Revolut's New License Approval & Nubank's Big Move Into Telecom

Hey FinTech Fanatic,

In a recent development, Revolut India announced that it has received an in-principle approval from the Reserve Bank of India (RBI) to issue Prepaid Payment Instruments (PPI). This approval allows the company to offer prepaid cards and wallets in India, significantly enhancing its operational scope in the country's payments market.

According to Paroma Chatterjee, CEO of Revolut India, the app is currently live with its employees for testing purposes focusing on compliance and customer experience. The public rollout is expected soon after all technical issues are resolved.

This authorization complements the existing licenses that Revolut India holds, including a Category-II Authorised Money Exchange Dealer (AD II) license, enabling them to offer multi-currency forex cards and cross-border remittance services. With these comprehensive financial services, Revolut is poised to provide both international and domestic payment solutions on a unified platform to Indian consumers.

In Mexico, Revolut received a banking license from the National Banking and Securities Commission (CNBV), allowing it to operate as a bank. Led by Juan Miguel Guerra Dávila, Revolut Mexico will offer international transfers and plans to rely on fee-based income and shared global infrastructure costs for operational efficiency.

These steps are part of Revolut’s strategy to enhance its global presence and innovate in the digital banking sector, leveraging its licenses to offer diverse and efficient financial solutions in multiple countries.

Now let's see when we hear more about a license in the UK..

Read more global FinTech industry updates below and I'll be back with more news in your inbox tomorrow!

Cheers,

P.s. If you like this newsletter and/or my other content, you can support me by becoming a member. I'll be forever grateful.

Now let's dive into the news of today:

BREAKING NEWS

🇧🇷 Nubank is aiming to expand beyond Banking Services and plans to venture into the Telecommunications sector by launching its own Mobile Phone Network Operator company. Nubank has been approved by Anatel, Brazil's National Telecommunications Agency, to create its own virtual network operator (MVNO). Read on

#FINTECHREPORT

🇺🇸 The 2023 Top 10 Merchant Acquirers in the US

📊 Within the context of predicting what the 2030 European Mobile Payment landscape will look like, there are 3 possiblescenarios according to Arkwright Consulting. Download and read the complete European Payments Report for more info on this topic here

FINTECH NEWS

🇰🇪 Mastercard and Equity Bank join forces to enhance cross border money transfers in Kenya. The collaboration will enable Equity Bank customers to send money safely and securely to 30 countries. This collaboration marks a significant milestone for cross-border financial transactions in Kenya.

🇺🇸 How PayJoy built a $300M business by letting the underserved use their smartphones as collateral for loans. PayJoy became a public benefit corporation last year and is an example of a company attempting to do good while also generating meaningful revenue and running a profitable business. Read the full story here

🇬🇧 Satago partners With mmob to simplify and speed up its embedded finance proposition. This collaboration enables lenders and corporates to embed Satago’s flexible Invoice Finance and Cash Flow solutions, using mmob’s hyper-efficient integration capabilities.

