Is New York Threatening London’s ‘supremacy’ In FinTech?

Hey FinTech Fanatic!

In a recent statement at the Innovate Finance Global Summit, Francesca Carlesi, Revolut's UK chief executive, highlighted the competitive threat New York poses to London's leading position in the FinTech sector.

Carlesi noted the significant advantages New York offers in terms of talent and deep capital markets, which could attract FinTech companies considering IPOs.

Despite considering a London listing, which could revitalize the city's stock market, Carlesi emphasized the importance of aligning the listing location with the company's primary business operations and shareholder value.

“It is proven that it’s always better to list where the majority of your business is,” she said.

“However… you have a responsibility towards your shareholders, so you need to assess that your listing is what’s right from a value creation point of view.”

Can we expect a Revolut IPO in the US..?

On the same day, Revolut shared a ‘Statement of capital following an allotment of shares'.

The reason for this could be to the issuing of new shares as part of a fund raise or either consolidating and/or splitting of shares into a new class.

The BoE previously mentioned they wanted the preference shares removing as there were too many share classes and they were not happy with the complicated share structure.

Is Revolut one step closer to UK banking license? What do you think?

Cheers,

P.s. If you like this newsletter and/or my other content, you can support me by becoming a member. I'll be forever grateful.

Now let's dive into the news of today:

#FINTECHREPORT

📊 Report calls for more support for female founded FinTechs. More here

INSIGHTS

🇮🇳 Jio Financial Services, part of the Indian conglomerate Reliance, is forming a joint venture with U.S. asset manager BlackRock to set up a wealth management and broking business in India, the two firms said Monday. That joint venture is awaiting the Indian market regulator’s approval.

FINTECH NEWS

🇬🇧 London FinTech CEOs say UK employees can't compete with "100 hour weeks" in Asia. At the Innovate Finance Global Summit, a panel of CEOs from some of the UKs major FinTechs discussed the FinTech landscape. While there was much praise for the talent market, there was also an acknowledgement that productivity for UK FinTech staff is a continuous issue.

🇿🇦 South African financial services giant Sanlam under ASIC scrutiny. The conglomerate, which supports some of the country’s largest neobrokers including Stake and Pearler is being closely monitored by the corporate regulator ASIC as part of a clampdown on "licensee for hire" firms.

🇬🇧 Australian SME lender Bizcap launches in the UK, offering faster, more open-minded lending solutions. As an open-minded lender in Australia and New Zealand, Bizcap brings its innovative lending solutions to the dynamic UK market.

🇬🇧 UK universities collaborate on FinTech courses. A team of four leading universities (Bristol, West of England, Glasgow, and Glasgow Caledonian) has collaborated with SETsquared, FinTech West, and prominent industry partners to deliver a timely new business and innovation support programme for the sector, ‘Future Finance’.

🇩🇰 Fire ravages Copenhagen’s historic stock exchange. A fire ripped through Copenhagen’s old stock exchange and toppled the building’s iconic spire, a centerpiece of the city’s skyline since the 17th century. Read more

🇳🇿 Nium, the global leader in real-time, cross-border payments, announced that it is now registered as a Financial Services Provider in New Zealand. This pivotal step marks Nium’s entry into the dynamic financial landscape of New Zealand and reinforces its commitment to delivering innovative financial solutions globally.

🇦🇷 Credicuotas, an Argentine FinTech company part of the Bind Group, which provides access to credit lines digitally and inclusively, has launched its prepaid card in collaboration with Pomelo to make it easier for its users to utilize their loans.

🇺🇸 Rapid Finance partners Galileo for SMB prepaid card programme. Rapid Finance’s Mastercard is the first program sponsored by SoFi Bank, and managed by Galileo, giving eligible small business (SMB) customers quick and flexible access to their funds when they need it most.

🇸🇦 Episode Six has announced a partnership with Loop, an e-Money institution (EMI), to power its FinTech-as-a-Service offering in the Kingdom of Saudi Arabia. E6 will power Loop’s cards, wallets and instant payment solutions to fulfill Loop’s strategic goal to become a digital financial services enabler.

