$375M Move: Coinbase + Echo Expand On-chain Capital Formation

Hi FinTech Fanatic!

Coinbase has acquired Echo, a pioneering on-chain capital formation platform, in a $375 million deal, further solidifying its position at the center of the crypto innovation stack.

Echo enables projects to raise funds directly from their communities through private sales or public token offerings, utilizing its Sonar platform. With over $200 million raised across 300+ deals, Echo has proven its value in opening up early-stage investing to broader audiences.

The company has championed more inclusive, transparent, and efficient fundraising tools. Its mission aligns with Coinbase’s vision: to democratize access to investment opportunities once limited to insiders.

This acquisition helps solve a persistent problem: while builders struggle to raise capital, everyday investors are shut out of early-stage crypto deals. Echo’s on-chain-first tools create new pathways for both sides, giving founders flexible capital options and investors a seat at the table.

Looking ahead, Coinbase plans to expand Echo’s reach beyond token sales, eyeing tokenized securities and real-world assets.

With this step, the company strengthens its position as the go-to platform for builders and investors alike.

FinTech Fanatic, are you in NYC?

I’m writing this from the plane on my way to the Big Apple. I’ll be spending the next month in the US for Money20/20 and other FinTech-related stops around the country.

One of the things I enjoy most is meeting readers beyond the screen, and running. That’s why I’d love to see you in person at a Fintech Running Club event next Thursday, the 23rd.

Pedro D'ávila and I are bringing together runners of all levels for a casual jog and some lively networking, no suits required. You can subscribe here.

Hope to see you there!

Cheers,

ARTICLE OF THE DAY

🇬🇧 3S Money’s Take on Stablecoins. What a Paris metro ticket has to do with Stablecoins, or why a ‘fiat-crypto-fiat’ flow is wrong. Using a Paris metro analogy, 3S Money CEO Ivan Zhiznevsky compared fiat to an unnecessary paper ticket slowing progress. He calls for treating stablecoins like real currencies, empowering businesses and individuals to transact directly in digital assets for greater efficiency and flexibility.

INSIGHTS

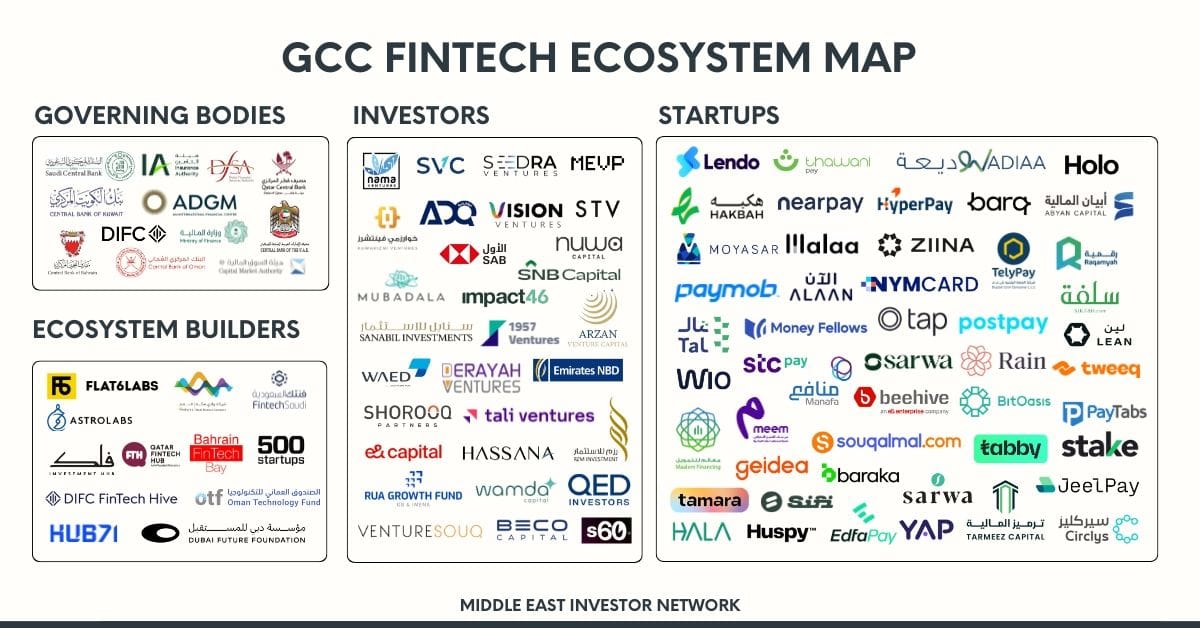

🌍 GCC FinTech Ecosystem Map👇

📰 The 6 strategic moves every retail merchant must make by ACI Worldwide. Retailers must optimize payment strategies to stay competitive. Key priorities include reducing fees, using AI to fight fraud, ensuring provider flexibility, supporting new payment channels, enabling seamless omnichannel experiences, and leveraging real-time data.