PAYMENTS NEWS

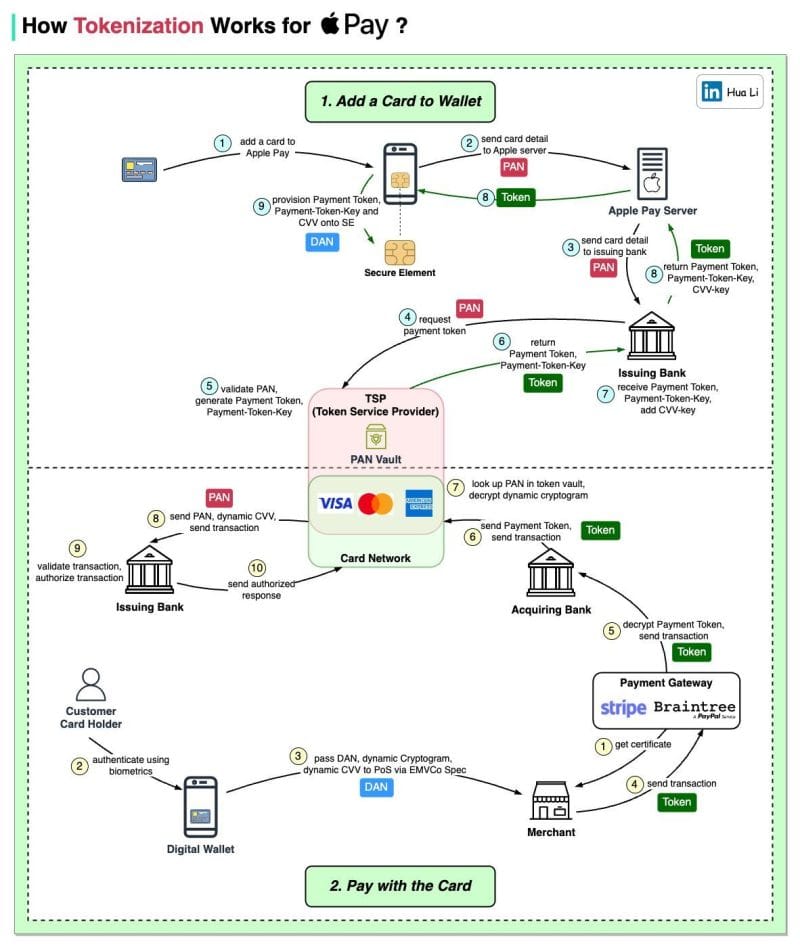

➡️ How does Payment Tokenization work?

The diagram below shows the tokenization process in Apple Pay:

🇺🇸 How FedNow is shaping payments since its launch. In the six months following its launch in July 2023, FedNow has emerged as a transformative force in real-time payments, marking a significant departure from the traditional ACH system. FedNow's journey from conception to its current state reflects a significant advancement in creating a more efficient, accessible, and secure payment system in the US.

OPEN BANKING NEWS

🇧🇷 Brazilian credit marketplace Bom Pra Crédito partners Belvo to use open finance to rescue more than 60% of rejected applications for credit. The conclusion is the result of an experiment conducted by Bom Pra Crédito, which has just partnered with Belvo to launch BPC Check.

REGTECH NEWS

🇳🇱 Dutch cities consider biometric checks to stop rising passport, ID fraud. Several municipalities in the Netherlands want to use biometric identity verification to prevent fraud, but it’s unclear whether this conflicts with privacy legislation, according to NOS.

DIGITAL BANKING NEWS

🇮🇳 Revolut India said it has received the PPI license from RBI and is planning to launch its app soon. Notably, with the approval coming into force, Revolut India can offer Indian consumers both international and domestic payment solutionson a single platform.

Additionally, Revolut plans to launch Dutch IBAN to simplify business banking in the Netherlands 🇳🇱 Around six months after introducing Dutch IBAN for personal accounts, Revolut made the announcement for business users. After transitioning to Revolut Bank UAB's Netherlands branch, customers will receive a new IBAN starting with 'NL', the country code for the Netherlands.

Moreover, Revolut's <18 App, catering to 6 to 17-year-olds, has surpassed 2 million young customers worldwide, reaching 3.5 million when including guardians. In Ireland 🇮🇪, the total customers of the <18 app, comprising both kids and their guardians, have surged by nearly 35% over the past year.

DONEDEAL FUNDING NEWS

🇺🇸 Tabs, an Accounts Receivable (AR) platform for B2B businesses, announced a $7 million seed funding round led by Lightspeed Venture Partners. The investment will fuel Tabs' mission to reimagine B2B AR processes at a critical time. "With this funding, Tabs is set to revolutionize AR and how finance understands the customer," remarked Ali Hussain, Co-founder and CEO of Tabs.

MOVERS & SHAKERS

🇺🇸 Ex-PayPal CEO Schulman joins Valor Capital. Dan Schulman is joining Valor Capital Group, the cross-border venture fund focused on bridging the US and Latin American technology markets. Schulman, who left PayPal last year after a nine-year stint as president and CEO, joins Valor as a managing partner.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()