Stripe Confirms $694.2 Million Funding Round & Revolut's New Valuation

Hey FinTech Fanatic!

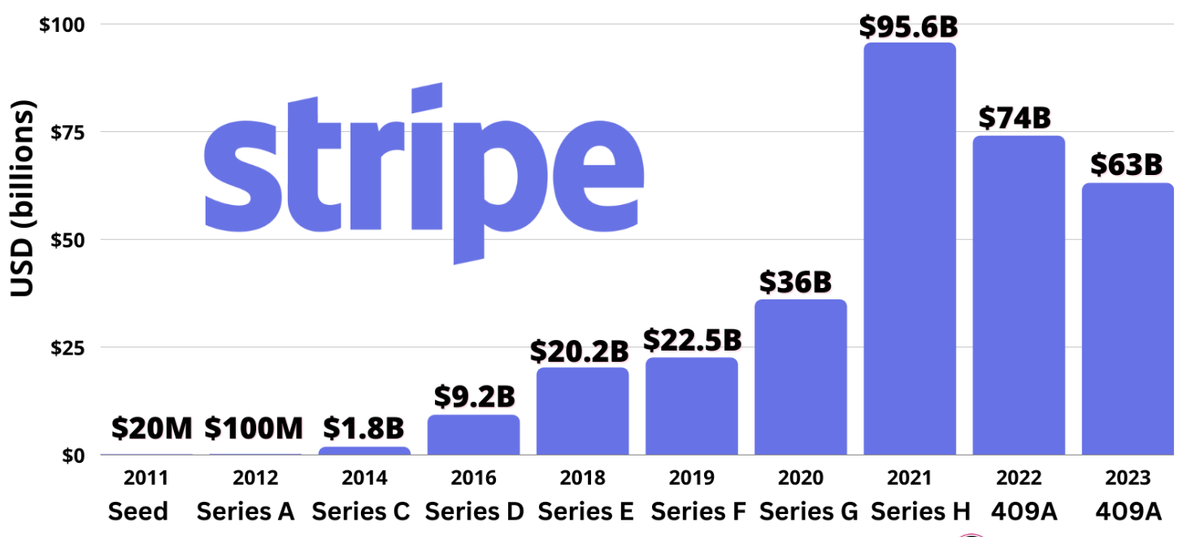

In a notable development in the FinTech sector, Stripe has successfully raised $694.2 million through a stock sale, according to a recent U.S. SEC filing.

This move, first announced in February, highlights a rare positive trend in an otherwise subdued venture capital landscape, marked by investor caution driven by high interest rates and a near five-year low in global venture capital investments in early 2024.

While Stripe's plans for an IPO seem delayed as it allows employees to cash out some stock, this strategic decision could enhance its financial standing before going public.

Meanwhile, Revolut's valuation has seen a significant uptick, with Schroders Plc revising the value of its stake in the company by 45%, signaling a renewed investor interest in fintech.

This adjustment raises Revolut's overall valuation to approximately $25.7 billion, despite being below its peak valuation of $33 billion in 2021.

The London-based company reported a substantial revenue increase to just over $1 billion and continues to attract about a million new customers monthly as it awaits a pivotal UK banking license.

This recent financial activity from both companies underscores a cautious but optimistic outlook for the fintech industry amidst challenging economic conditions.

You can find more Global FinTech industry news listed for you below, and I'll be back in your inbox tomorrow!

Cheers,

P.s. If you like this newsletter and/or my other content, you can support me by becoming a member. I'll be forever grateful.

Now let's dive into the news of today:

#FINTECHREPORT

📊 What could be costing your marketplace more money than necessary? Access this guide by Mangopay to discover what hinders your marketplace's revenue growth and strategies to tackle them: Link here to get full report

