$10 Million Boost for Obita’s Stablecoin Plans

Hey FinTech Fanatic!

The Hong Kong-based FinTech, Obita, just closed a $10 million angel round with backing from Vision Plus Capital and Mirana Ventures.

The funding will go toward strengthening systems and compliance, expanding into new markets, and doubling down on stablecoin-powered cross-border payments.

As Co-Founder Dayong Zhang put it, “We are committed to building enterprise-level solutions that make cross-border payments cheaper, faster, and more transparent.”

Keep reading for the full story and your daily FinTech dose 👇

See you tomorrow!

Cheers,

PODCAST

🎤 In this Q&A episode of Connecting the Dots in FinTech, we sit down with Mary Wisniewski, a former journalist turned FinTech content leader. From her journey into FinTech to the critical role of clear, human-centered communication, Mary shares insights on what companies often miss when trying to connect emotionally with audiences, the importance of media transparency, and how content can drive financial inclusion.

Q&A with Mary Wisniewski

FINTECH NEWS

🇬🇧 Revolut begins secondary share sale at $75 billion valuation. That secondary sale will value each share at $1,381.06, according to a memo. The company has already fielded demand for the sale from new and existing investors, the memo shows. The deal will solidify Revolut’s status as one of the most valuable FinTech companies globally.

🇮🇳 Tata͏ C͏ap͏ita͏l’s͏ $2͏ bill͏ion IPO ͏t͏o ͏͏op͏en ͏͏week͏͏ ͏of S͏͏e͏pt 22͏; eye͏s͏ ͏͏$11 billio͏n͏ va͏lu͏ati͏͏͏on. Tata Capita͏l͏ IPO͏ ͏will cons͏is͏͏t of͏ a͏ fresh͏ issu͏e of 21͏ crore equi͏ty͏ sha͏r͏es and͏͏ ͏an͏ Off͏er f͏or Sale͏ (͏OFS͏) of͏ 26.58 cror͏e͏͏ shares. Of th͏is,͏ Ta͏t͏a ͏Sons will ͏div͏est 2͏3 ͏c͏rore s͏h͏ar͏e͏͏͏s͏, ͏while͏ ͏I͏n͏͏ternat͏i͏onal Fi͏͏nance͏ ͏Corp͏oration (͏IFC͏)͏ wil͏l ͏s͏e͏l͏͏l 3.5͏8 cro͏͏re ͏s͏har͏es ͏from its͏ ͏1.8%͏ s͏take.

🇺🇸 Klarna readies IPO marketing to start as soon as Tuesday. The Sweden-based FinTech and its bankers will seek to drum up investor demand for the IPO shares during the marketing period, which is expected to kick off following the Labor Day holiday. That effort will lay the groundwork to price the issue later this month and list shares in New York.

🇬🇧 Green FinTech hits £1.1M in payments and 12k+ users, second crowdfunding round launches. It has registered more than 12,000 users, processed £1.1m worth of payments, and completed more than 415,000 GreenScore transactions, helping customers understand and reduce the environmental impact of their spending.

PAYMENTS NEWS

🎤 Zelle's Secret Roadmap to the Next Trillion. In this episode, Denise Leonhard, Head of Zelle at Early Warning, shares her journey from leadership roles at American Express and PayPal to overseeing one of the largest real-time payment networks in the U.S. She discusses how Zelle grew into a $1 trillion platform, what sets it apart from other peer-to-peer networks, and its expansion into small business payments.

🇮🇳 UPI crosses 20 billion monthly transaction milestone in August. The platform recorded 20.01 billion transactions in August compared to 19.47 billion transactions in July. The digital payments platform also saw its total transaction value for August at Rs 24.85 lakh crore, marginally lower than the Rs 25.08 lakh crore it recorded in July.

🇮🇳 India taps homegrown digital payments network to widen access to credit. The National Payments Corporation of India has started making its infrastructure available to banks to deliver short-term loans to small businesses such as vegetable vendors and food stall operators.

