A Major Step Forward: Our Partnership with The Financial Revolutionist

Hey FinTech Fanatic!

Today marks a significant milestone for 'Connecting the dots in FinTech', as we embark on a strategic partnership with The Financial Revolutionist (The FR), a leading platform renowned for its in-depth fintech insights and analysis.

This collaboration is more than just a partnership; it's a fusion of our dedication to providing top-tier fintech content and The FR's cutting-edge reporting and technology, like their Event Analyzer.

Our combined efforts will significantly enhance the value we offer to our loyal followers, who now total over 130,000 subscribers and nearly 150,000 social media enthusiasts.

You can expect a richer, more comprehensive fintech news experience, with shared content across both platforms. This will include insights from The FR's original reporting, augmented by my global perspective on the latest fintech trends and developments.

Together, we will bridge local insights and global trends, offering a well-rounded, in-depth look at the fintech world.

For those who haven't yet subscribed to 'Connecting the dots in FinTech' or The FR, I encourage you to do so and join our expanded community. Subscribe to stay ahead in the ever-evolving world of fintech.

We’re hosting an intimate (or exclusive) happy hour in NYC on Tues, Jan 23rd for industry friends to celebrate our partnership – and we’re inviting 10 special guests to join us. Click here to request your invite.

Thank you for your continued support, and here's to a future where we connect more dots in the fintech universe together!

Cheers,

Marcel

SPONSORED CONTENT

FINTECH NEWS

🇺🇸 Plug and Play and Visa select 21 startups for accelerator programme. The diverse cohort of startups was chosen through a rigorous selection process considering factors, including market potential, technological innovation, and the ability to drive a positive impact in the fintech ecosystem.

🇺🇸 Neobank Arc looks to fill SVB gap with venture debt platform. Arc Technologies is expanding its services beyond cash management with its new marketplace, called Arc Capital Markets, which aims to connect startup firms with lenders looking to expand into the venture capital space.

🇮🇳 Mastercard is unlocking efficiencies in B2B healthcare payments through innovative partnership. Mastercard is pioneering a first of its kind medical claim payment solution with one of the leading financial institutions in India and health tech platform Remedinet Technologies.

🇧🇪 Qover enters £19bn UK motor insurance market. The insurtech announced the launch of its innovative motor insurance solution in the UK, which enables car manufacturers to provide digital insurance programs across Europe. This expansion also follows a year of extensive growth and industry recognition.

🇬🇧 FinTech Wales welcomes Starling Bank as its latest partner. The collaboration aims to strengthen Wales as a globally recognized hub of fintech excellence and to leverage Starling Bank's expertise and resources to contribute to the growth and recognition of Wales in the fintech and financial services industry.

🇺🇸 LA Clippers arena deal dragged into U.S. investigation of California FinTech. A Marina del Rey company that promised to help the NBA’s Clippers build “the most sustainable arena in the world” is now reportedly facing a possible federal investigation for allegedly misleading customers. More here

PAYMENTS NEWS

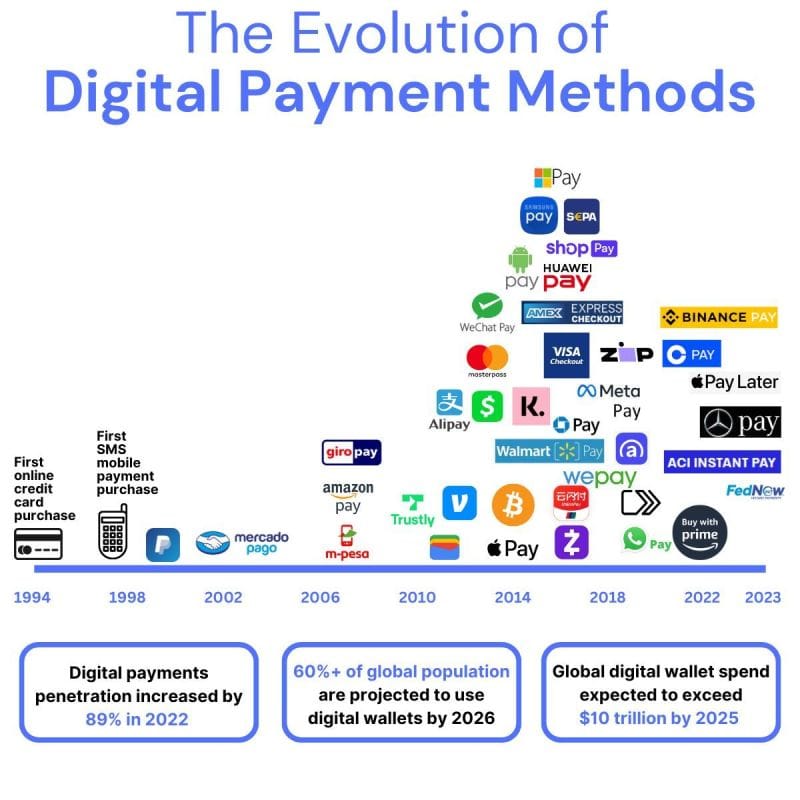

The evolution of payment methods is reshaping the way we pay, but how do merchants handle this constant change on a global scale?

