Adyen and Uber Push Payments Into The Real World with Kiosks

Hey FinTech Fanatic!

This one sparked a lot of reactions today. And not by accident.

Uber and Adyen just expanded their global partnership.

Same payment stack, now showing up far beyond the app. Airports. Hotels. Physical kiosks. Real-world touchpoints.

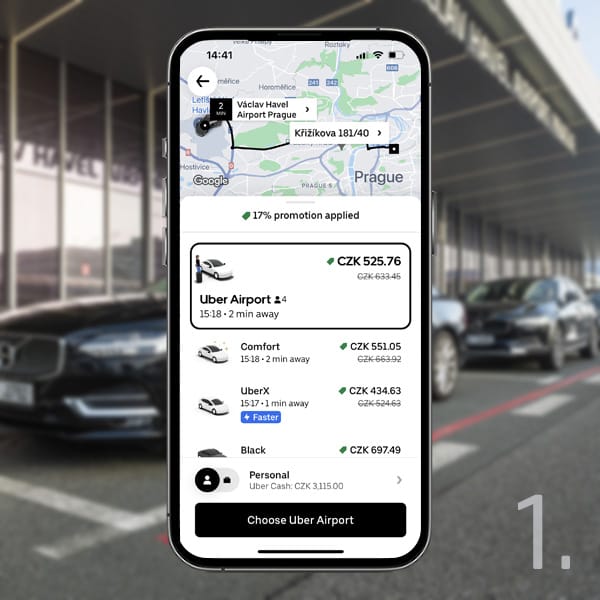

In places like Prague airport, travelers can walk up to an Uber kiosk, choose a ride, tap a card, and go. No app. No login. Sometimes no internet. Payments just work.

Take a look 👀:

Uber Kiosk (Prague Airport)

What’s interesting is not the kiosk itself...

It’s what sits underneath. One global acquiring setup. Local payment methods. Consistent UX across 70+ countries. The same infrastructure serves app users and walk-up travelers.

People reacting to this are pointing out the obvious thing we often forget. Payments only matter when friction shows up. Tired passengers.

Foreign cards. Offline moments. That’s where infrastructure either breaks or proves its value.

This feels like a quiet signal of where large platforms are heading next. Payments embedded everywhere demand exists. Not just on screens.

Check out today's latest updates in the FinTech industry below👇 I’ll be back tomorrow with what else is moving.

Cheers,

PODCAST RECOMMENDATION

🎤 Checkout.com CPO, Meron Colbeci: Invisible Payments, Agentic Commerce, and Globalising Products with Jas Shah. The episode features Colbeci discussing the role of payment service providers as the “invisible force” behind online and in-person commerce. The conversation also explores how FinTechs scale globally and Checkout.com’s role in enabling emerging trends such as agentic commerce. Watch the full interview here

FINTECH NEWS

🇺🇸 MrBeast’s Beast Industries to buy Gen Z–Focused Banking App. Beast Industries has agreed to buy Step Mobile, a teen-focused banking app, the companies plan to announce Monday. The acquisition will expand the YouTube star's reach beyond media, restaurants, and packaged food into financial services.

🇺🇸 Bilt customers are getting Wells Fargo cards they didn’t ask for. Wells Fargo’s split with Bilt Technologies sparked confusion after customers who closed their accounts still received Wells Fargo Autograph cards. The cards were mailed before Bilt’s deadline due to production timelines, and both firms said recipients could simply discard inactive cards.

PAYMENTS NEWS

🇦🇪 PhotonPay secures new license by Dubai Financial Services Authority to expand global payment network in the UAE. The company said the milestone strengthens its compliance-focused approach and enhances its ability to support businesses operating across the Middle East with improved local payment access, onboarding, and cross-border settlement tools.

🇨🇴 Bancolombia and Davivienda, the banks that move the most money through Bre-B. With more than 33.9 million customers and 99.2 million registered keys, Bre-B is beginning to consolidate its position in the financial system.