🇬🇧 Verto unveils the Atlas Suite: API-first embedded finance solutions to transform global payments for FinTechs, marketplaces, platforms, and white label brokers. This allows customers to enjoy faster, more reliable, and compliant financial services across multiple currencies and markets.

🌍 EuroPA and EPI prepare to expand cross-border payments in Europe. The exploratory phase of the partnership is nearing completion, and the next step will be to finalize the feasibility study by December 2025, preceding the implementation phase. The implementation will follow a phased approach, starting with peer-to-peer transfers and gradually expanding to other use cases.

OPEN BANKING NEWS

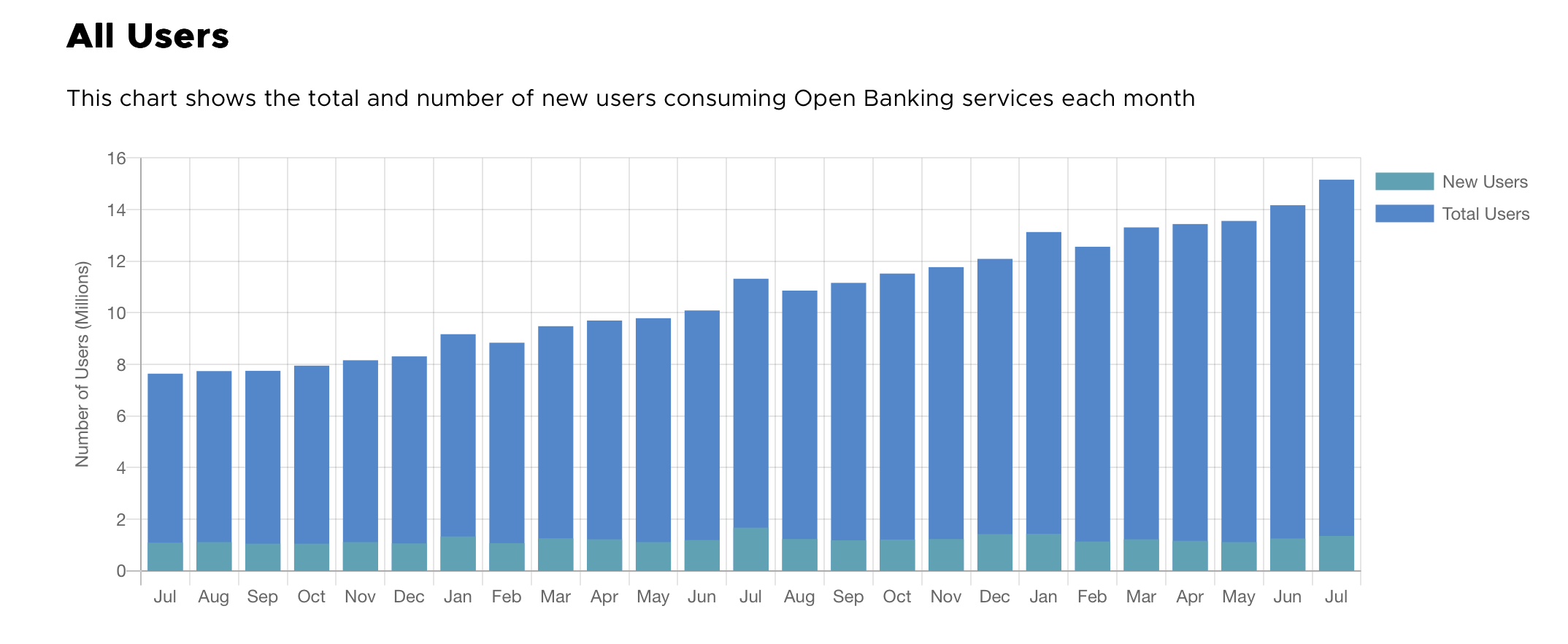

🇬🇧 Open Banking Surges to 15 Million UK Users as July Marks Record Adoption.