🇮🇳 Comviva unveils innovative Low-Code/No-Code platform for digital payments and banking. The new platform will help Financial Institutions to quickly adjust to market shifts, regulations, and evolving customer demands. Also, with the potential for a 30%-40% reduction in deployment time, it will lower development expenses and elevate productivity.

PAYMENTS NEWS

🇮🇳 The Unified Payments Interface (UPI) is rewriting the global payments landscape, not just in India. Millions now enjoy seamless, secure transactions, transforming businesses and lives.

🇬🇧 Modernising the trains and rails of UK payments − speech by Sarah Breeden. Amidst the prospect of significant technological change in payments, Sarah sets out how the Bank of England seeks to deliver trust and support innovation, both as a provider and as a regulator of retail and wholesale money. She discusses primary threats and opportunities for central banks and the private sector.

REGTECH NEWS

🇺🇸 Prove Identity launches solutions in AWS marketplace to elevate digital customer experiences. With Prove’s availability in AWS Marketplace, customers can now seamlessly access Prove’s commerce enablement, identity verification, and identity authentication solutions.

DIGITAL BANKING NEWS

🇺🇸 As use of Bank of America’s virtual assistant Erica balloons, the bank is continually fine-tuning and feeding the tool new information to better respond to customer inquiries. That’s according to Nikki Katz, Bank of America’s head of digital, who oversees the team that supports the bank’s mobile app and website, as well as AI-powered Erica.

🇦🇪 Tuum Announces Expansion into the Middle East and the Creation of a Regional HQ at ADGM. This development is aligned with Tuum’s strategy to work closely with local banks, FinTechs, and financial institutions, providing them with access to its state-of-the-art core banking platform.

🇪🇸 Revolut announced Two important milestones in Spain: Barcelona has been chosen as the first location to open an inaugural Revolut Tech Hub, and it was announced that they have reached 3 million Revolut customers in Spain. Click here for further insights

🇬🇧 HSBC’s Zing has less than 20% of Wise’s monthly downloads - but CEO insists it’s ‘bang on plan.’ Zing’s UK installs numbered 36k while Revolut and Wise attracted 1.1m and 203k respectively, according to estimates from app data intelligence platform Apptopia.

🇺🇸 Wells Fargo chooses TradeSun to digitise trade finance. Wells Fargo will utilize the TradeSun AI platform to digitize, extract, validate, and classify unstructured data for use with compliance and document checking. Read on