🇮🇳 Razorpay launches official n8n Node for no-code payment automation. This integration bridges the gap between Razorpay’s robust payment infrastructure and n8n’s visual automation platform, empowering customers to create powerful automations that previously demanded weeks of development time.

🇲🇾 PM Modi lays out his vision for Indian-Malaysia ties in landmark visit. Prime Minister Narendra Modi announced that India’s digital payments platform UPI will soon be introduced in Malaysia, as he commenced his two-day visit to the Asian nation.

🇰🇿 Singapore's 8B enters the Kazakhstan market. 8B's expansion follows Kazakhstan's introduction of the Unified QR Code, which is expected to become mandatory for banks operating in the country. The company will process settlements with counterparties through Zesta LLP.

🇦🇺 ByteFederal Australia launches ByteConnect. ByteConnect is a fully integrated, Bitcoin-enabled Payment Terminal and Online Payment Gateway leveraging blockchain technology to enable Australian merchants to accept cryptocurrency payments within a robust compliance and operational framework.

🇸🇳 Wave, Visa, and Ecobank Senegal launch virtual card to expand online payments. The virtual card enables users to make online payments on international e-commerce platforms, subscription services, ticketing sites, and digital streaming platforms, without requiring a traditional bank account or a physical card.

REGTECH NEWS

🇱🇹 IDenfy bakes AI into KYB platform. These new improvements were built to help compliance teams quickly pre-fill business key entity details from multiple official registries and government global databases, allowing compliance teams access AI assistant’s tips and insights much faster.

DIGITAL BANKING NEWS

🇱🇰 ComBank makes history as the first bank in Sri Lanka to enable Google Pay for Mastercard cardholders. Customers can transact seamlessly at contactless-enabled Point-of-Sale terminals across Sri Lanka and at any location globally where Mastercard is accepted, eliminating the need to carry physical cards.

🇦🇺 Revolut surpasses 1 million users in Australia. Marking the milestone since launching in Australia six years ago, the company said it now has more than 100 staff locally and plans to invest a further $400 million into the market over five years. Keep reading

🇮🇪 Zippay vs Revolut: The battle for Ireland’s instant payments. Ireland’s major banks are launching Zippay, an instant payments service built into their mobile apps to rival Revolut. While Zippay will enable easy person-to-person payments, Revolut already has strong traction with around three million Irish users, including a large teenage base.

🇨🇿 Czech Bank challenges Revolut with new multi-currency service. Partners Banka now allows clients to hold and manage several currencies within a single account without extra fees. The bank says the goal is to simplify everyday international payments while keeping exchange costs predictable.

🇬🇧 Digital bank Monzo wrongly rejects fraud refunds for more than 1,000 customers. The ombudsman overturned 34% of Monzo’s decisions across 3,372 cases, the worst rate among major UK banks, involving authorised push payment scams, card fraud, and identity theft.

BLOCKCHAIN/CRYPTO NEWS

🌍 Market share of centralized crypto exchanges, by trading volume. Binance led centralized exchanges in December 2025 with a 38.3% market share, despite spot volume dropping 40.6% to $361.8 billion. Bybit and MEXC followed with around 9% market share each, as overall volumes declined across the top exchanges.

🇹🇷 Crypto giant Tether aided Turkey in a billion-dollar crackdown. Turkish authorities have frozen over $500 million in assets linked to Veysel Sahin, who is accused of operating illegal betting platforms and laundering proceeds. Tether carried out the freeze at Turkey’s request as part of broader efforts to combat crypto-related crime.

🇺🇸 Hylaq wins Coinbase and Stripe approval to enable handle-based payment solutions, enabling compliant fiat-to-crypto and crypto-to-fiat transactions. The platform uses human-readable handles instead of wallet addresses to simplify transfers while remaining fully non-custodial, with users retaining control of funds and private keys.