REGTECH NEWS

🇸🇬 MariBank launches new in-app safeguards to combat phishing scams. These new security measures are to protect customers’ cards from increasingly sophisticated phishing scams involving digital wallets. Keep reading

🇧🇷 Cyberattack on Evertec’s Sinqia hits HSBC and others in Brazil. Cyber criminals invaded Sinqia’s systems used by Brazilian financial institutions and attempted to make several transfers through a fast-growing electronic payments system known as Pix. Sinqia confirmed the attack but said there was no evidence of suspicious activity in any system besides Pix.

DIGITAL BANKING NEWS

🇬🇧 Wise is said to be exploring a UK banking license. If successful, the move will allow Wise to offer interest-bearing accounts and potentially issue loans, services currently off-limits under its existing electronic money licence. It would also bring the firm under the remit of the Financial Services Compensation Scheme, offering deposit protection up to £85,000 per customer.

🇮🇹 Revolut launches Duo in Italy: two paid plans and one low price. This new offering allows two customers to enjoy all the benefits of a Revolut plan at a reduced combined price, offering premium features while maintaining their own account autonomy.

🇿🇦 Nedbank readies public launch of MVNO platform. In an email interview, Ciko Thomas, group Managing Executive for Personal and Private Banking at Nedbank, says Nedbank Connect is currently available on the Money App and online banking, with a broader public launch scheduled for 15 September.

BLOCKCHAIN/CRYPTO NEWS

🇯🇵 Japan Post Bank to roll out tokenized deposits on DCJPY network by 2026. Under the plan, retail depositors will be able to exchange cash balances for DCJPY tokens, which can then be used to purchase tokenized securities targeting yields of 3% to 5%, according to the report.

🇨🇭 Ripple partner Amina Bank deepens Circle alliance ties to advance regulated stablecoins. Amina emphasized its intent to strengthen client confidence in stablecoin transactions, noting: “As Circle continues to lead the way in stablecoin utility, Amina enables individuals and institutions to transact with confidence across a global infrastructure. We’re proud to stand alongside Circle in this journey.”

🌎 Bitso Business expands into new markets and unveils new products. According to Bitso Business, the expansion aims to provide financial services to assist businesses in managing cross-border operations across Latin America. Read more

🇲🇽 Binance launches Mexico entity Medá and plans $53 million investment. “With a planned investment exceeding one billion Mexican pesos ($53 million) over the next four years, Binance aims to expand access to innovative, user-friendly digital services through this vertical, creating a positive impact on the Mexican population,” Binance said.

PARTNERSHIPS

🇨🇭 Swiss-based YouHodler extends strategic partnership with Torino FC. The agreement, which began in 2022, now enters its fourth season, underscoring a shared commitment to resilience, tradition, and innovation at the intersection of sport and technology.

🇱🇹 Lithuania's Perlas Finance taps Amlyze for compliance tech upgrade. The deployment of Amlyze's Software-as-a-Service solutions will equip Perlas Finance with customer risk assessment tools, real-time transaction monitoring, anti-money laundering investigation capabilities, and screening services for politically exposed persons, sanctions, and adverse media.

🇮🇳 BharatPe and Unity Bank unveil new credit card. The card is available on the RuPay network and can be linked to UPI, allowing users to make payments across numerous merchants in India. It features a “zero-fee structure”, with no joining charges, annual fees, or processing charges, and customers can prepay their EMIs at any time without facing penalties.

🇰🇷 Korea’s Kbank partners with blockchain firm BPMG to launch cross-border stablecoin. The deal is for a blockchain wallet, platform development, and stablecoin consulting. Kbank has 14 million clients and is known as the partner bank for Upbit, the country’s largest cryptocurrency exchange.