INSIGHTS

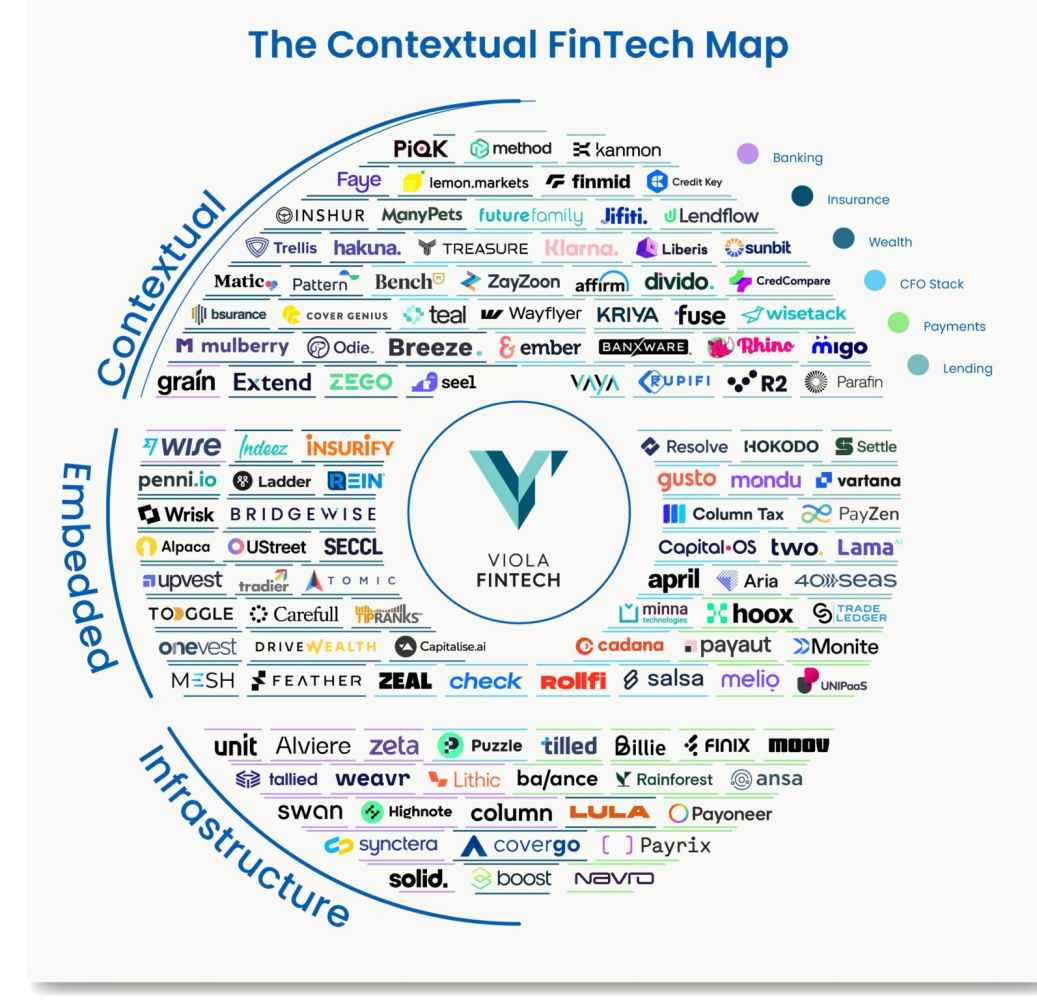

➡️ Embedded Finance is predicted to reach a market size of $588 billion by 2032.

Let’s dive into 3️⃣ categories in Embedded Finance:

FINTECH NEWS

🇬🇧 Revolut and Monzo say scrap stamp duty as top FinTechs launch bid to boost stock market. Revolut and Monzo are among a group of top FinTech firms to urge the government to ditch its contentious tax on share trading as part of a sweeping call for reform to boost the appeal of the London Stock Exchange.

🇸🇦 Climate FinTech Fils partners with digital bank Aion. This groundbreaking collaboration aims to set new standards in sustainable finance, leveraging cutting-edge technology to drive meaningful change in the financial industry across the MENA region.

🇳🇱 The Netherlands Authority for the Financial Markets has raised concerns about minors accessing BNPL services, despite a Code of Conduct by Billink, In3, Klarna, and Riverty to prevent such access. The Code of Conduct mandated a clear disclosure of costs, conditions, and payment obligations by providers.

🇲🇽 FinTech Company Fiado Authorized as an Electronic Payment Fund Institution in Mexico, making it the first Financial Technology Institution of 2024 to receive approval, with the document published in the Official Gazette of the Federation (DOF).

🇬🇧 Zopa eyes IPO after hitting FY profitability. The digital bank has swung to its first full year profit as it prepares to start offering current accounts and eyes a future IPO. Zopa posted a pre-tax profit of £15.8 million in 2023, compared to a £16 million loss the previous year.

🇨🇦 Mastercard and leading Canadian FinTech VoPay enter strategic partnership to empower Canadians to move moneyquickly and securely with Mastercard move. The partnership will simplify both domestic and cross-border money movement for businesses and consumers in Canada.

