Connecting the dots in FinTech 2024: Experts Predicting Trends For The Year Ahead

In collaboration with Juni we spoke to experts in all things finance to look at key predictions, what finance teams should watch out for, and valuable advice for CFOs heading into 2024.

AI tools bring more automation

Different kinds of AI tools are set to continue changing the game next year, not only in fintech but across a range of applications. We can expect to see less manual work, more automation, and better prediction of customer behaviour.

Brice Groche of Skaleet SaaS Core Banking Platform thinks there will be a “booming of genAI tools dedicated to FinTech to help finance teams, sales, marketing” across the year. His top piece of advice for finance teams is applying “machine learning to predictive analytics”, which can help with tasks like forecasting and scenario planning.

Panagiotis Kriaris shares this sentiment. “AI will be at the centre of attention, driving practical changes across three main domains: efficiency, forecasting and helping players across the board deliver highly personalised experiences on a massive scale.”

Samir El-Sabini, CEO and Co-Founder of Juni agrees, focusing on how AI can help FinTechs compete and provide automated services for their customers. “All internal processes can benefit from AI, from improving and simplifying compliance to creating better output from engineers.

This will mean that FinTechs can better compete with incumbent banks and big tech companies.”

“AI can give businesses better financial tools too. It will continue to automate the different elements businesses need to get a complete financial overview, including benchmarking insights, costs, financial processes, treasury, accounting, cards and controls.”

The rise of the machine economy

One key area that will benefit from AI automation and technological advances is payments.

Lex Sokolin of Generative Ventures believes that “We are going to see more automated payments and transactions between humans and software than ever before, including commerce between machines – both hardware and software.”

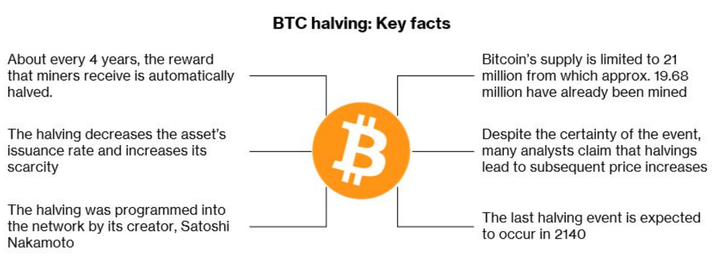

How will we achieve this? “Blockchains are going to be more clearly used for machine finance, with artificial intelligence agents and other software representations of human interests competing for financial outcomes.”

What exactly we’re paying with could change too. New digital currencies are growing in use, and Arthur Bedel of Nuvei thinks that next year could bring the “creation of a new decentralized currency that enables cross-border transactions instantly, backed by the biggest governments in the world.”

New payment systems are already being launched, and how we make transactions could change globally.

Marcel van Oost forecasts “a global expansion of instant payment systems in 2024, mirroring the success of Brazil's PIX and India's UPI, indicating a significant shift towards more efficient and accessible financial transactions worldwide."

Payments orchestration –the integration and management of the payments process– is growing in popularity. Marcel van Oost offers this advice: “In 2024, I advise CFOs of ecommerce companies to take note of the rising trend in 'payments orchestration.' This emerging approach is gaining traction in the market, and I predict that an increasing number of merchants will be exploring this solution in the upcoming year.”

As the way we handle payments is undergoing drastic shifts, Lex Sokolin suggests that CFOs should “figure out your digital asset providers for banking and payments” to prepare as you head into 2024.

Focus on the customer journey

The customer journey and payment devices are being brought into focus.

“Unified commerce, which brings a holistic platform approach and omnichannel customer journeys emphasizing seamless experiences, are top of mind,” says Panagiotis Kriaris.

Omnichannel customer experience has been a trend over the past few years, but for good reason: it improves the customer experience, and customers are starting to expect it. It will be a must for businesses to get this right in 2024.

Part of the customer experience is payments, and how this works in-store could continue developing next year.

Arthur Bedel suggests that “new devices are to be used for in-store payments, outside of phones and regular hardware.”

What people are buying is rapidly changing too, paving the way for startups or businesses to create new revenue streams. Lex Sokolin predicts that “commerce in digital objects” will be a key trend next year.

Embedded finance gives more options

Embedded finance, which involves integrating financial products into non-financial spaces, is growing in popularity. How this works could change next year.

Arthur Bedel expects “embedded finance to be fully white labelled with global embedded finance providers instead of local ones at the centre of the initiative.”

He thinks a key trend for next year will be “Embedded Finance Adoption and the need for resellers to have access to more products,” so watch this space to see how embedded finance could change your offering.

When it comes to handling your finances, he has this piece of advice: “make payments a new revenue stream, not a cost-cutting solution.” Embedded finance is one way that you could handle this.

Modifications to BaaS

This year, Banking as a Service (BaaS) entities saw a decline in investments and a regulatory upswing which targeted individual companies.

Sam Boboev, COO and Co-Founder at Botcommerce, thinks that BaaS will undergo some big changes this year.

“The forthcoming cohort of BaaS enterprises is poised to prioritise the integration of compliance and Anti-Money Laundering (AML) measures at the core of their operational framework to navigate the intensifying regulatory landscape. This strategic pivot towards enhanced compliance is likely to incur augmented operational costs, thereby exerting increased financial pressures. Consequently, an adjustment in pricing strategies is envisaged as a pragmatic response to the evolving regulatory environment and heightened operational demands."

His advice for finance teams to handle these changes? “It is imperative to integrate robust compliance frameworks into their operational structures.”

“To navigate the potential increase in regulatory scrutiny and associated costs, finance teams should strategically review and optimise their resource allocations. This may involve investing in advanced compliance technologies, fostering a culture of regulatory awareness within the organisation, and ensuring that financial strategies align with the forthcoming changes in the BaaS model.”

“Furthermore, CFOs should engage in a thorough evaluation of their existing partnerships with BaaS providers, taking into account their compliance capabilities, financial stability, and ability to adapt to regulatory changes. Establishing contingency plans and fostering open communication with BaaS partners will be crucial to mitigating potential disruptions in financial services."

Financial management keeps the spotlight

Two key functions of financial management are set to step into the limelight in the coming year.

Marcel van Oost predicts that treasury will take centre stage. “For CFOs in 2024, I anticipate treasury management becoming a primary focus. This will drive them to seek out multiple banking partners and explore collaborations with fintechs and neobanks that provide innovative treasury management solutions.”

Liquidity has long been a focus area for finance teams, but next year will see it become a priority across businesses. Panagiotis Kriaris believes that “managing liquidity will remain a key topic and will continue gaining in significance, across the board, both at a corporate and SME level.”

Liquidity is a big piece of the financial puzzle for ecommerce CFOs, and factoring in seasonality can make it even more challenging. Maximising your capital can be one way to improve your liquidity. Juni is a financial platform that gives businesses in digital commerce the financial tools and intelligence you need to manage and ease cash flow and make smarter decisions – faster. Find out more about how we can help you manage your liquidity here.

Comments ()