DONEDEAL FUNDING NEWS

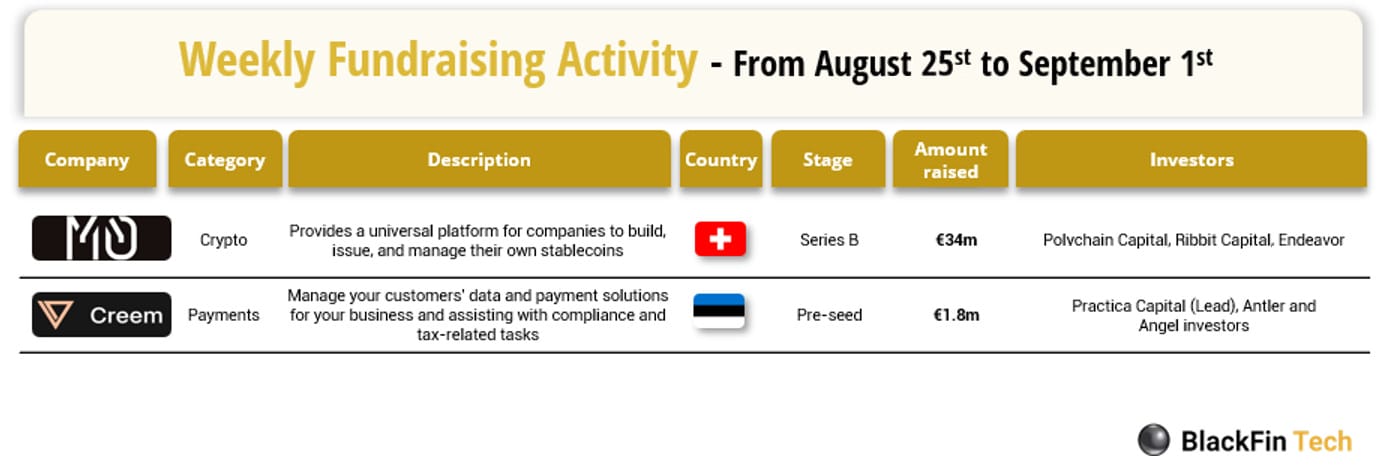

💰 Over the last week, there were two FinTech deals in Europe, raising a total of €36 million, including one deal in Germany and one in Estonia.

🇨🇦 Canadian Crypto Firm Luxxfolio eyes $73M raise after pivot to Litecoin. The filing will allow Luxxfolio to issue a mix of securities, including shares, debt, and warrants, over a 25-month window. Keep reading

🇨🇳 HK FinTech firm Obita secures $10M to expand stablecoin payment. The company said the funds will be used for system development, compliance infrastructure, and global expansion, with a focus on stablecoin-based cross-border payments.

🇨🇭 Allasso secures $3M to deliver AI-powered options analytics. The funding will help Allasso scale commercially and expand into other asset classes, STIR and bond futures, ETFs, FX, single stocks, and crypto. Read more

M&A

🇺🇸 Carlyle acquires Intelliflo to expand WealthTech portfolio. The transaction, which also includes Intelliflo’s US-based subsidiaries, is valued at up to $200 million. Under the terms of the agreement, Carlyle will make an upfront payment of $135 million, expected to close in the fourth quarter of 2025, subject to customary closing conditions.

MOVERS AND SHAKERS

🌏 Binance appoints ex-Crypto.com Executive, SB Seker, as new APAC head. Seker will oversee Binance’s regional strategy and manage relationships with policymakers and regulators across the Asia Pacific. Binance is the world’s largest cryptocurrency exchange by trading volume.

🇫🇷 Worldline appoints Anika Grant as new Chief People Officer. She has over 30 years of experience helping organisations transform through strategic talent management. She was most recently the CPO at Ubisoft, where she successfully navigated a period of pivotal change for the organisation and transformed the HR function.

🇵🇭 VBank taps Former Netbank Executive, Young Paul Raneses as COO and CPO. As both COO and CPO, Raneses will lead the bank’s product strategy, user experience design, platform innovation, and all end-to-end operations. This includes overseeing core banking processes, internal systems, service delivery, and customer support.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()