$820M Boost: iCapital Bets Big on Alts Investment

Hey FinTech Fanatic!

iCapital has just added $820 million to its war chest, pushing its valuation past $7.5 billion and signaling significant momentum in the alternative investments infrastructure race.

The round, backed by T. Rowe Price, SurgoCap, State Street, and longtime supporters such as Temasek and UBS, positions the FinTech to double down on acquisitions, technology, and global reach.

CEO Lawrence Calcano is calling it a win for clients, not just investors. But with over 23 acquisitions under its belt and a platform supporting 114,000 financial professionals, this raise might be more than just a growth story.

Scroll down for what’s next in iCapital’s playbook and your daily dose of FinTech updates. 👇

Cheers,

FINTECH NEWS

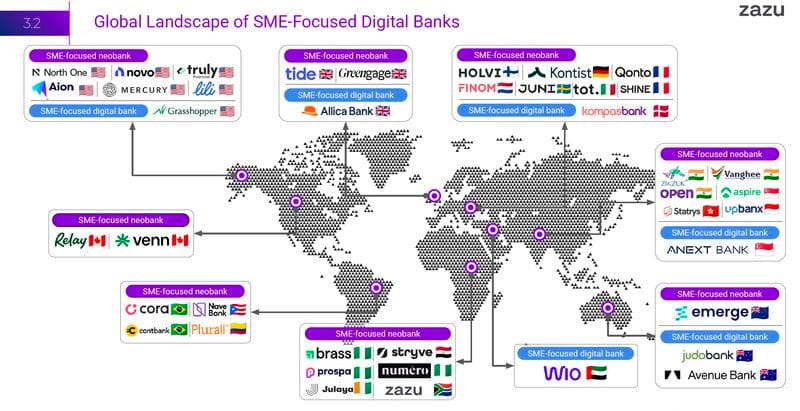

🌍 Here's a Global Landscape of SME-focused Digital Banks👇

Who is missing from this overview?

🇬🇧 Deloitte and Azets probed over audits of collapsed UK FinTech Stenn. The UK accountancy regulator has launched an investigation into Deloitte and Azets over their audits of Stenn. This FinTech collapsed into administration in December after its lenders began probing potentially suspicious transactions.

PAYMENTS NEWS

🇮🇳 India now makes faster payments than any other country, courtesy of UPI. India leads in faster payments due to the rapid growth of UPI. UPI processes over 18 billion transactions monthly, dominating electronic retail payments. Interoperable systems like UPI foster digital payment adoption and reduce reliance on cash, as evidenced by decreased ATM withdrawals.

🇬🇧 Runa launches white label solution for rapid gift card marketplace deployment. Featuring more than 5,000 popular merchant options, Runa Shop offers multiple use cases spanning from building customer and employee engagement to boosting sales and revenue.

🇩🇪 Deutsche Bank goes live with Swift Instant Cash Reporting. Through ICR, the bank's clients can collect real-time account and balance data via a single access point using the ISO 20022 data model and secure JSON format. Swift acts as the central connector, routing API pull requests from corporates to Deutsche Bank.

🇹🇭 Bangkok Bank launches Paybooc QR Payments. The Paybooc app allows South Koreans to shop and pay with ease while exploring all that Thailand has to offer, utilizing real-time exchange rates for transactions. Keep reading

🇨🇴 Instant payments with Bre-B will also be available for businesses. Bre‑B aims to make digital payments ubiquitous in Colombia, empowering both consumers and businesses alike. While cash remains king for now, Bre‑B could usher in a gradual shift toward a safer, more efficient, and inclusive financial ecosystem.

OPEN BANKING NEWS

🇺🇸 JPMorgan tells FinTechs to pay up for customer data access. The US bank has sent pricing sheets to data aggregators, which connect banks and FinTechs, outlining the new charges. The fees vary depending on how companies use the information, with higher levies tied to payments-focused companies.

