$75 Billion for Revolut?

Hey FinTech Fanatic!

Revolut is reportedly raising $2 billion at a massive $75B valuation, up from $45B last year, pushing it ahead of Nubank’s current market cap.

Some say it’s justified, while some others say it’s FinTech froth.

So, what do you think?

👉 Vote here in the quick poll: Is Revolut overvalued or just getting started?

And while that simmers, don’t miss today’s other major FinTech moves.

Let’s get into it 👇

Cheers,

INSIGHTS

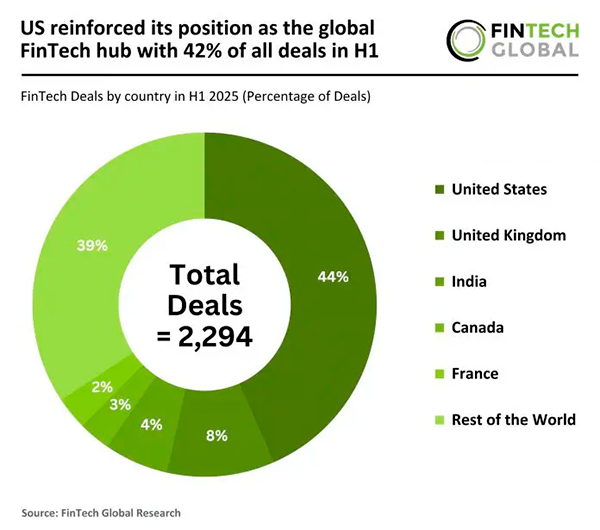

🇺🇸 The US reinforced its position as the global FinTech hub with 42% of all deals in H1. In H1 2025, the global FinTech market recorded 1,695 deals, a slight 3% increase from the 1,647 deals seen in H2 2024, but a substantial 38% decline from the 2,754 deals completed in H1 2024.

🌍 Mobile Money boosts Africa's savings to a decade high. The share of adults in sub-Saharan Africa who saved through formal channels surged by 12 percentage points to 35% in 2024, the second-highest regional rate after East Asia and the Pacific, according to the World Bank’s Global Findex Database 2025.

FINTECH NEWS

🇲🇽 Dock Executive Anderson Olivares de Oliveira arrested in Mexico for $10 million fraud. Olivares was detained at Mexico City International Airport following an alert from the Attorney General's Office. He is accused of fraud in a case involving corporate disputes and regulatory questions about the company's operations in the country.

🇺🇸 FinTech giant FIS lays off 133 people at Seattle-area office. A new filing with the Washington state Employment Security Department revealed the job cuts, which begin Sept.15. “FIS is evolving our embedded finance strategy to prioritize delivery of embedded finance capabilities to banks,” a company spokesperson said.

🇬🇧 Bank of England readying the new retail payment infrastructure plan. This new model, the central bank’s Payments Vision Delivery Committee said in a news release, “embeds public and private sector collaboration, utilizing the right expertise in the right functions to drive transformation.”

🇺🇸 Elliott Management builds stake in Global Payments in wake of Worldpay deal. The investment comes as the Atlanta-based payments group plots its future after buying Worldpay earlier this year in its biggest acquisition to date, as it tries to expand its core business of processing payments for merchants.

🇺🇸 Claude for Financial Services. Financial Analysis Solution is designed to transform the way finance professionals analyze markets, conduct research, and make investment decisions using Claude. This solution consolidates financial data into a unified interface.

🇺🇸 OpenAI to take cut of ChatGPT shopping sales in hunt for revenues. The San Francisco-based company currently displays products on the platform with an option to click through links to online retailers. It also announced a partnership with payments group Shopify in April.

PAYMENTS NEWS

🇪🇸 Bizum for minors. Bizum has launched a new feature that allows minors aged 12 to 17 to use its instant payment service under the supervision of a legal guardian. With parental approval and a compatible bank account, teens can send and receive money, make online purchases, and pay in person using only their mobile phone.