FINTECH NEWS

🆕New Look, Same Running Spirit! 🏃➡️ The FRC Newsletter just got a brand-new design: simple, fun, and packed with all the juicy details about upcoming runs. Are you curious to be the first to know what’s next? Subscribe and get the weekly newsletter straight to your inbox!

🇺🇸 Blockchain.com eyes public listing through SPAC deal amid crypto IPO surge, and has hired Cohen & Company Capital Markets as an advisor. A SPAC offers a faster alternative to a traditional IPO by merging with a listed shell company, an option increasingly favored by crypto firms seeking quicker access to capital markets.

🇸🇪 Trial opens in Klarna's $8.3 billion lawsuit against Google. A Swedish court has begun hearing a lawsuit by Pricerunner, owned by Klarna, seeking over $8 billion from Google for allegedly favoring its own shopping services in search results. Pricerunner initially sought $2 billion but later indicated damages could be much higher due to the ongoing violation.

🇬🇧 Wise appoints new product leadership role for stablecoins. The London-based FinTech firm is hiring a product lead with experience in building wallet and payment solutions. This development comes amid rising global stablecoin adoption and evolving regulatory clarity in key markets.

🇿🇦 Optasia aims for $375 million IPO on the JSE. In an interview with CNBC Africa, Optasia CEO Salvador Anglada discussed the company’s plans to list on the Johannesburg Stock Exchange. Anglada shared insights into the listing’s potential impact and the opportunities it presents for growth and financial inclusion.

🌍 Tether invests in Kotani Pay to revolutionize Africa’s digital asset infrastructure and cross-border payments. This investment aims to empower people and businesses in Africa by allowing easy access to digital assets and lowering barriers to global financial participation.

PAYMENTS NEWS

🇲🇽 SumUp launches in Mexico, introducing new payment solutions to its 37th market. With this launch, SumUp aims to introduce a new level of efficiency and ease that the Mexican market has yet to experience. As part of the launch, SumUp has introduced the SumUp Go card reader to the Mexican market.

🇺🇸 Zip shares jump 12% on strong update and buyback news. Zip Co announced 38.7% growth in transaction volume and a 32.8% revenue increase for the first quarter of FY 2026. It has increased its share buyback limit, reflecting balanced capital management to optimise shareholder returns and bolster growth.

🇧🇷 The latest hacker attack on a FinTech company allegedly stole at least R$26 million. FictorPay was the target of a hacker attack that resulted in the diversion of company funds. According to a source, the Central Bank observed unusual financial transactions through FictorPay on Sunday and alerted Celcoin, the company to which FictorPay is affiliated.

OPEN BANKING NEWS

🇬🇧 Zilch and Plaid collaborate on open banking repayments. Zilch customers will now be able to use the Pay by Bank method for one-off repayments, allowing them to repay directly from their bank account with just a few taps. Zilch is also leveraging Plaid’s Virtual Account capabilities to strengthen its payment operations further.

REGTECH NEWS

🌎 Australian FinTech Eftsure launches payment verification service in 39 countries. CEO Jon Soldan said the move addresses a “perfect storm” of growing threats, as stretched finance and IT teams struggle to manage cross-border payments securely amid language barriers, time zones, and increasingly advanced fraud tactics.

DIGITAL BANKING NEWS

🇧🇷 Nubank creates products capable of gaining global scale. In the new episode of Nu Videocast, Laura Marino, Global GM of Nu’s Account, uses the account as an example to detail how the company develops products capable of scaling globally. According to her, there are four key elements for success: “the first one, and probably the most important, is to focus on the customer.

🇨🇴 Nubank launches new credit card and loan program in Colombia. Nubank founder David Vélez, along with Colombia country manager Marcela Torres, announced two new credit products in Bogotá: the “Abrecaminos” credit card, similar to offerings by international banks in markets like the U.S., and personal loans for individual customers.