REGTECH NEWS

🇸🇳 Flutterwave secures full license to empower businesses in Senegal. With this license, Flutterwave is positioned to help companies in Senegal scale by offering its full range of seamless digital payment services. Read more

🇺🇸 Alchemy Pay accelerates regulatory expansion in the U.S. with South Carolina MTL license approval. With the inclusion, Alchemy Pay now holds MTLs in ten U.S. states. The license enables Alchemy Pay to lawfully offer its suite of fiat-crypto on-ramps and off-ramps within South Carolina's jurisdiction.

DIGITAL BANKING NEWS

🇪🇸 Neobank Vivid launches Spanish IBAN and offers 4% initial returns to businesses and self-employed individuals. This includes a return on your liquidity of up to 4% per year in the Interest Account during the first month and up to 3% per year during the second month.

BLOCKCHAIN/CRYPTO NEWS

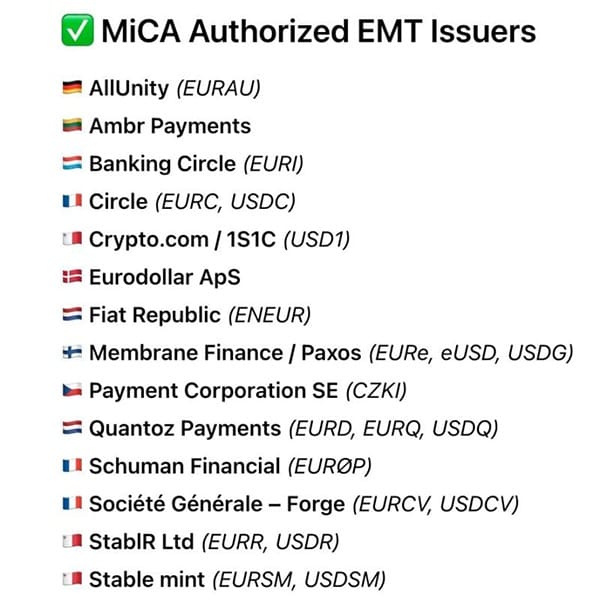

➡️ 6 months into MICA’s application for CASPs, and 12 months for stablecoins, here’s the latest July snapshot with a full list of Authorized Stablecoin Issuers & Crypto-Asset Service Providers:

🇺🇸 Coinbase integrates with Copper’s ClearLoop to unlock institutional-grade Off-Exchange Settlement. ClearLoop will enable Coinbase clients to settle trades off-exchange, enhancing institutional asset security while offering greater flexibility and operational efficiency.

🇺🇸 The Opyn Markets leadership team is joining Coinbase. Their experience building decentralized products will accelerate our efforts to bring more of the financial system, including more of our business, on-chain. Keep reading

🌍 Binance launches Sharia Earn, an Islamic banking-aligned token. Targeting the untapped $4 trillion Islamic finance market, Sharia Earn will allow Muslims to participate in the decentralised finance movement without concern for how it conflicts with Islamic banking principles.

🇺🇸 Robinhood’s crypto trading promotions probed by Florida AG. The Florida Attorney General's office alleged that Robinhood is falsely promoting its trading platform as the least expensive way to purchase crypto. Meanwhile, Robinhood opens Ether and Solana staking to US Users. The offering brings Solana back to the platform after Robinhood removed the token in 2023.

🇨🇳 HSBC completes e-HKD trials of CBDC on public blockchains. The bank said it explored e-HKD payments on various public blockchains, including Arbitrum, Ethereum, Linea, and Polygon. Additionally, within the bank, it developed a private DLT solution using Hyperledger Besu, presumably to act as a tokenization platform before public issuance.

PARTNERSHIPS

🇵🇪 EBANX offers the first direct integration for cross‑border merchants with Peruvian Wallet Yape. It supports recurring and one-click and on-file payments through a simple user enrollment process. Users will be able to pay for their purchases on global e-commerce websites with either their wallet balance or a linked card.

