a FinTech in Britain. Lendable's plan will be powered by U.S.-based tech company Gigs, which provides the operating system, and will be available on the Lendable-owned Zable app, which has 2 million customers.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Tether pays $299.5M to settle Celsius bankruptcy dispute. Tether settled with the Celsius bankruptcy estate for $299.5 million, ending a year-long dispute over alleged improper bitcoin liquidations before Celsius’s 2022 collapse. The payout covers 7% of Celsius’s $4.3 billion claim.

🌏 BitGet Wallet launches crypto payment card for Asia-Pacific markets, aiming to expand its cryptocurrency payment services in the region. The new card allows users to spend digital assets like USDT and USDC through the Mastercard and Visa networks, and can be added to Apple Pay or Google Pay.

PARTNERSHIPS

🌍 bunq accelerates global expansion with premium rewards proposition powered by Ascenda. The collaboration elevates bunq’s loyalty program, unlocking superior rewards that power its users’ international lifestyle. The new partnership with Ascenda is marked by a shared vision for superior user experiences and technology-driven innovation.

🇦🇪 Wio Bank leverages Mambu for customer-centric banking. By leveraging Mambu’s composable banking platform, Wio can quickly adjust offerings for SMEs and individual customers, ensuring scalable solutions that respond to real-time customer insights. Additionally, Wio Bank and TAMM sign an MoU to simplify business banking in Abu Dhabi. Through this collaboration, Wio Business will be directly embedded into TAMM’s digital ecosystem, enabling users to open new accounts, link existing ones, and view their account dashboards.

🇮🇩 Krom Bank renews multi-year partnership with Mambu to accelerate digital banking innovation in Indonesia. Krom aims to serve the 75% of the Indonesian population that remains unbanked or underbanked. Keep reading

🇸🇬 Tiger Global-backed HitPay has partnered with Triple-A to enable stablecoin payments. The initiative aims to reduce merchants' exposure to cryptocurrency price volatility while ensuring compliance with local regulatory requirements. The companies stated that merchants can activate this new feature within minutes.

🇺🇸 Bankjoy announces strategic partnership with InvestiFi to offer digital investing. Through this partnership, financial institutions utilizing Bankjoy’s digital banking platform will have the opportunity to offer their members and customers access to seamlessly invest in stocks, ETFs, and crypto trading directly from their checking accounts.

🇦🇪 E& money will become the UAE’s first PayPal-linked digital wallet with instant AED withdrawals. PayPal customers will be able to link their accounts to e& money and move funds into their wallets instantly, converting US dollars to AED at a fixed exchange rate with no hidden fees.

DONEDEAL FUNDING NEWS

🇮🇳 Coinbase invests in India’s CoinDCX at $2.45 billion valuation, as the exchange operator seeks to deepen its exposure to India and the Middle East. The investment is an extension of CoinDCX’s last fundraise, and once completed, will give the firm a post-money valuation of $2.45 billion.

🇺🇸 Telcoin raises $25 million to launch a regulated digital Asset Bank. The funding enables Telcoin to meet capital requirements for its conditionally approved Nebraska Digital Asset Depository Institution charter, positioning the company to bridge the $4 trillion blockchain economy with traditional banking.

🇺🇸 Nova Credit raises $35M Series D to accelerate cash flow underwriting revolution. The funding arrives as cash flow underwriting reaches an inflection point, with lenders, property managers, and financial service providers. Continue reading

🇹🇿 Kuunda secures $7.5M in pre-Series A funding to drive expansion across Africa and MENA. This capital injection will enable Kuunda to scale its operations, deepen partnerships, and introduce new financial products tailored to micro, small, and medium enterprises (MSMEs).

🇧🇷 Crown raises $8.1M to launch BRLV, a Brazilian real-backed stablecoin. The funding will accelerate the Crown’s product development and market expansion as it seeks to become Brazil’s leading BRL stablecoin issuer. Keep reading

🇺🇸 Basis Theory raises $33M to power agentic commerce and the next era of merchant payments. The funding validates Basis Theory's strong product-market fit and will accelerate its work with agentic commerce while expanding its enterprise-grade payment vault for merchants worldwide.

🇲🇦 Moroccan FinTech startup Chari raises $12 million Series A and wins a landmark central bank license. With the new license, the company aims to transform its e-commerce marketplace into a merchant super app, allowing shopkeepers to not only restock their shelves but also accept digital payments, pay bills, transfer money, and provide financial services to their communities.

M&A

🇪🇪 Lightspark acquires Striga. Striga’s deep regulatory expertise, licensing framework, and financial services stack, including direct integrations with fiat providers, card networks, and banks, will accelerate Lightspark’s ability to bring compliant, borderless money movement to millions of users and businesses worldwide.

MOVERS AND SHAKERS

🇬🇧 Wealthtech startup Zilo appoints Andrew Cole as COO. As COO, Cole will support ZILO’s global expansion drive and implement processes and systems to prepare the company for the next stage of its development. He will oversee coordination across all ZILO operations, with a particular focus on key areas such as Legal, Finance, Information Security, and Governance Resilience and Control.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()