🇵🇭 GCash to delay record-breaking Philippine IPO to the second half of 2026. The company had been considering an IPO as soon as this year and is looking to raise $1 billion to $1.5 billion. A $1.5 billion IPO would be the biggest on record in the Philippines. Continue reading

🇩🇪 German banks open private equity to everyday investors. The push comes as private capital groups hunt for new sources of funding, with institutional investors reluctant to commit more until prior investments return cash. Experts warn the investments can be risky, but attitudes toward private equity are changing.

🇰🇷 Kakao founder wins legal battle over stock manipulation claims. South Korean authorities arrested Kim in July last year on charges of being involved in the stock price manipulation of SM Entertainment in 2023. Kim was alleged to have manipulated the company’s share price to hinder a competitor, Hybe, from acquiring it.

🇬🇧 OpenPayd triples currency account access to fuel global expansion. OpenPayd clients across all key verticals will now be able to access over 70 currencies across its banking and payments infrastructure. This product expansion addresses the critical market gap for high-growth, digital-first sectors that are global by nature and require global financial solutions.

PARTNERSHIPS

🇲🇽 ACI Worldwide and Prosa redefine payments in Latin America with a groundbreaking infrastructure upgrade. The payment network has completed a major infrastructure upgrade, migrating Prosa’s clearing house services to a new, state-of-the-art data center in Monterrey powered by ACI’s cutting-edge software.

🇺🇸 Cloud-based payment orchestration platform Gr4vy partners with Mastercard. The partnership enables Gr4vy’s merchant customers to integrate Mastercard Merchant Cloud to access advanced payment solutions, including network tokenization, Click to Pay, and Gateway services, directly through Gr4vy’s platform.

🇨🇾 Salt Edge and Sola partner to power instant payments across Europe. By integrating Salt Edge’s Payment Initiation Solution, Sola gains access to Salt Edge’s ever-expanding network of thousands of banks across the continent. The integration will enable broader market reach and more reliable, secure, and instant payment experiences for merchants operating in diverse markets.

🇬🇧 Paysend expands Visa partnership with new program to enhance cross-border payments. By integrating Paysend’s technology with Visa’s vast network, this expanded collaboration aims to accelerate adoption among Visa’s merchant and collaborator ecosystem, enabling more businesses to offer real-time, transparent money transfers.

🇬🇧 Suits Me partners with tell.money. Through this partnership, Suits Me gains access to tell.money’s purpose-built SaaS platform that delivers fast, secure, and frictionless PSD2 compliance services, including the provision of dedicated AIS and PIS interfaces, robust third-party provider management, and ongoing regulatory alignment.

🇶🇦 Doha Bank and PayTabs enter into a strategic partnership to empower Qatar’s digital commerce sector. Through this collaboration, Doha Bank and PayTabs Group will jointly support merchants, entrepreneurs, and corporations by providing secure, seamless, and future-ready digital payment solutions.