🇺🇸 Orion Innovation successfully implements Temenos’ digital banking platform for BNI. As a trusted Temenos partner, Orion delivers innovative and scalable digital banking solutions that empower financial institutions to stay ahead in a rapidly evolving digital landscape.

🇺🇸 Circle expands USDC strategy with revenue-sharing deal with Bybit. The deal with Bybit is seen as a strategic move to help close this gap by aligning financial incentives with platforms that can drive adoption at scale. Keep reading

🌍 Amazon payment services improve BNPL offering for merchants in MENA with Tamara partnership. This partnership allows businesses in the United Arab Emirates (UAE) and the Kingdom of Saudi Arabia (KSA) to offer flexible payments to their consumers.

🇺🇸 New Gen teams with Visa on AI native storefronts with embedded payments to power agentic commerce. Its rails are built for any AI agent and any brand. It is working with Stripe, OpenAI, Anthropic, and fashion brands to power intelligent storefronts that go from “I need breezy linen pants for a beach wedding” straight to purchase.

🇺🇸 OnePay unveils new payment system with Mastercard for cross-border transfers. Central to the system is Mastercard Move, which supports OnePay users in sending money overseas with traceable transactions, clear fee structures, and defined delivery times.

DONEDEAL FUNDING NEWS

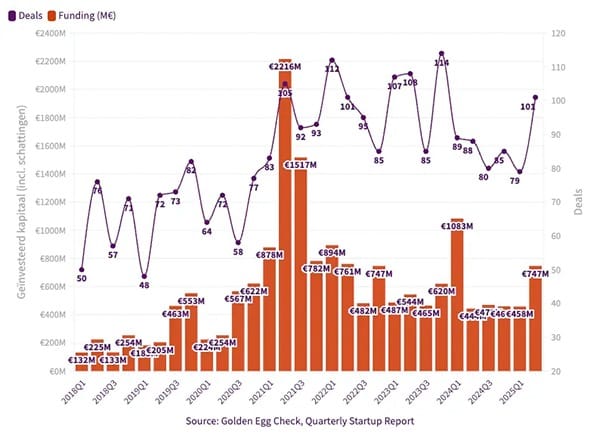

🇳🇱 Dutch startup funding soars to €747 million in Q2.

🇺🇸 FinTech giant iCapital raises $820M for global growth. The fresh capital will be used to accelerate iCapital’s global acquisition strategy, drive geographic expansion, and support technology innovation across its services. Read more

🇮🇳 Saas FinTech platform Arteria Technologies raises Rs 100 crore funding from ICICI Venture. It will be used to drive the company's growth plans and artificial intelligence (AI) product expansion. The capital will also be used to scale Arteria Technologies’ engineering and product teams.

🇩🇪 Berlin FinTech re:cap gets €125M boost to bring its Capital OS to the UK. The company will continue its geographic expansion across Europe, targeting additional tech hubs beyond Germany, the Netherlands, and the UK. re:cap also aims to integrate deeper analytics and planning features.

🇩🇪 EV payments platform Cariqa secures €4m seed funding. The company plans to use the new capital to develop its infrastructure-first platform further and scale its reach across Europe and into other markets. Continue reading

🇺🇸 Oslo-based Two nabs €13M to expand B2B payments in the U.S. Two provides B2B merchants instant payouts while offering buyers flexible terms, mirroring consumer-style checkout for the wholesale market. This enables merchants to shorten their sales cycles and provide net terms significantly.

🇮🇳 Wealthtech platform InvestValue FinTech eyes $5 Million fund-raise to power NeoFinDesk. The funds will be used to revolutionise its product, NeoFinDesk, which is a multi-issuer marketplace designed to connect financial product issuers and distributors.

MOVERS AND SHAKERS

🇪🇸 N26 appoints Antón Díez from Trade Republic as Managing Director for Spain and Portugal. Díez brings over 12 years of experience in financial services. His mission is to expand N26’s customer base, strengthen user engagement, and promote digital banking across Iberia.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()