PARTNERSHIPS

🇲🇽 Mexico’s Fincomun partners with Accion and Mastercard to improve the financial resilience of micro and small businesses, leveraging alternative data. Accion will work with Fincomun to develop embedded and digitally-enabled working capital credit for MSEs by crunching alternative data to help maximize eligibility and access.

🇳🇱 Viva.com and BlueStar EMEA announce strategic partnership to power end-to-end commerce across Europe. This partnership aims to bridge Viva. com’s unified payments and embedded finance platform with BlueStar’s leading hardware and distribution capabilities.

🇺🇸 Adyen and Uber expand global partnership to power new markets, Launch Uber Kiosks. The expanded partnership reflects Uber's growing use of Adyen's global payments platform to enhance performance and offer more alternative payment methods, to support Uber's continued international growth.

🇪🇬 MNT-Halan Partners with Visa to expand its prepaid card offering and accelerate digital payments in Egypt. The partnership with Visa will enable the expansion of card issuance and distribution by leveraging Visa’s robust infrastructure and a suite of value-added services, accelerating everyday usage for digital payments.

🇺🇸 Honor Capital partners with ePayPolicy to offer financing at online checkout. With ePayPolicy's Finance Connect, insurance brokers and agencies that work with Honor Capital can now present simple financing options to payors when they pay online.

🇦🇪 Deem Finance and Biz2X launch POS-based credit solutions for UAE SMEs. Through this partnership, Deem Finance will leverage Biz2X’s AI-driven lending platform to introduce POS-based SME financing solutions, enabling eligible merchants to access credit based on real-time sales and transaction data rather than static balance-sheet assessments.

DONEDEAL FUNDING NEWS

🇸🇦 Simplified Financial Solutions Company secures $20m Series A to scale Saudi Arabia's leading spend management platform. SiFi will deploy the new capital to expand its market presence, deepen AI-powered capabilities for finance teams, and layer additional finance workflows as it evolves into a full-suite finance management platform.

🇸🇦 InvestSky expands into Saudi Arabia following $4 million seed round. According to the company, the new capital will be used to broaden market access, scale operations in Saudi Arabia, and further enhance the retail investing experience across MENA.

🇸🇪 Swedish AI FinTech Fintower raises €1.5 million seed to replace spreadsheets in financial planning. The fresh capital will be used to deepen product development and scale the business as the company targets becoming the leading financial decision-support platform in the Nordics.

🇦🇪 omnispay raises $2m pre-series A led by Infinity Value Capital Group to power an "all-in-one" finance platform for SMEs. The funding accelerates omnispay's evolution from rapid merchant settlements into an AI-native, all-in-one finance platform designed to solve persistent SME cash-flow challenges.

M&A

🇬🇧 NatWest to buy Evelyn Partners in $3.68 billion bid to break crowded wealth market. NatWest said it expects the deal to generate about 100 million pounds in annual cost savings and announced a 750 million pound share buyback. Continue reading

MOVERS AND SHAKERS

🇦🇺 Send Payments appoints Jason McClintock as Chief Commercial Officer. McClintock brings more than 25 years of experience in various senior product and executive enterprise sales roles at Westpac, HSBC, American Express, Convera, and, most recently, Worldpay.

🇸🇬 Swissquote names Rafael Weber Deputy CEO of Singapore Operations. Weber will focus on expanding the company’s presence in the city-state while managing client relationships to maintain continuity and foster long-term partnerships. With nearly 20 years of experience in banking and FinTech, Weber joined Swissquote in 2021.

🇸🇬 Ebanx promotes Eduardo de Abreu to CPO and Singapore CEO amid APAC expansion. Credited with being a driving force behind Ebanx's expansion into Africa, India, and the Philippines, Abreu will now relocate to Singapore to oversee the firm's "global product roadmap as the company strengthens its presence in the APAC region", according to a company statement.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()