PAYMENTS NEWS

🇳🇱 Currence announced a big update to the iDEAL payment system: From now on, consumers can create their very own iDEAL account + Speedy Checkout. This addition not only expedites transactions but also heightens security since consumer data is securely stored within the iDEAL system, reducing the need for separate data handling by each retailer.

🇮🇳 To tighten the offline payments ecosystem, the RBI is expected to come out with guidelines for issuing licenses to operate in the point of sales (POS) business. Third-party POS operators would have to obtain licenses to function in the space. The move is expected to impact players such as Pine Labs, MSwipe, Paytm and BharatPe to name a few.

OPEN BANKING NEWS

🇧🇷 Brazilian Open Finance introduced several new functions, including smart transfers. Defined by experts and executives in the finance sector as "powerful," this feature is expected to boost adherence to the data-sharing system among financial institutions established by the Central Bank (BC).

DIGITAL BANKING NEWS

🇬🇧 Monzo boss aims guns at HSBC and Barclays saying "consider" yourselves "challenged." In an interview, TS Anil, Monzo CEO, said Monzo had ambitions to capture "hundreds of millions" of customers and talked about its global ambitions. More on that here

🇨🇭 Temenos rejects Hindenburg claims after probe completed. Shares in core banking provider Temenos have risen upon news that an investigation commissioned by the company found that accusations of mismanagement by short seller Hindenburg Research were "inaccurate and misleading".

🇧🇷 In Brazil, Revolut began operations just over a year ago and has been aggressively promoting offers to attract new users. Last month, it offered cashback of up to R$100, and now it is launching a new campaign, promising to help Brazilians who need to obtain an American visa to save on fee payments in the process.

🇺🇸 Goldman Sachs traders help profits jump 28%. Wall Street bank beats estimates by almost $1bn as investment banking and trading arms report strong results. The bank said net income for the first three months of the year was $4.1bn, up from $3.2bn a year earlier and almost $1bn ahead of analyst forecasts compiled by Bloomberg.

BLOCKCHAIN/CRYPTO NEWS

🇮🇳 The Reserve Bank of India (RBI) is opening doors for non-bank payment system operators (PSOs) to offer CBDC (Central Bank Digital Currency) wallets. Read Monica Jasuja's complete article for comprehensive insights.

🇩🇪 Germany’s largest Federal Bank LBBW forms Crypto partnership with Bitpanda. As part of this cooperation, LBBW is provided with an “Investment-as-a-Service” infrastructure, which is used, among other things, to store and procure cryptocurrencies such as Bitcoin, Ethereum and other digital assets.

DONEDEAL FUNDING NEWS

🇺🇸 FinTech giant Stripe raises nearly $694m in funds. Stripe, which was valued at $65 billion in February, has raised $694.2 million via a stock sale, the FinTech giant said in a regulatory filing with the US SEC.

🇬🇧 Revolut valuation raised 45% by Schroders shows FinTech rebound. Schroders have just revised the value of their Revolut stake to £7.8m (Vs £5.4m last year) - implying a new company valuation of $25.7bn (Vs $17.7 billion last year). Read on

🇨🇴 Dapta, a no-code platform facilitating seamless API and AI integrations, raises $1.2M to empower SMEs with AI. This marks a significant milestone in Dapta's mission to empower small and medium-sized enterprises (SMEs) with the tools to implement AI solutions, improving operational efficiency and customer engagement.

🇬🇧 FinTech Mimo raises £15.5M to develop financial management platform. Mimo, which stands for ‘Money In, Money Out’ hosts tools that streamline international transactions in particular, easing financial admin for SMBs who hold inventory or trade internationally such as those in consumer goods or retail.

MOVERS & SHAKERS

🇺🇸 It's not just banks and hedge funds hiring people to work with generative AI. As part of $45bn payments FinTech Adyen's US expansion, it has hired a new VP of product to work with the technology in its growing Chicago office: Keith Munns.

🇦🇺 Change Financial appoints Jennifer Mateer to drive ongoing global expansion. Mateer’s role will focus on the commercial aspects across the business, ensuring Change is well positioned to enhance its global client acquisition capabilities, expand existing customer engagements, and continue to bolster their customer operations functions.

🇺🇸 Neobank Current named Scot Parnell its first CFO. The news comes as the company strives to hit profitability by mid-2025. Read the full article here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()