🇮🇪 Revolut Pay gives Aer Lingus customers a first-class checkout experience. The partnership aims to give Aer Lingus customers a secure one-click checkout with Revolut Pay improving the overall customer purchasing journey and finding ways to reduce friction, leading to faster and more efficient purchases.

🇿🇦 Bank Zero working on smartphone tap payments. The digital bank is working on three new features, including integrating smartphone wallets for tap payments. A spokesperson for the bank said that all phone options are being evaluated, and watch support will follow later.

🇺🇸 Payroc launches PayByCloud, a low-code semi-integrated solution for ISVs that simplifies omnichannel payment integrations. PayByCloud creates a cloud-based link between Payroc's application on a payment device and the Payroc gateway, streamlining transactions for partners in a more efficient and timely manner.

DIGITAL BANKING NEWS

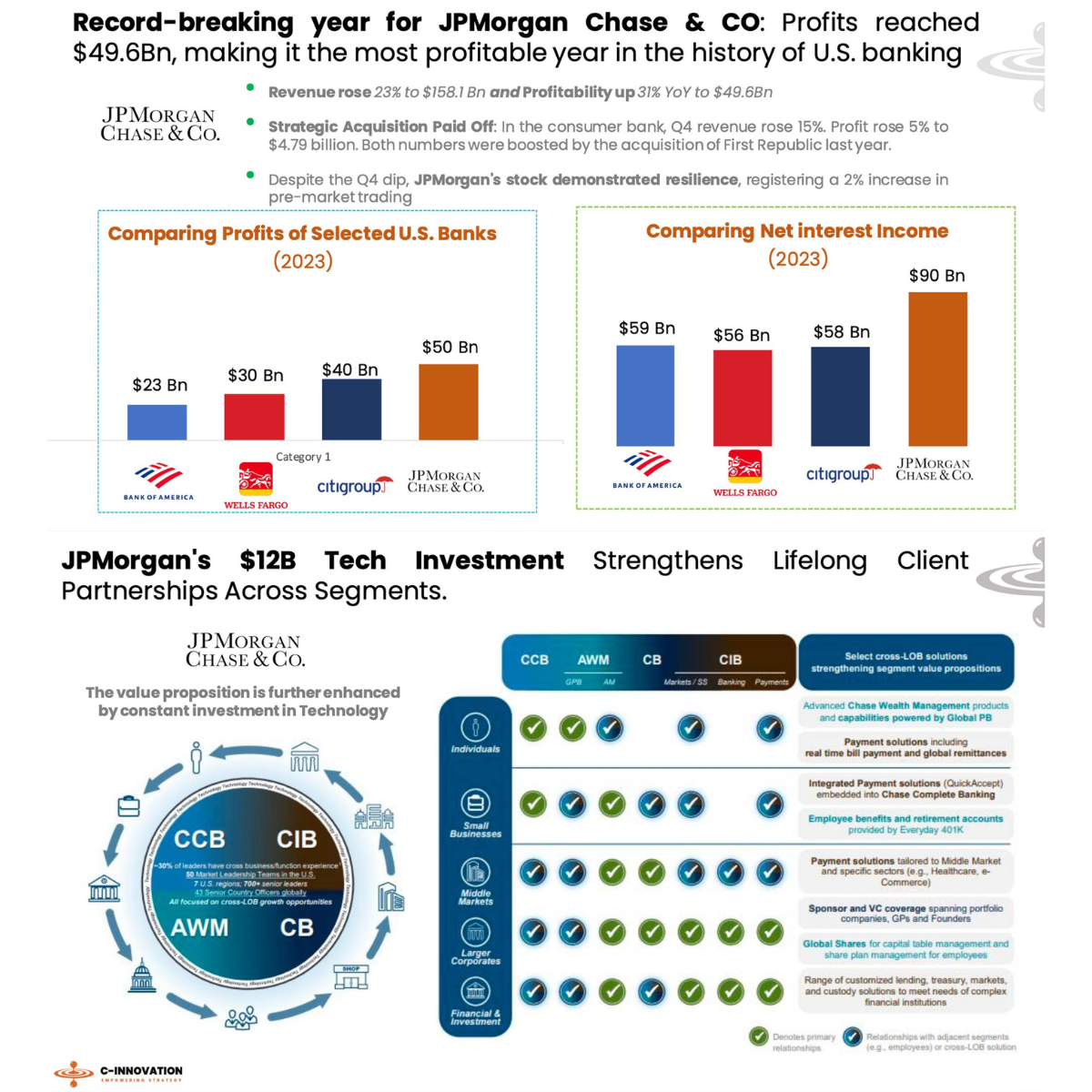

🇺🇸 JPMorgan Chase & Co reported a record-breaking year with profits reaching $49.6 billion, making it the most profitable year in the history of U.S. banking.

🇬🇧 Plum launches ‘Spend Tracker’ feature to make budgeting easier. The spend tracker feature, available to Ultra and Premium members and paired with an automatic bill tracker, automatically categorises a user’s outgoings and shows them as a percentage of overall spending.

🇰🇷 Toss Bank launches commission-free foreign exchange service. The internet-only bank said it was the first domestic financial company to introduce this service, which allows customers to exchange 17 different currencies in real time, 24 hours a day and seven days a week.

🇺🇸 Trump promises to block CBDC. The former president has vowed to prevent the creation of a central bank digital currency if he wins the US presidential election, calling a digital dollar a "dangerous threat to freedom". More on that here

🇺🇸 Pinwheel collaborates with Jack Henry to streamline access to the industry’s Top performing direct deposit switching solution. The integration of Pinwheel's Direct Deposit Switching (DDS) solution with Jack Henry's digital banking platform provides an enhanced and seamless banking experience. Read on

🇧🇷 Nubank’s 176% surge backs CEO’s drive to poach clients from rivals: Brazil-based lender has doubled customer base to 90 million. David Velez, the co-founder and chief executive officer, also has his sights set on grabbing market share from competitors, including big lenders and small digital competitors.

🇺🇸 SoFi launches small business loan marketplace. SoFi small business clients can now secure loan approval and funding up to $2 million within 24 hours. SoFi had flirted with the idea of small business loans previously and this appears to be their solution. Read more