DONEDEAL FUNDING NEWS

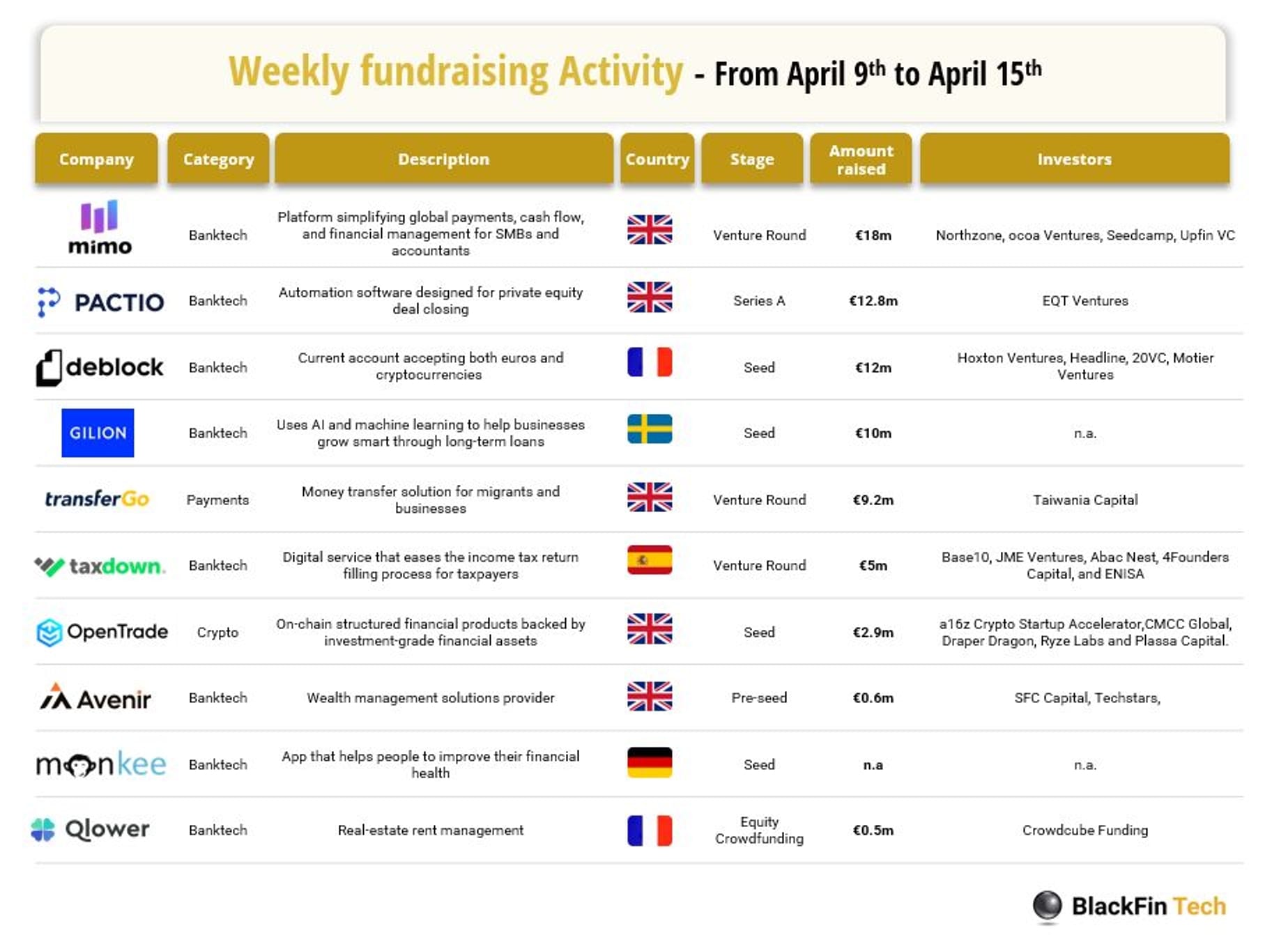

Last week we saw 10 official FinTech deals all over Europe for a total amount of 71m€ raised, with 5 deals in the UK, 2 in France, 1 in Germany, 1 in Sweden, and 1 in Spain. Check out the full BlackFin Tech article here

🇩🇪 Berlin-based FinTech finmid has announced a €35 Million funding round following its emergence from stealth mode. Investors include Blossom Capital, Earlybird VC, and N26-founder Max Tayenthal. finmid is an embedded finance platform that aims to provide platforms with an alternative to working with banks.

MOVERS & SHAKERS

🇺🇸 Gigs appoints ex-Stripe exec Rishi Sachdeva head of FinTech. Based in San Francisco, Sachdeva will lead Gigs’ strategy and growth in the FinTech sector, overseeing key partnerships at a time of significant momentum for the company. More on that here

🇺🇸 Green Dot names Renata Caine General Manager of Banking as a Service (BaaS). Caine will oversee the company’s BaaS business with a focus on building and supporting embedded finance that fuels retention, engagement and growth for Green Dot’s growing list of world-class BaaS partners.

🇺🇸 Tifin, an AI and innovation platform for wealth, announces the appointment of Rob Pettman as its Chief Revenue Officer and President. With a proven track record of leadership and success in the financial services sector, Pettman brings a wealth of experience and expertise to TIFIN.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()