🇺🇸 Jamie Dimon says JPMorgan Chase will get involved in stablecoins as the FinTech threat looms. Last month, JPMorgan announced it would launch a more limited version of a stablecoin that only works for JPMorgan clients; a true stablecoin would presumably be more universally accepted.

🇫🇷 Worldline introduces AI-powered routing to boost payment authorisation rates. Following successful pilots, the solution has delivered increased authorisation rates by more than 2% in addition to the 3% improvement achieved with its rule-based routing.

🇺🇸 Cash App enables over a million sellers to accept contactless payments using only an iPhone. This new capability, powered by Square, is now available to millions of eligible Cash App Business sellers using their Cash App iOS app. Read more

🇺🇸 Mastercard debuts experience-focused world legend card. The Mastercard Collection is available across the company’s World, World Elite, and newly created World Legend Mastercard cards, offering rewards on things like dining, entertainment, and travel.

REGTECH NEWS

🇸🇬 eToro enters Singapore amid approval of MAS licence. Now, retail investors in Singapore can access eToro locally and trade stocks from over 20 stock exchanges, along with exchange-traded funds and derivatives. Keep reading

🇬🇧 FCA fines Barclays £42 million for poor handling of financial crime risks. Barclays Bank UK PLC failed to check that it had gathered sufficient information to understand the money laundering risk before opening a client money account for WealthTek.

🇺🇸 Interactive Brokers fined nearly $12m for alleged US sanctions breaches. Following an internal compliance review, the Connecticut-based brokerage firm voluntarily self-disclosed more than 12,000 apparent violations to OFAC, which deemed them “non-egregious”.

BLOCKCHAIN/CRYPTO NEWS

🇸🇨 Crypto exchange BigONE loses $27M in third-party attack. BigONE said it detected the security incident after abnormal asset movements triggered real-time monitoring alerts. “Upon investigation, it was confirmed to be the result of a third-party attack targeting our hot wallet,” it said.

PARTNERSHIPS

🇶🇦 QIIB and Visa launch Biometric Click to Pay. Users can employ a unique identifier, such as their email address or phone number, to swiftly complete transactions with participating merchants. Integrated with Visa’s Payment Passkey Service, this solution leverages biometric authentication, eliminating the need for manually entering card details or one-time passcodes.

🇦🇪 Telr and Peko ink a strategic partnership agreement to launch Telr Incepta, an all-in-one platform designed to help in setting up businesses in the UAE and empower SMBs with advanced tools that transform the way businesses manage their finances and operations.

🇩🇪 Vivid Money and Adyen launch payouts on speed. Adyen processes have been integrated into the Vivid Money interface, allowing customers, upon acceptance of Adyen's terms and conditions, to withdraw revenue from payments directly to their account.

🇺🇸 EDGE and MX partner to advance financial inclusion with enhanced end-to-end cash flow underwriting. With this partnership, EDGE improves upon its best-in-class account connection success rates with maximum data quality to deliver more conversions from lead to loan and even higher fidelity decisions on a complete financial picture.

🇺🇸 Currency.com pilots AI initiative with ComplyControl to boost compliance. The pilot focuses on how intelligent systems can strengthen sanctions screening, adverse media detection, and regulatory gap analysis. Continue reading

🇺🇸 ZBD secures EU EMI license and announces partnership with ClearBank to merge digital assets with traditional finance. ClearBank will provide ZBD with operational accounts for business expenses and safeguarding accounts for holding client funds. This enables ZBD EU users to fund a EUR balance in their virtual account.

🇺🇸 ICBA Payments and Visa renew partnership supporting community bank payments. Together are deepening their efforts to equip local financial institutions with the modern payment tools and support they need to grow and better serve the needs of their customers.