🇧🇷 Ebury launches operations in Brazil with Ebury Bank. Ebury is particularly focused on facilitating direct currency transactions between the Brazilian real and the Chinese yuan, catering to the growing Chinese presence in Brazil. The services will include risk management solutions for exporters and importers, aiming to minimize Brazilian real volatility.

BLOCKCHAIN/CRYPTO NEWS

🇫🇷 Gemini secures French crypto registration, continuing global expansion. Once available in France, customers located there will be able to seamlessly trade over 70 cryptos on the Gemini website and mobile app and have access to Gemini’s high-performance ActiveTrader platform.

🇺🇸 Judge questions SEC’s claim to regulate Coinbase: Crypto exchange is seeking dismissal of lawsuit at center of agency’s oversight strategy. A federal judge on Wednesday questioned whether allowing the SEC to impose its regulations on Coinbase would give the agency sway over markets it doesn’t have authority to supervise.

DONEDEAL FUNDING NEWS

Varengold Bank invests €29.5 in Dutch BNPL firm Billink. The firm says it will use the funding to expand its offering to the top-50 largest Benelux web shops, enter the German market, and further fuel its ambitions to bring the same level of assurance consumers have in offline transactions online.

🇺🇸 Briq, a startup that uses AI to automate finances in construction, brings in $8M extension at a $150M valuation. Briq has built an offering that uses a group of proprietary technologies, the flagship of which are its use of generative automation bots. While it is focused on serving the general and specialty contracting market in North America, it has plans to expand into new geographies in the coming years.

🇺🇸 Kashable closes $25.6m Series B. The investment will fuel Kashable's rapid expansion, accelerate the development of additional financial wellness services and bolster the company's ability to extend affordable credit to employees across the credit spectrum.

M&As

🇬🇧 Ukheshe acquires EFT International. This is a major milestone in both companies’ commitment to innovation and growth, underscoring a shared vision of transforming financial services across the continent. Read more

🇩🇪 Getsafe acquires EQT-backed student loan platform deineStudienfinanzierung. The acquisition marks another milestone in Getsafe’s journey, solidifying its position as a forward-thinking insurtech dedicated to enhancing the financial well-being of individuals.

MOVERS & SHAKERS

Revolut is buffing its finance team with ex-Citi MDs and AmEx VPs. In London, John Kerrisk joined Revolut as the Head of Financial Control. Simultaneously, on the other side of the world, Martin McLeod announced his role as the CFO of Revolut Australia last week. Keep reading

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()