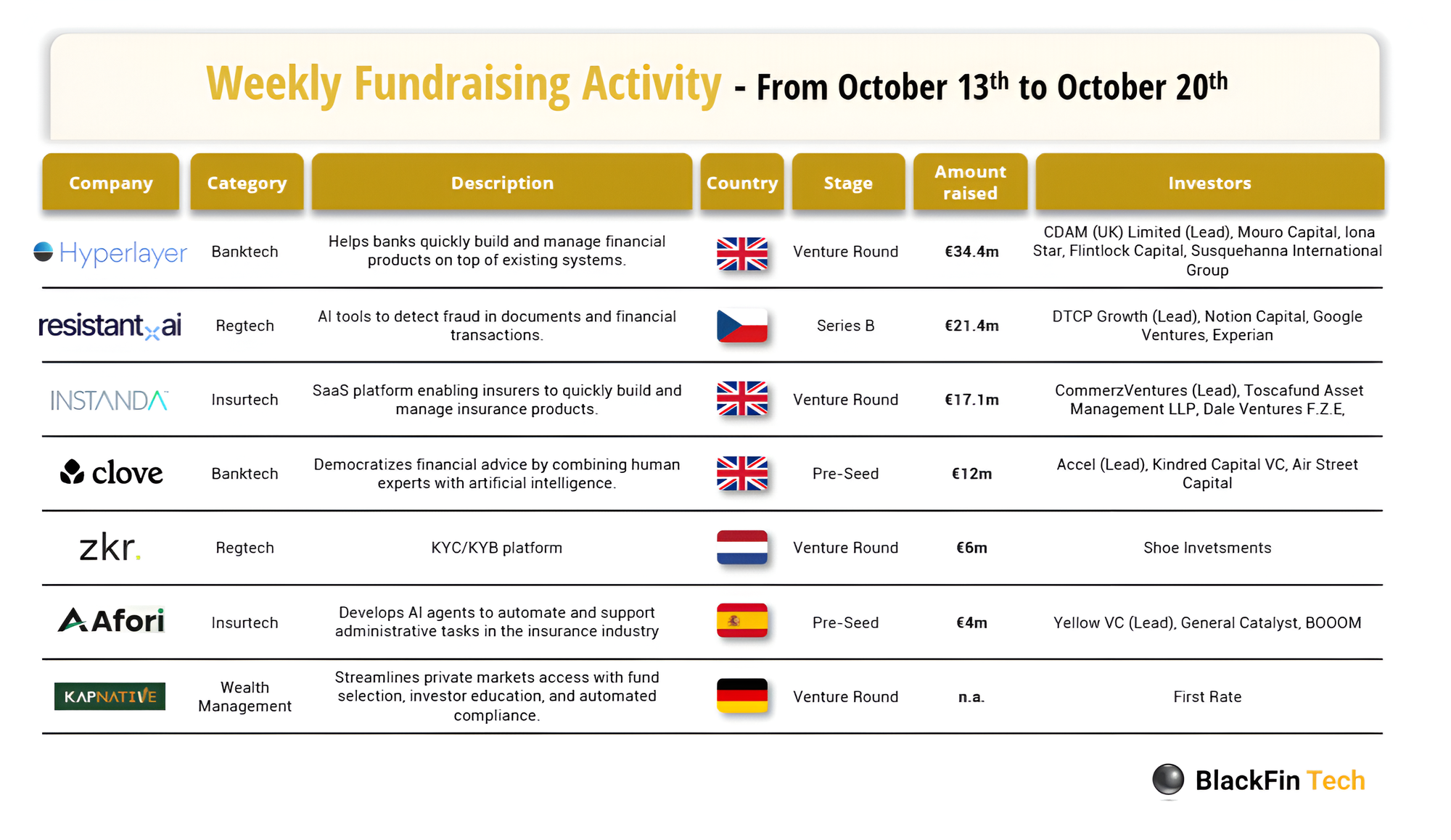

DONEDEAL FUNDING NEWS

💰 Over the last week, there were seven FinTech deals in Europe, raising a total of €95 million, including three in the UK, one in Germany, one in Spain, one in the Czech Republic, and one in the Netherlands.

🇳🇬 Visa-backed FinTech Moniepoint raises an additional $90 million. The company plans to use the funds in its core market of Nigeria, as well as to expand into new markets like the UK and Kenya. Continue reading

🇺🇸 Karta raises $5.4M seed round. The company will be using the funds to grow its team, build its credit card offering, and scale its footprint with financial institutions across the United States. Also, it has launched a premium credit card designed for global non-residents with a U.S. bank account.

🇸🇦 TabSense raises $5m for AI agentic PoS. With this new funding round, TabSense will accelerate product innovation, expand regional sales, and grow its full-stack engineering and AI teams to further advance its agentic intelligence capabilities. Read more

M&A

🇺🇸 Coinbase acquires Echo. The acquisition supports Coinbase’s goal of building more accessible and efficient capital markets, with plans to expand Echo’s capabilities beyond crypto token sales to include tokenized securities and real-world assets. Echo allows projects to raise capital directly from their communities through private or public token sales using its Sonar tool.

🇩🇪 PayPal to take over Carlyle stake in e-commerce firm Shopware. PayPal is set to increase its stake in Shopware to about 41% from roughly 11%. A PayPal spokesperson said the move reinforces the company’s long-standing partnership with Shopware and its commitment to fostering digital commerce growth across Europe.

🇸🇪 TrueLayer to acquire Nordic FinTech competitor Zimpler. By acquiring Zimpler, TrueLayer will have more than 20 million users and a greater presence in key Nordic markets such as Sweden and Finland. Keep reading

🇮🇱 Bizcap acquires Israeli FinTech 8fig to expand AI-powered funding for SMEs. The acquisition allows 8fig to retain its brand and leadership team while benefiting from Bizcap’s global reach, operational expertise, and access to capital. The company’s operations are split between Tel Aviv and Austin, Texas.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()