DONEDEAL FUNDING NEWS

🇮🇳 FinTech firm PayU India raises Rs 302 crore from Prosus arm. “This fundraiser is to fuel the growth of our credit business, which is expected to break even by September,” a PayU India spokesperson told Inc42. “It also reflects Prosus’ confidence in our growth trajectory and our path to profitability.”

🇺🇸 Candex raises $33M. The new capital will fuel continued global expansion, product innovation, and customer growth. The round was led by 9Yards Capital, with participation from Hedosophia and existing investors including Goldman Sachs, Altos Ventures, Craft Ventures, NFX, and Edenred.

🇮🇳 FinTech firm Infibeam raises $84.3M in oversubscribed rights issue. It has completed its 700 crore rupees (US$84.3 million) rights issue, which was oversubscribed by 1.4 times. Eligible shareholders were allowed to buy four new shares for every existing share for 10 rupees (US$0.12) each.

🇺🇸 Heron raises $16M Series A to bring the AI revolution from Silicon Valley to American businesses. The new capital will be used to scale Heron's presence in insurance, equipment finance, and SMB lending, while expanding into adjacent verticals that have shown demand for Heron's solution.

🇨🇴 Addi secures $35M financing deal from BBVA Spark. Addi will use the funds to strengthen its product offering in Colombia. Addi is a BNPL that enables consumers, especially those without access to traditional credit, to split purchases into installments in both physical and online stores.

🇺🇸 Retirable raises $10M for smarter retirements. With the new funding, Retirable plans to expand its internal adviser team and introduce additional products to better manage retirees' financial and medical needs. Read more

🌍 Paypercut lands €2 million pre-seed. Paypercut's BNPL Aggregator connects several underwriters in one place. Merchants integrate once, then either allow shoppers to choose their preferred BNPL provider at checkout or let an internal algorithm route the transaction.

M&A

🇬🇧 Wagestream swoops for pension technology provider Zippen to provide specialist knowledge in defined contribution pensions to FinTech, empowering frontline workers with financial wellbeing tools. Keep reading

🇺🇸 Crypto infrastructure giant Talos acquires Coin Metrics for more than $100 million. The acquisition reflects Talos’ ambitions to become a one-stop shop for institutional players looking to get into digital asset trading and portfolio management, with Coin Metrics a leader in supplying both on-chain and off-chain data.

🇺🇸 FinTech Hourly merges with WeSure US at a $168M valuation and raises $10M more. Hourly will become a wholly owned subsidiary of WeSure Global Tech, and Hourly shareholders will receive, on a fully diluted basis, approximately 49% of its issued and outstanding share capital.

MOVERS AND SHAKERS

🇬🇧 Akoni founder Panos Savvas joins Kani Payments as CTO. The company says Savvas will focus on "platform scalability, real-time analytics and data quality", with the new CTO adding that he will work on "scaling what already works, embedding more deeply into client workflows and setting new standards".

🇨🇦 Canada’s former open banking lead, Abraham Tachjian, joins FinTech startup Brim Financial. Tachjian said the role will focus on growing Brim’s business and leading its regulatory matters. He added it’s an opportunity to bring out his “payments nerd side,” and draw on his experience in the legal field, capital markets, and digital banking.

🇺🇸 PayPal Blockchain Lead José Fernández da Ponte Joins Stellar. Fernández da Ponte said the move was more about choosing to work at the infrastructure layer, ensuring applications like stablecoins can run at scale. The foundation also said it appointed Jason Karsh, a former Block and Blockchain.com Executive, as CMO.

🇬🇧 Starling Bank makes major comms restructuring. Alexandra Frean has stepped down as Chief Corporate Affairs Officer at Starling Bank, as part of a shake-up of the comms team. Read more

🌍 PayPal Appoints Maria Teresa Minotti as a new Vice President and General Manager of Southern Europe. Throughout her career at the company, she has held various roles of increasing responsibility, distinguishing herself for her ability to explore new market segments and develop advanced digital solutions.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()